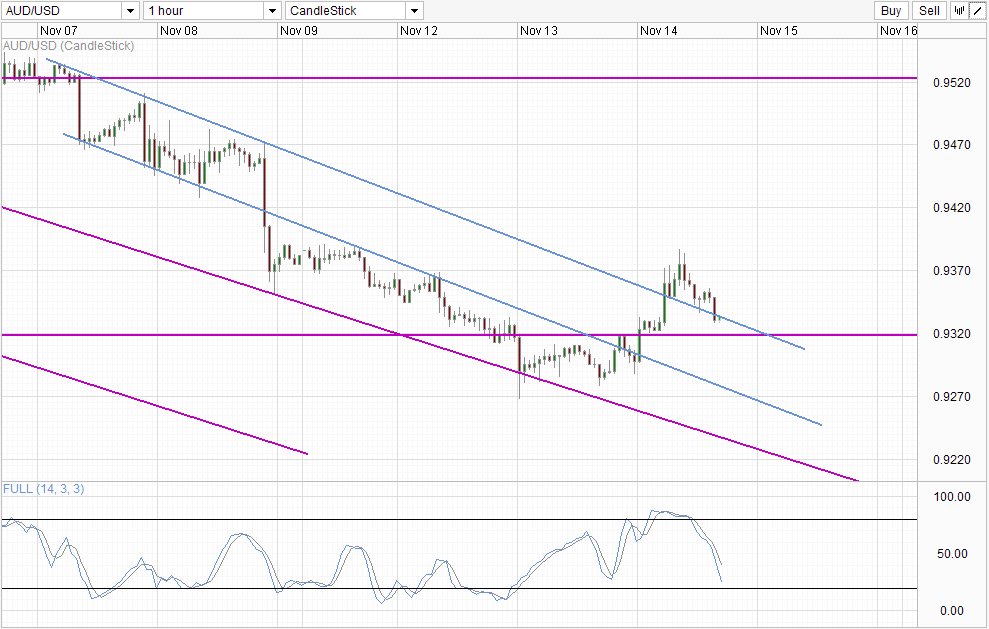

Hourly Chart

AUD/USD pushed higher during early Asian hours, extending the gains made during US session yesterday following weakness seen in USD. This weakening of USD was brought by dovish statements by Janet Yellen ahead of her testimony in Senate today. AUD/USD wasn’t the only currency pair affected, with major currency pairs such as EUR/USD, GBP/USD and USD/JPY equally affected.

This is actually a good sign for AUD/USD bulls, as prices is currently having a bearish predisposition, and the ability of AUD/USD pushing higher in equal magnitude to other major currency pairs is a sign that the bearish predisposition is weakening. However, overall bearish bias remains, and the failure to break the soft ceiling of 0.9390 has resulted in a strong bearish response, with 0.932 the bearish target currently.

Given that prices would have breached into the blue descending channel in order to test 0.932, there is an additional bearish pressure that may break 0.932 in favor of a move towards 0.927 – Channel Bottom and confluence with the swing low of Wednesday (Tuesday US time). It is likely that Stochastic curve would be deeply oversold then, increasing the chance of prices rebounding higher from there.

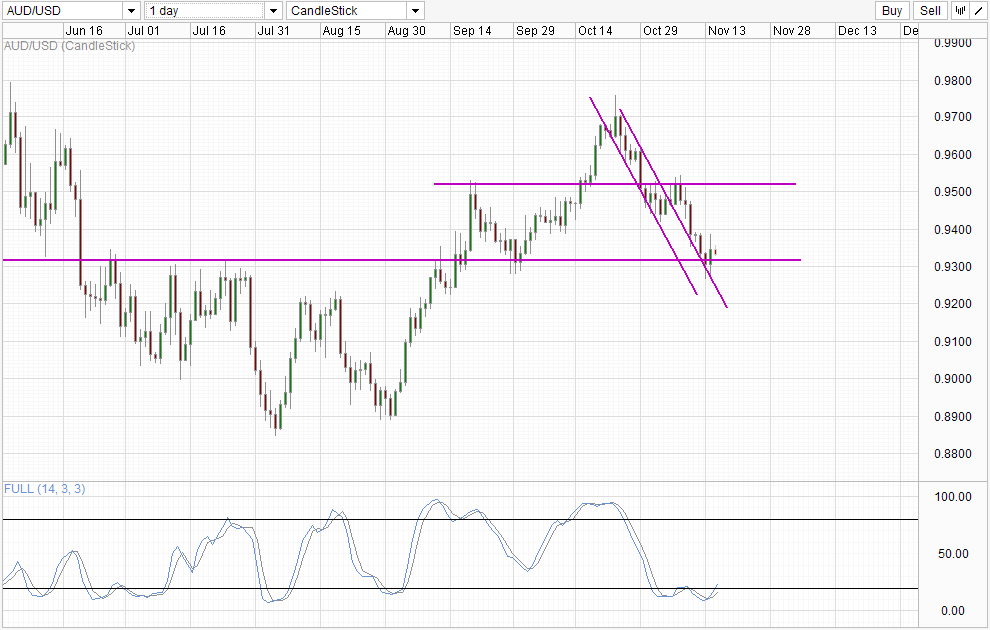

Daily Chart

Daily Chart is caught between crossroads. Currently prices setup is mildly in favor of a long-term bullish scenario with prices 0.952 as bullish target, but current price action does not instil confidence that the 0.932 support is holding well, as we are literally re-testing it right now. Should 0.932 fail (which short-term chart suggest is more than a faint possibility), we could see prices accelerating lower towards Channel Top. Stochastic readings are favoring a bullish push with a fresh bullish cycle signal. However, we have evidence of failed signals before – back in late June and as recent as last week (which could still be regarded as a bullish signal as Stoch curve did cross the 20.0 mark), hence traders should not be married to the idea that the bullish cycle will definitely take flight.

Fundamentals continue favor a weaker AUD, and today’s Consumer Inflation Expectation numbers do not change this perception – coming in at 1.9%, lower than previous month’s 2.0%. This presented yet additional scope for RBA to cut rates once again if they choose to do so. On the US front, it is unlikely that USD weakness will last for long even if a Dec Taper does not happen, as the potential for additional stimulus for an improving US economy is zero. Certainly USD will definitely weaken ala post Sep FOMC meeting style, but eventually the directional difference between the 2 economies will shine through, resulting in a lower AUD/USD in the long run.

More Links:

EUR/USD Technicals – Pulling Back Towards 1.345

USD/JPY – GDP Growth Slowing Down But Strong Nonetheless

GBP/USD – Pound Soars as UK Employment Data Shines

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.