Uptrend in Nikkei 225 continues, with prices currently pushing towards 15,000 round figure. However, today’s gains is much more interesting the than past few days, and not just because current pace of gains seems to be much faster than before.

The increased pace of gains is definitely related to the latest Q3 GDP data, which came in at an annualized rate of 1.9%, stronger than the expected 1.7%. However, that is not the reason Nikkei 225 rallied. Instead, prices actually dipped lower slightly following the announcement, attributable to the fact that the pace of economic growth has slowed down once again, compared to previous quarter’s 3.8% annualized rate. Instead, prices only started to pick up after that, gaining more than 250 points in the next 4 hours.

This behavior suggest that the rally is a speculative move, most likely due to additional speculation that BOJ will increase stimulus in December due to the slow down in growth rate. The same speculation also weakened Yen, providing even more additional bullish winds to drive Nikkei 225 higher, resulting in the stupendous bullish run right now.

Hourly Chart

From a technical perspective, there is very little forward guidance as price has entered into a uncharted territory in the short-term. We only have Stochastic indicator as reference which suggest that bullish momentum is still in play as Stoch readings managed to avoid forming a bearish cycle signal just when the GDP results were released. Then again, we do not really need Stochastic to tell us that current momentum is bullish as it is clearly visible from where price is at right now. As such, conservative traders may need to wait for a significant pullback and observe how price react after the pullback in order to formulate the next phase of Short-Term direction.

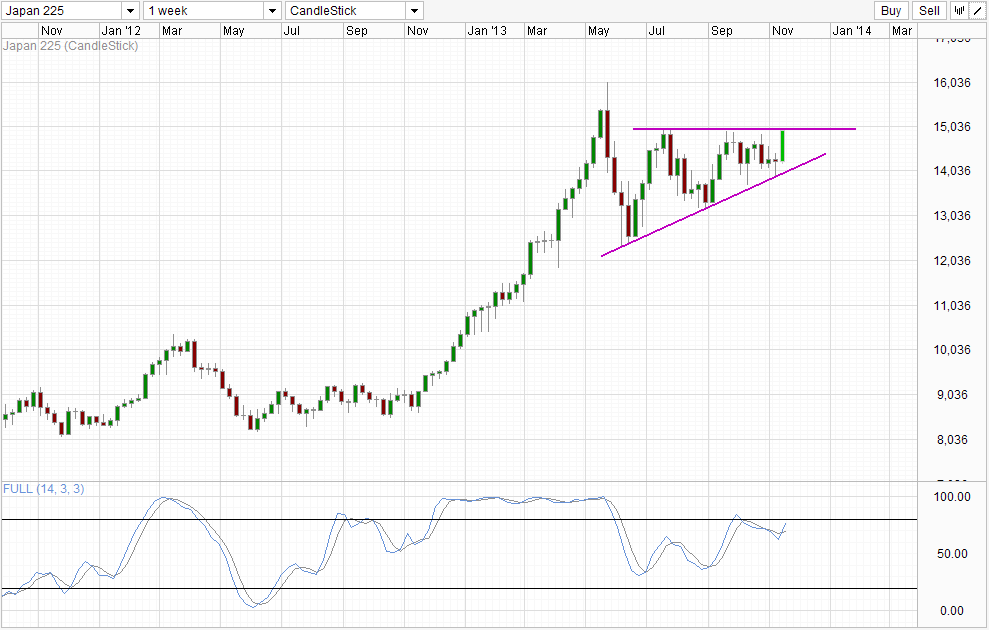

Weekly Chart

Technicals of weekly chart is more helpful, with past candles showing the significance of the 15,000 ceiling. Stochastic readings is still bullish, but we are very close to the Overbought region. Hence from a long-term perspective even if 15,000 is broken, it is unlikely that we will be able to break the 2013 high which is forged in May. Nonetheless, that may be a good enough risk reward ratio for traders to enter especially if they manage their downside risk well.

However, it should be noted that current rally is based on speculators expecting BOJ to introduce new stimulus packages, a theme that has been in play since ECB slash rates unexpectedly last week. The problem is that there is no guarantee that BOJ would do so, and even if BOJ did, the new quantum may not be impressive. As such, there are tremendous downside risk moving forward even as momentum push higher, and traders should take note of this when assessing their risk/reward ratio.

More Links:GBP/USD – Pound Soars as UK Employment Data Shines

USD/CAD – Canadian Dollar Remains Under Pressure

USD/JPY – GDP Growth Slowing Down But Strong Nonetheless

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.