Yesterday we were calling for stronger show of strength from the bears, and they have duly delivered. Prices broke the soft 1,330 support during early US session and reached a low of just under 1,320.

Reason for this decline appears to be further speculation that Fed will announce a QE tapering action in December – a move which pushed US Stocks and Treasuries lower while propping USD higher. Besides a stronger USD dragging Gold lower, prices of Gold naturally traded lower as the need for inflation protection would be lower as well, resulting in little need and thus demand for the yellow metal.

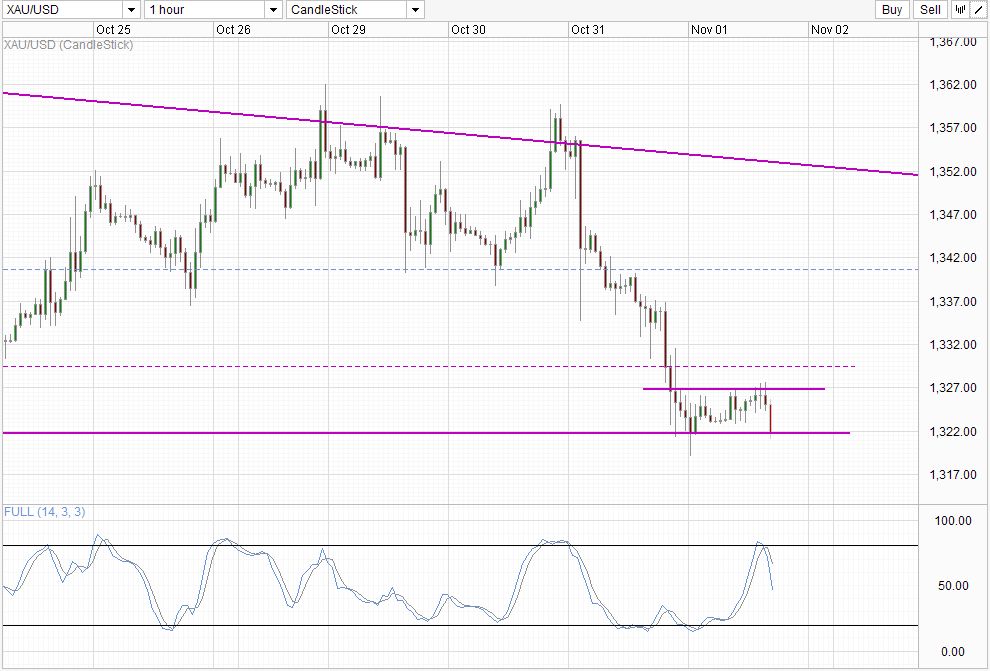

4 Hourly Chart

Currently, price is trending between 1,322 and 1,327, with the entire Asian session trading within this 5 dollar band. Generally this would sound the alarms for incumbent bears that are still holding onto their shorts, but in this case the sideways movement provide necessary pause for the strong bearish momentum that started since FOMC announcement on Wednesday, which is needed in order to prevent current momentum from being overstretched.

Stochastic readings agree, with readings showing a fresh bearish cycle coinciding with a test of 1,322 following the holding of 1,327. If the test succeed, we could see strong bearish accelerating which can potentially bring us closer to 1,300.

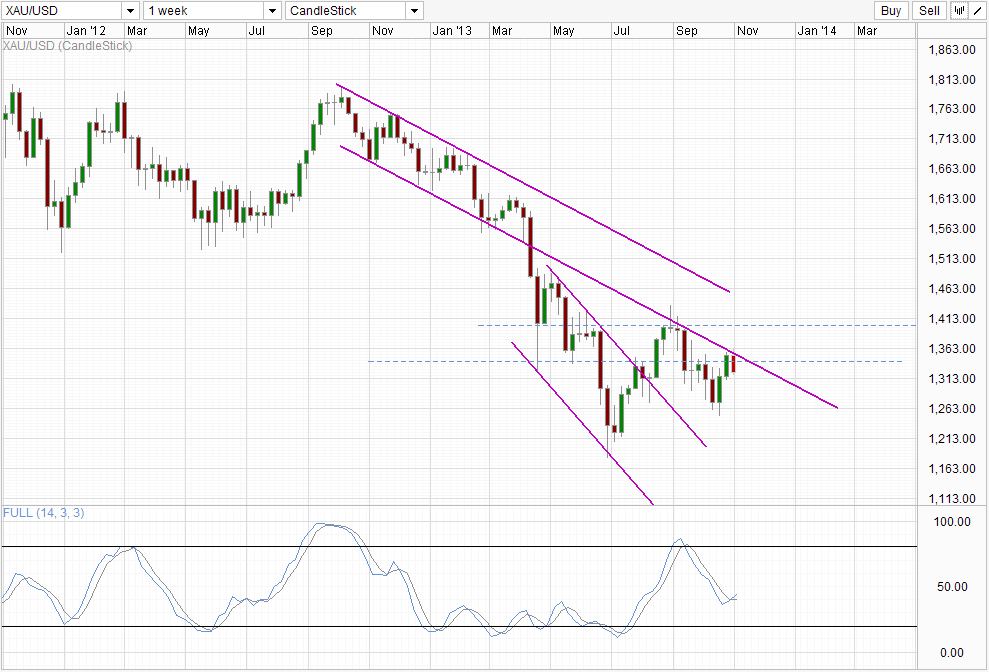

Weekly Chart

Weekly Chart is definitely more bearish compared to yesterday, but we are still some distance away from the most perfect bearish scenario where price closes this week candle below last week’s open and show a Tweezers Top bearish reversal pattern fresh on the heels off a Channel Bottom bearish rejection. It will be icing on the cake if we could see Stochastic readings pointing lower and perhaps even break below the Signal line. Nonetheless, even if we close around current level right now, conservative traders can wait for early action next week and see if market likes the bearish setup as it is, which will increase the chance of a push towards 1,300 and potentially around 1,260 as a reasonable bearish target beyond.

This is in line with the bearish fundamental outlook with a guaranteed QE Taper/End in 2014. Furthermore, demand for physical gold is expected to fall with India’s holiday celebration ending this weekend. The only factor that could still be fueling Gold prices higher would be institutional speculative purchases, specifically those who have bought Gold when the yellow metal was around low 1,200s. However, even that is looking suspect with COT open interest decreasing week on week, suggesting that such demand is drying up.

That being said, it should be wise to remember that Fed Chairman Bernanke only recently said that even he does not understand price movements in Gold. Hence do not assume anything and continue to manage risks with both eyes open even though technical and fundamentals are both pointing lower.

More Links:

Nikkei 225 – Gloomy Start For November

GBP/USD – Finds Support at 1.60

AUD/USD – Continues to Drift Lower below 0.95

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.