Kiwi dollar rose sharply during the wee hours of Asian session when central bank RBNZ reiterated the need for New Zealand to increase its benchmark rates in 2014 “in order to keep future average inflation near the 2% target midpoint”. Despite not raising interest rates during this round of decision making, traders turned bullish with most analysts believing that a rate cut will likely come by March 2014. NZD/USD rallied to a high of 0.8286 immediately, but prices actually retreated quickly as well, as Governor Wheeler has dropped a previous comment that NZD’s strength would give him greater flexibility on the timing and magnitude of rate increases, implying that the hawkish Governor may be less pleased about the high NZD compared to the month prior and suggest that some form of action may be taken between now and the next rate hike to drop NZD.

Hourly Chart

On balance of things, price action post RBNZ rate decision appears to be a draw between bulls and bears. Prices did have a net gain in the hour that followed, but the inability to climb above 0.826 is disappointing and suggest that bears are actually rather strong. Price did break the resistance level on the 3rd try, but that was fueled by Wheeler’s hawkish press conference which actually gave an idea of the magnitude of rate hikes RBNZ may be embarking – 2.25% in 9 quarters was mentioned on top of the usual rhetoric about how RBNZ “is serious about containing inflation”. This timeline should have given fresh bullish wave as it gave a clear exit strategy for carry traders and speculators – buy NZD/USD for the next 2 1/4 years. But the resultant rally was disappointing, hitting a high of only 0.8285, not even matching the original highs post rate decision. This is yet another sign of strong bearishness, hence giving us the neutral S/T outlook despite 0.826 being broken.

From a pure technical perspective, price is also not bullish, but rather bearish momentum has been temporarily thwarted. Price would need to push above this week’s high before bias is shifted. Currently, the likelihood of price trading sideways between 0.826 – 0.834 remains, agreeing with the neutral sentiment outlook. On the other hand, Stochastic readings tell us that bullish momentum may be Overbought soon, and given that we are not too deep into the consolidation zone, the likelihood of this being a false “break-in” remains. Furthermore, considering that bulls only managed to wrestle a draw despite such strong bullish fundamentals, one wonders how much more bearish we may be right now if not for RBNZ’s influence, and that could be a ticking time bomb in the future that could bring NZD/USD lower moving forward.

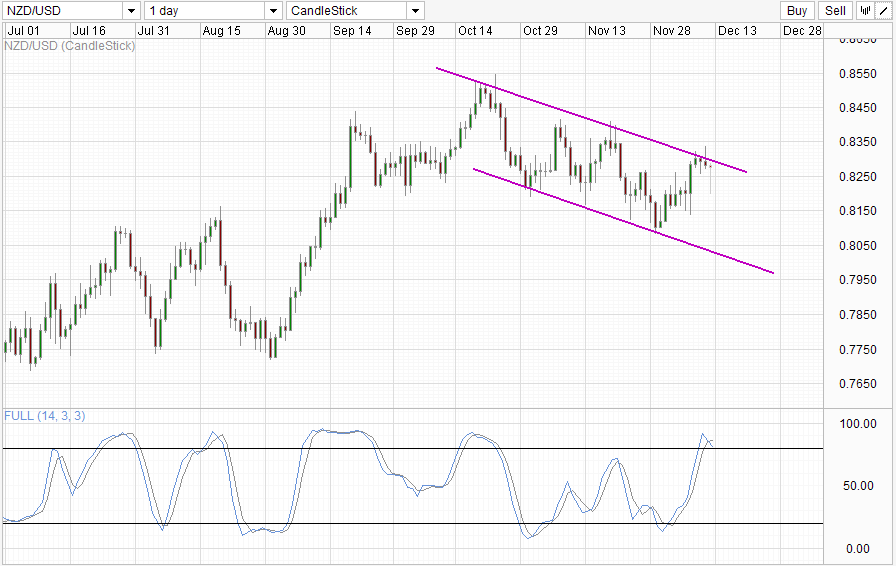

Daily Chart

Bearish pressure is even stronger on the Daily Chart. The rebound off Channel Top remains in play, and Channel Bottom remain a viable bearish objective. However, bears may need to wait for confirmation in the form of a break below 0.825-0.826 which will likely result in Stochastic curve pushing below 80.0 and forming a bearish cycle signal. However, should price manage to break Channel Top, there could be bullish acceleration towards the resistance band above 0.84. This is once again coherent with S/T chart which suggest that bullish bias will be in play above 0.834.

Fundamentally, what is also interesting besides the rate outlook is that Wheeler said that NZ economy is expected to grow by 3%, but that is faster than potential output growth and hence the need to combat inflation. In this regard, shouldn’t RBNZ favor a stronger NZD rather than a weaker one? Infact, if a real growth of 1% (nominal 3% – 2% inflation) is actually considered too fast, New Zealand’s target inflation rate of 2% is obviously too high and should actually be closer to low 1+%. It would be strange if RBNZ doesn’t realize this, and hence it will actually be more surprising if Wheeler actually start to push NZD lower in order to facilitate better export prices for local businesses. In this type of scenario, a higher NZD would actually force NZ firms to seek production optimization in order to increase productivity levels which will allow NZ to compete better in the international level and present a better sustainable growth model.

Another thing to take note is this: just because NZD is slated to go higher doesn’t mean NZD/USD will be higher. USD continue to remain a wildcard due to QE Tapering uncertainty, and traders who wish to speculate in the NZD 2 1/4 years rate outlook may wish to find a currency pair that is more stable or at least have less prone to wild swings.

More Links:

AUD/USD – Turns and Looks Again at Key Level of 0.90

EUR/USD – Eases Back from Resistance Level at 1.38

GBP/USD – Falls Sharply From Resistance Level at 1.6450

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.