Kiwi Dollar took an early beating this morning following the release of RBNZ’s half yearly report on financial stability. In which the central bank reiterated the problem of rising house pries as a huge risk to economic stability. However, unlike before, RBNZ mentioned that recent tightening measures which limit the total amount of loans banks can lend for Low Deposit-High Value (LVR) houses appear to be having a visible effect. This is interesting as the measures were only introduced in October, and it is definitely premature to to say that it is working. In so doing, it feels as though RBNZ is trying to climb down from its previously hawkish perch – implying that RBNZ may not need to hike rates anymore to combat the housing inflation.

On top of being suspiciously less hawkish, RBNZ reminded the market that it would prefer to see a weaker NZD, saying that NZD is still being “elevated”. These drove prices to a low of 0.8170, but prices recovered significantly as well, pulling above the pre-RBNZ report levels. This recovery is all the more impressive when we consider that USD has strengthened during US session following additional speculation on the likelihood of a December QE Taper event.

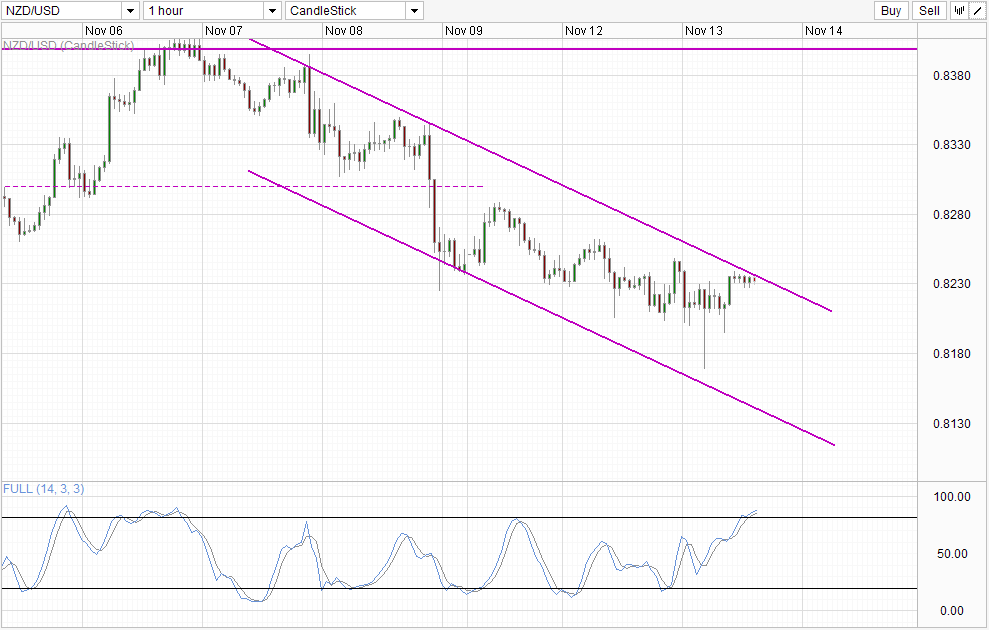

Hourly Chart

Perhaps market is still believing that RBNZ will eventually raise its policy rates which is at its record lows. This latest “dovish” revelation was only interpreted as a possibly delay to the expected 2014 rate hikes promised previously by Governor Wheeler. However, this doesn’t change the fact that short-term momentum for NZD/USD is clearly lower. But even that has more to do with USD strengthening than weakness in NZD.

What happened in NZD/USD for the past 2.5 days is a textbook case of why one may not wish to trade a currency pair where both currencies are strengthening – even when we have strong bearish factors pushing prices lower with short-term bias towards the downside, prices remain buoyant and refuse to go down. If NZD has been inherently weaker, it is likely that prices will be able to hit much lower and perhaps even break Channel Bottom.

Right now, prices are facing resistance from the descending Channel Top, this should open up Channel Bottom as a possible bearish target. Stochastic readings agree with Stoch curve within the Overbought range. However, considering that USD strengthening coupled with RBNZ report failed to keep prices down, one wonders what a technical resistance line can do.

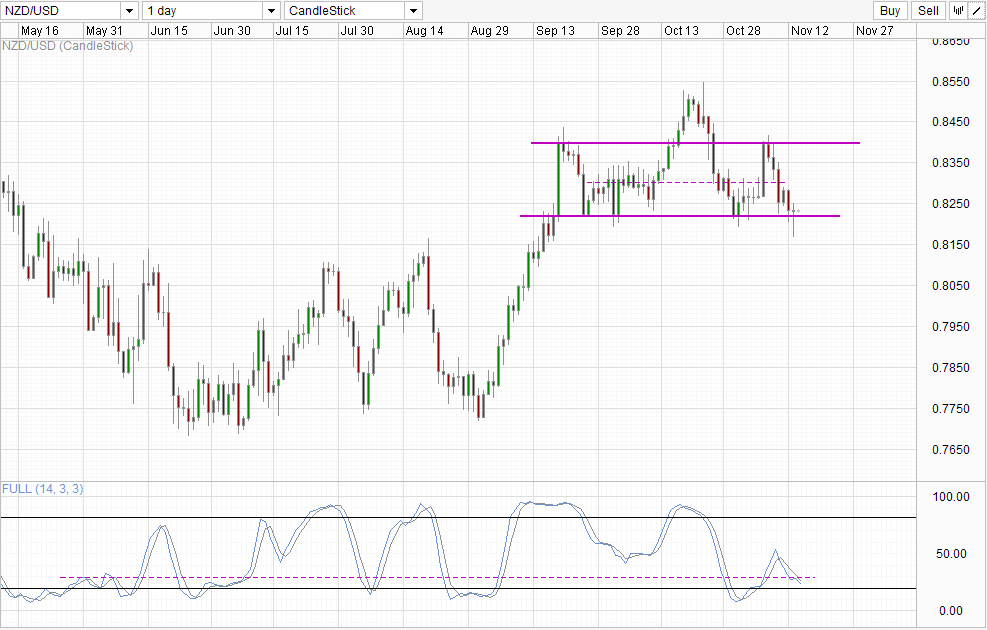

Daily Chart

Direction on the Daily Chart favors bulls for now though, but we are still far away from forming proper bullish reversal signal. Stochastic readings are close to the Oversold region but there is no sign that the Stoch curve is flattening. On the aspect of price action, we have a long-legged doji which coincide with 0.822 support holding. However we are still lacking a bull candle today in order to confirm the bullish reversal which will open up 0.840 as a bullish target. Hence, there is still the likelihood of the Head and Shoulders pattern forming, and a retest of 0.822 support cannot be ruled out.

More Links:

EUR/USD Technicals – 1.345 Resistance Holding Up

Gold Technicals – Moving Closer to 1,250

AUD/USD Technicals – Stoch Divergence Hints Bearish Move

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.