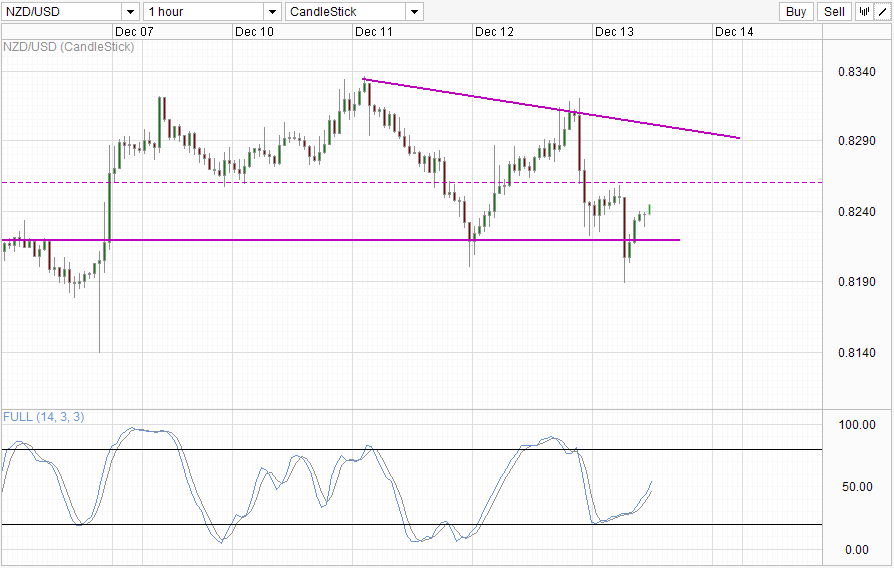

Hourly Chart

Kiwi dollar sank yesterday as USD strengthened significantly on the back of strong risk-off sentiment. S&P 500 shed 0.38% while Dow 30 clocked in yet another triple digit loss to the tune of 0.66%. This increase of risk aversion was triggered by a singular trader that bought 40,000 call options of VIX for slightly over $5 million that expires on 22nd April for a punt that VIX prices will push up by at least 50% from now till then. Such a huge speculative move shook markets, bringing out the bears out of the woodwork and resulted in hot money entering into safe haven currencies such as USD.

This sparked off a strong bearish momentum on the less than bullish NZD/USD, which had a disappointing rally despite an extremely hawkish RBNZ announcement yesterday – and hence was susceptible to bearish trigger. Statements made by neighbors RBA’s Glenn Stevens fueled the selling even further when the Australian central banker said that AUD/USD should be closer to 0.85 which torpedoed AUD/USD and dragged NZD/USD with it. As a result price hit a low of 0.8222 before New York noon.

Prices did rebound subsequently, but we were not able to reclaim territory above 0.826, which confirmed the bearish sentiment and led to a quick sell-off to a low of 0.819 – soft support level of the dip pre NFP on Friday. This sell-off happened despite improving Business Manufacturing Index which came in at 56.7 vs 55.9 previous, and a higher percentage of Non-Resident NZD Bond Holdings – showing that foreign funds are entering New Zealand – which will be a long-term appreciative impact for NZD/USD. The fact that bears ignored all these and traded lower anyway once again underline the strong bearish strength that is in play right now, which suggest that prices may be less likely to break the 0.826 level if reached, and we should not be surprised if prices even managed to reverse lower here without warning.

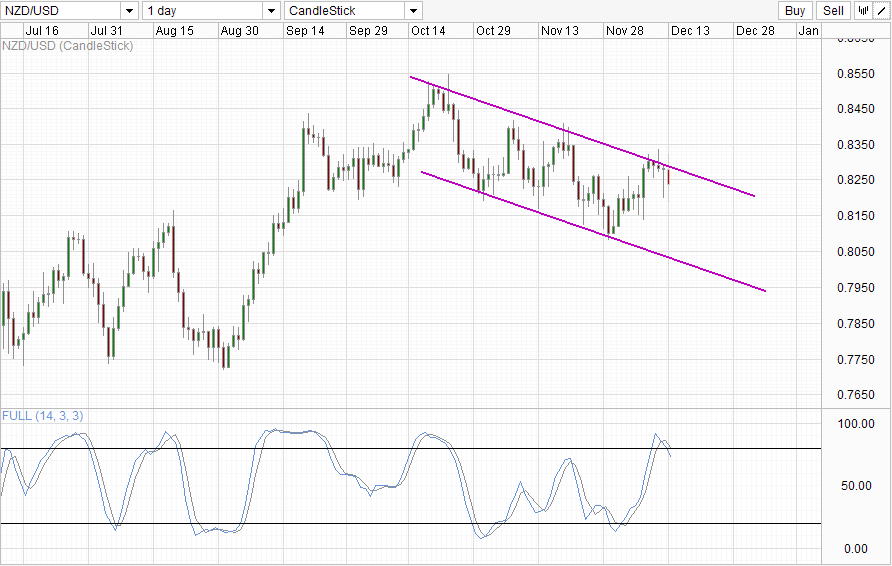

Daily Chart

Daily Chart confirms the bearish rejection of Channel Top, with Stochastic curve giving us a proper bearish cycle signal which opens up Channel Bottom as the next bearish target and interim support expected around 0.815. However, long-term direction NZD/USD is difficult to gauge as RBNZ will be hiking rates in 2014 and 2015, which will cause NZD to appreciate. Then again, US is expected to start tapering in 2014 if not next week, with Fed saying that they will most likely stop keeping interest rates so low in 2015. Hence, saying that fundamental outlook for NZD/USD is unpredictable is an understatement. Traders who wish to participate in the NZD rate expectation play may want to seek other NZD crosses instead.

More Links:

GBP/USD – Continues to Feel Supply Pressure from Resistance at 1.6450

AUD/USD – Drops Sharply to Three Month Low near 0.89

EUR/USD – Resistance Level at 1.38 Stands Tall

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.