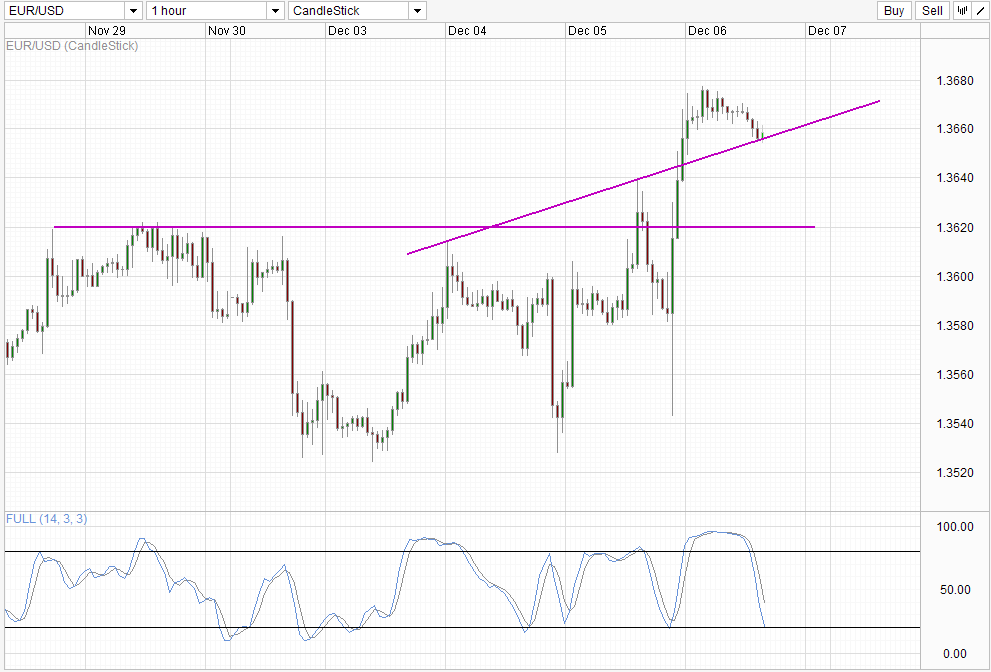

Hourly Chart

EUR/USD rallied after the European Central Bank held rates on Thursday. President Draghi said that ECB was ready to embark on new easing policy action, but there was scant details on whether the bank would use a negative deposit rate. Also, Draghi noted that the Euro-Zone banking system has improved significantly since the last liquidity injection in the form of Long-Term Refinancing Operation (LTRO), and laid out conditions for future LTROs. Such language suggest that Draghi will not be issuing further LTROs soon, while the avoidance of talking about negative rate also suggest that the ECB President does not have a concrete plan on how to carry out further easing, and may wish to simply not talk about it in case of over promising/committing to something that may not have even gotten past the first draft yet. Market responded in kind, sending EUR/USD reach to a high of 1.3677 after New York noon.

It is important to note that ECB did not mention anything remotely hawkish, and EUR/USD is actually rallying on the basis that ECB is less dovish than before, which makes the bullish reaction highly interesting. This is because prices were already on the rise, a more than 200+ pips higher than the recent swing low of 1.33 – price that was reached post ECB surprise rate cut in November. There is no sign of market pre-pricing in a dovish ECB since the previous rate decision, and hence bullish reaction to yesterday’s Draghi’s non-committal statements should have been muted. If anything, market may have already been calling Draghi’s bluff every since the rate cut, which explains why prices have been rallying so strongly.

Therefore, to say that the rally is perplexed may be an understatement, and EUR/USD run the risk of a sharp bearish pullback if this is indeed an knee-jerk overreaction. Currently price is testing the rising trendline that has been formed this week, and a break may open up bearish acceleration towards 1.362 resistance turned support. However if the rising trendline holds, we may need to accept that sentiment of EUR/USD is strongly bullish (doesn’t matter even if it may be irrational as the market is always right).

Today’s Non Farm Payroll may be yet another good test for this supposed EUR/USD bullishness. Should EUR/USD remain supported in the face of strong NFP numbers (to the tune of 200k+), we should be able to see continued bullish climb next week, ahead of the 17th-18th Dec FOMC meeting. Conversely, should EUR/USD fail to hold onto gains even when NFP turn out to be disappointing (less than 180K), the notion of EUR/USD being inherently bullish will need to be revised and the likelihood of a return to 1.362 and perhaps even lower may be possible next week.

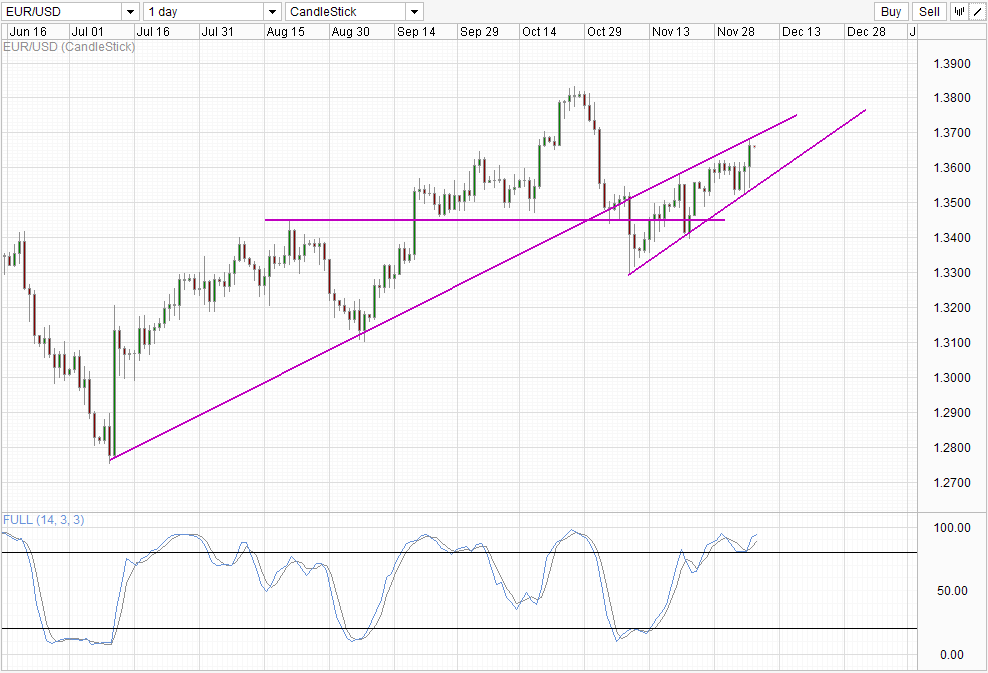

Daily Chart

However long-term trend for EUR/USD remains bullish, and short-term declines may be kept afloat by the lower rising trendline. Nonetheless, even daily chart favors short-term bearish pullback as prices have just tagged the top of the wedge with Stochastic readings deep within Overbought region. However, there is no evidence that bearish momentum is in play, and hence reaction post NFP today remains the key indicator for direction for next week.

More Links:

USD/JPY – Yen Post Gains As Markets Eye US Unemployment Claims

AUD/USD Technicals – 0.907 Resistance Holding

Gold Technicals – Staying Above 1,225 For now

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.