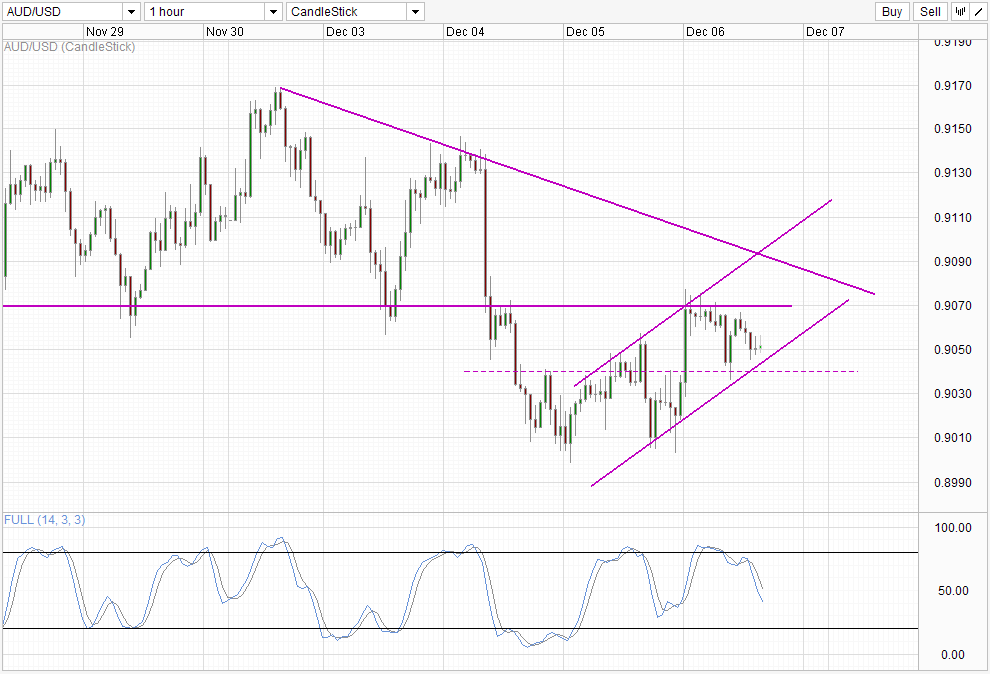

Hourly Chart

Aussie dollar has been enjoying slight recovery pullback for the past 36 hours after a recent swing low has been forged during US session on 4th Dec (5th Dec Asian morning). Bears tried to break the 0.90 round figure but were rebuffed, sending price to a high of 0.9077 yesterday. This move is interesting as US market has been broadly bearish on (supposed) QE Taper fears in the past few days, which should have drove USD higher and AUD/USD lower. Hence, it is clear that the move isn’t related to broad risk trends, and implies that technicals may be the bigger influence in play right now.

This assertion is backed up by how prices is trading nicely within a bullish channel right now, with prices looking to tag Channel Bottom. However, the inability to break 0.907 is a concern as it affirms that the short-term bearish decline that started from Monday is still in play. This would increase the likelihood of prices breaking Channel Bottom and potentially 0.904, opening up 0.90 round figure as a target for quick bearish acceleration.

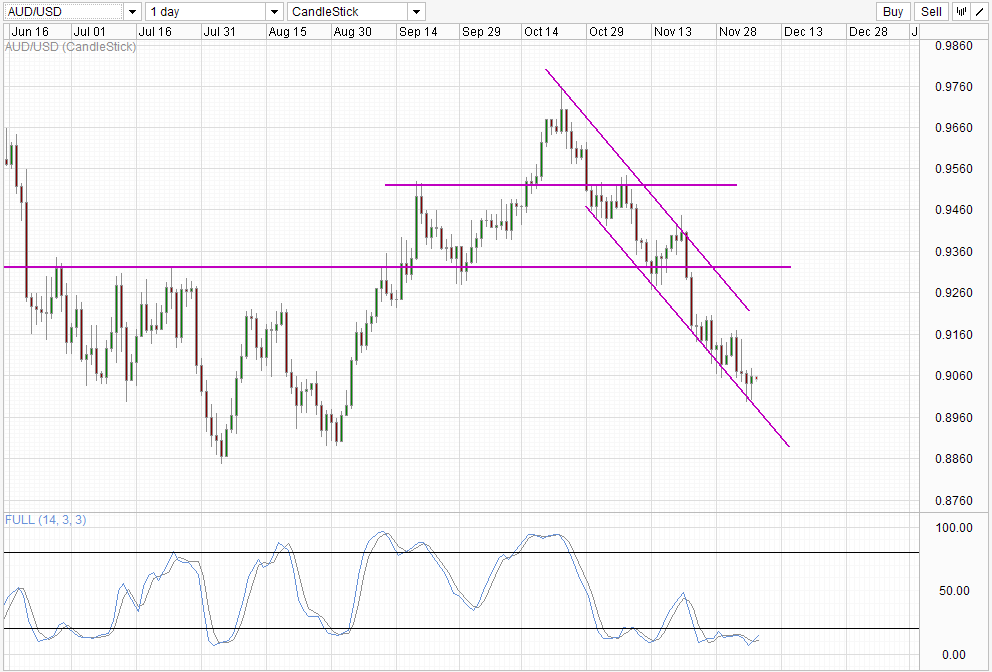

Daily Chart

Daily Chart is more bullish though. Prices is undoubtedly amidst a strong downtrend but it should be noted that price has been straddling Channel Bottom with no significant bullish pullback since the huge sell-off on 20th November. Therefore, the likelihood of a bullish pullback increases moving forward. Nonetheless it should be noted that there is no evidence that the bearish momentum is over, and technical traders will need to wait for Stoch curve to push above 20.0 in order for a “proper” bullish cycle signal to form.

With US Non-Farm Payroll figures scheduled to release today, there is no telling how AUD/USD will play out in the immediate short term. Currently market is expected a slightly better than expected NFP Print (based on analysts consensus estimate which was made earlier) as ADP Employment and Jobless Claims this week have been better than expected this week. However, there is no evidence at least from USD strength wise that currency traders have priced in or is even affected by QE Taper fears in the past 36 hours. Hence in theory AUD/USD should be weakening if NFP comes in much higher than 180+K but do not be surprised if prices end up staying flat.

A worse than expected print may illicit stronger reaction though, as one could make a case that AUD/USD is inherently bullish since prices managed to overcome USD strength amidst all the QE Taper scares (but there is very little evidence of that right now, and this assertion borderlines on speculation). If this is indeed true, then we could see prices breaking the 0.907 resistance today, but bulls will need to content with the descending trendline that has been in play since Monday, and there is no telling how price will play out around the level given so much uncertainty.

Therefore, traders may wish to sit out this NFP print, and instead look out for price reaction AFTER the dusts have settled as that will give us a better gauge of the underlying bullish/bearish sentiment for AUD/USD in the near term.

More Links:

Gold Technicals – Staying Above 1,225 For now

USD/CAD – US Dollar Edges Higher as Unemployment Claims Drop

EUR/USD – Volatility Ahead of ECB Rate Decision

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.