After 2 major events within the past 12 hours, we’re back to square one where the Kiwi is currently trading around 0.825, similar to when yesterday’s analysis was made. Prices continue to trade mostly between 0.822 and 0.827, with overall bearish bias from 22nd October remaining in play.

However that does not mean that we do not have new information about the market. Far from it, the lack of response from the 2 major events give us plenty of insights on the underlying market sentiment about NZD.

Hourly Chart

FOMC rate decision came first, and the more hawkish than expected statements drove USD higher and depressed NZD/USD. Nonetheless it seems that the Kiwi dollar is still broadly supported, with prices retracing more than 50% of the initial losses within the 1st hour post FOMC announcement – the strongest reaction seen amongst major USD pairs.

The 2nd major event was the RBNZ rate decision, in which Governor Wheeler maintained hawkish talks, using the same tone back in September. This was deemed a hawkish surprise as market was expecting Wheeler to be a tad more dovish and perhaps even put the 2014 rate hike timeline on hold based on his recent statements. NZD/USD rallied on the back of this announcement, but 0.827 ceiling held firm once again, and prices also pulled back lower quickly during early Asian hours.

The way price moved post events suggest that we could see sideways trading in NZD/USD for a while more between 0.822 – 0.827, as both major events should have been able to ignite strong directional movement in their own right, and the failure to do so suggest that market isn’t ready for any directional play right now. It is highly unlikely that these 2 events “cancel themselves out”, as one was bullish for NZD while the other was bullish for USD, especially since the news were 2 hours apart and the strong pullback was already seen post FOMC and pre RBNZ.

Perhaps some additional bearish space can be afforded to the sideways movement considering that overall bearish bias remains intact, and the Channel Top that has provided support previously is now lower. Hence, price may still be able to break 0.822 and find stronger support closer to 0.82 round figure.

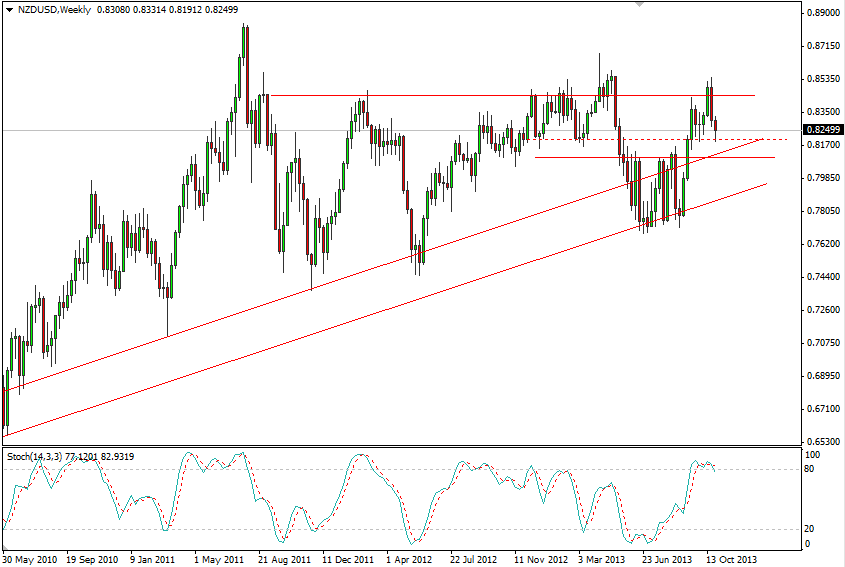

Weekly Chart

Due to the fact that price level is almost identical to yesterday’s, there isn’t any new information to be gathered from the weekly chart. However, knowing that price could be trading sideways in the short term suggest that the bearish rejection that started last week may take longer to have further bearish follow-through. From a momentum/stochastic perspective, the infant bearish cycle signal that Stochastic is showing now may be impaired, and we could see the Stoch levels pushing back up above 80.0 if price continue to trade sideways for the next week.

From a pure fundamental perspective, RBNZ rate hike in 2014 remains a high possibility, as market merely believed that the central bank would only hike rate to a lesser extent even if Governor Wheeler is more dovish than expected. This is evident from swaps that has been pricing in a more than 25 bps rate hike in 2013. On the USD front, QE is also seen as a certainty, and therefore a stronger USD in 2014 appears to be a foregone conclusion. With 2 opposing force tugging NZD/USD, we could see long-term sideways trend emerging as well.

More Links:

GBP/USD – Takes a Breather from Fall below 1.6050

AUD/USD – Trying to Hold on to Key Level of 0.95

EUR/USD – Finds Support at 1.37

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.