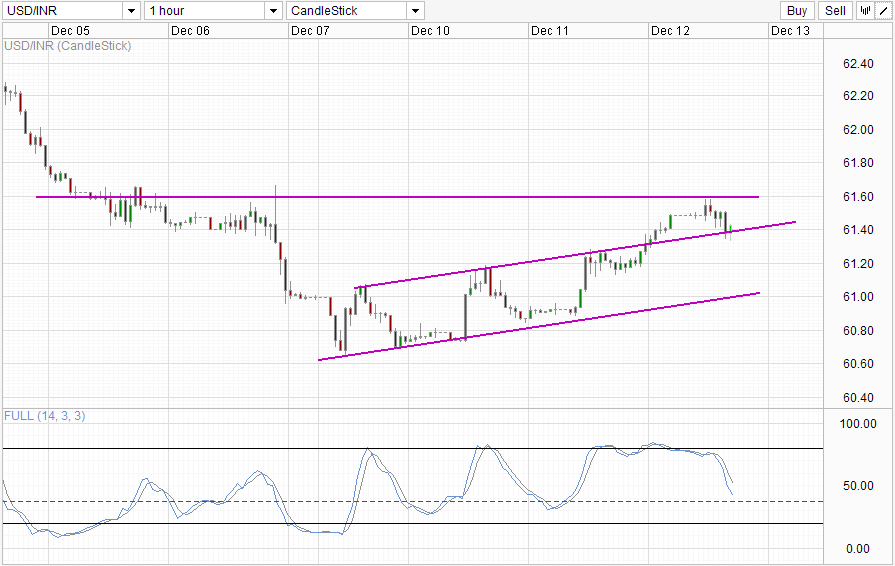

Hourly Chart

Has Rupee turned the corner? USD/INR has been rising continuously ever since the weekly low was forged on Monday, with sharp rallies seen around 11am SGT (10pm EST) for the past 3 days. Prices did rally similarly today at 11 am SGT but the magnitude is much lower than before, with the rally capped by the 61.6 ceiling which was the topside of consolidation zone seen on 5th and 6th December. Currently price has found support via rising Channel Top around 61.4 which also happens to be the confluence with the aforementioned consolidation zone’s floor.

Stochastic readings suggest that prices may be able to break into the rising Channel, but a direct move towards Channel Bottom is less likely considering that Stoch curve is below 50.0 and most likely will be within the Oversold region when price hits yesterday’s consolidation region between 61.15 – 61.25. Nonetheless, as long as price stay below Channel Top, Channel Bottom will remain a viable target moving forward.

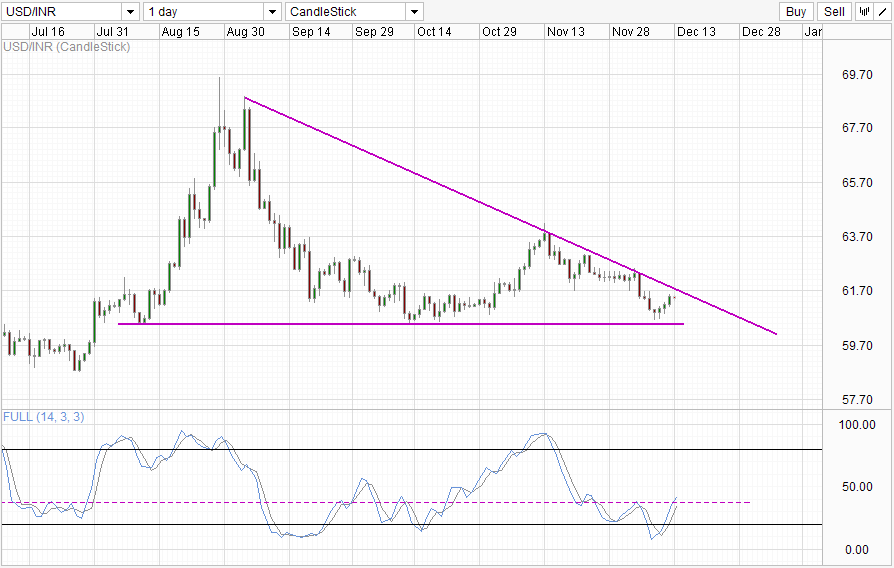

Daily Chart

Daily Chart also favor bearish movements with descending trendline providing overhead resistance. A bullish cycle is in play currently but Stoch curve may still reverse around the “resistance” level around 36.8. Should the descending trendline hold, bearish target would be the 60.5 support which has kept prices afloat back in early October and early August.

It should be noted that recent decline in USD/INR is contributed by the fall in Indian stock prices, with Sensex heading lower since Monday – the start of current USD/INR rally. Hence, in order for continued bearish movement in USD/INR, we should see Sensex reversing current decline, without which it would be hard for a long-term sustained strengthening of INR especially given that economic fundamentals in India continue to remain weak.

More Links:

WTI Crude – Decline In Inventory Not Quite All That Jazz

AUD/USD – Bearish Despite Stronger Employment Numbers

NZD/USD – Higher On RBNZ Guidance But No Home Run For Bulls

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.