Gold prices took a hit yesterday during US session as speculators increased their bets that a December QE Tapering event will happen. Prices dipped to a low of 1,261.50 by the time the US market closed, shedding slightly more than $20 USD an ounce. However it is interesting to note that the major bulk of the decline happened just before US midday, when the US market has already been opened for a good 1+ hours.

Why is this observation important?

Firstly, the catalyst for increased December Taper scenario has been solely attributed to statements made by Fed’s Fisher, who said that “QE won’t last forever”. This statement though hawkish as it sounds, doesn’t really tell us much. Nobody expected Fed to keep QE in its current form forever. When the economy is perceived to be healthy enough, the market knows that Fed will definitely pull the plug. The only question that remains is what is the level Fed deems “good enough”? Some believe that it is the 6.5% unemployment target, others think it’s related to GDP growth or pace of job growth. Whatever the benchmark may be, the Fed has not made clear guidelines and hence we are all speculating here. Therefore, the best proxy that the market has with regards to Fed’s “good enough” level would be to listen to the speeches of the various members.

In this case, Fisher is not a voting member for the upcoming December meeting, and will only start voting in 2014. Hence, his influence for December’s event is as good as zero. Even if he start to vote in 2014, he has always been known as a hawk amongst his fellow Fed members and it is likely that market would have priced that in already, and hence reactions to his statements yesterday should have been mute.

Speaking of which, his statements were made a few hours before the US market opening hours, when London market was in play. It seems funny that the largest spot gold market didn’t really react bearishly to the news (which makes sense given earlier analysis) but US traders did. Even if we were to grant that US traders are somehow more sensitive towards the Fed taper speculative play, we did not see the sell-off happening immediately when US traders come into play. Rather, prices actually pushed higher slightly during the first 1+ hours of trade, only to reverse heavily later.

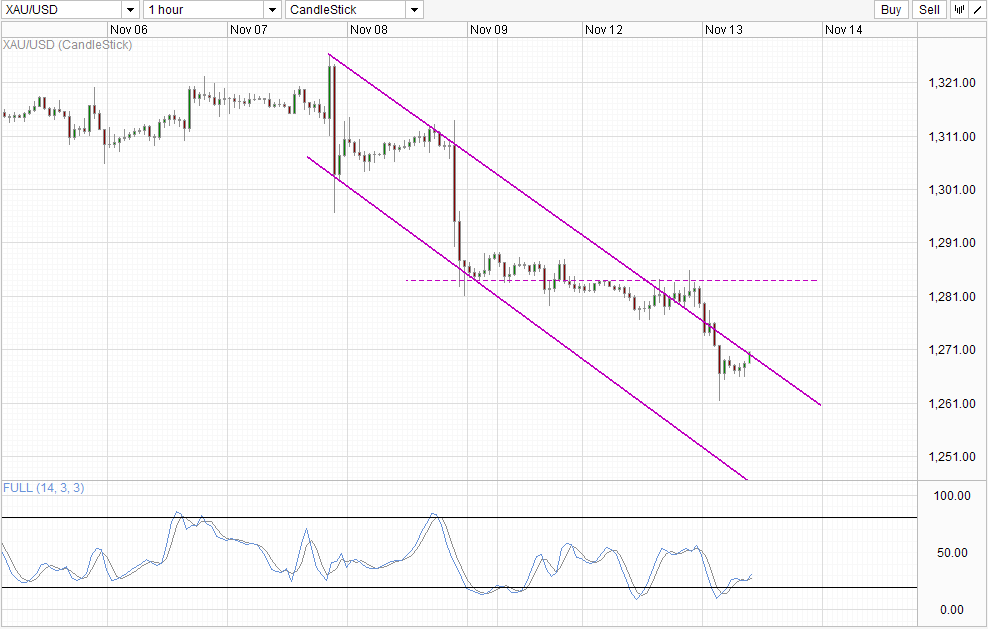

Hourly Chart

Hence, it seems that the strong decline yesterday may be due more to the failure of price to breach the soft support/resistance of 1,284, resulting in strong bearish technical pressure which probably made use of Fisher comments to send prices lower further. Looking at Stochastic indicator, we can see that Stoch curve peaked yesterday around the same levels of Monday just when prices are testing 1,284, lending strength to the technical influence assertion. Furthermore, price found significant support when Stochastic was in Oversold region, the depth of which similar to the troughs seen during Asian trade yesterday and last Friday’s US closing. Currently, prices is testing the Channel Top after breaking back into it. Should Channel Top holds, we could see a return of bearish momentum towards Channel Bottom, breaking the soft support of 1,265 and yesterday’s swing low along the way.

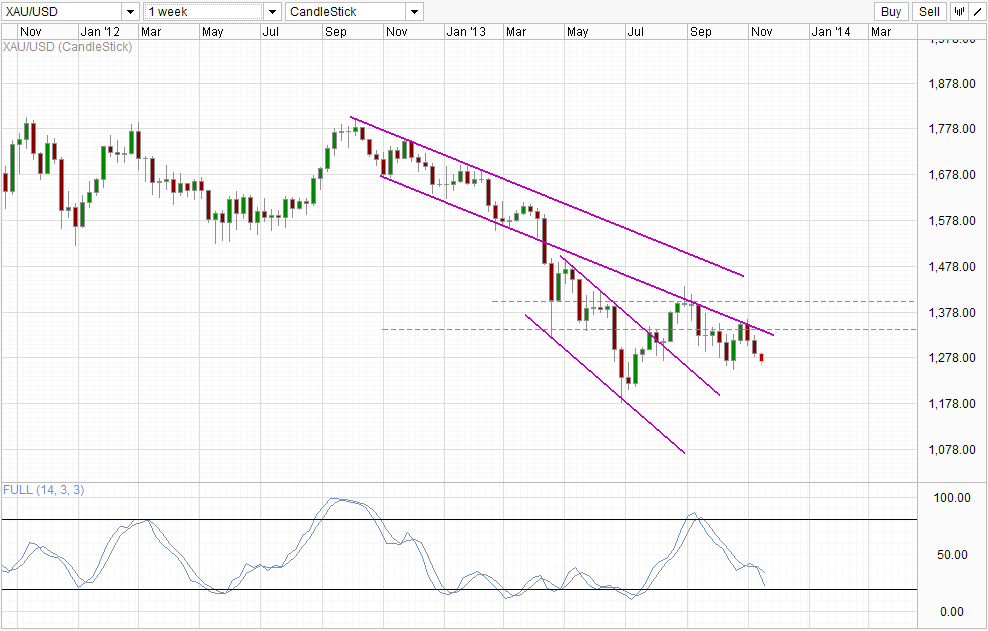

Weekly Chart

Weekly Chart is the same as yesterday’s, with 1,250 support continue to stay as the bearish target. We’ve failed to test the key support yesterday, but Stochastic readings remain above the Oversold level, suggesting that a bearish move is still going – in line with Short-Term direction.

More Links:

USD/JPY – Yen Loses Ground As Industrial Data Declines

GBP/USD – Pound Continues to Drop as Inflation Weakens

USD/CAD – Canadian Dollar Under Pressure, Tests 1.05

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.