Gold prices fell heavily yesterday, with the largest hourly decline since 17th October seen during early European hours. Prices did recover during US session, with prices rebounding from Channel Bottom (seen via Hourly Chart) but ultimately failing to breach the 1,350 soft support turned resistance. The seemingly innocuous failure became more devastating for the bulls when USD strengthened when US session entered fully, dragging commodities as a group broadly lower. This resulted in Gold prices breaking Channel Bottom towards the end of the US session, with Asian bears taking over and testing the 1,340 key support level currently.

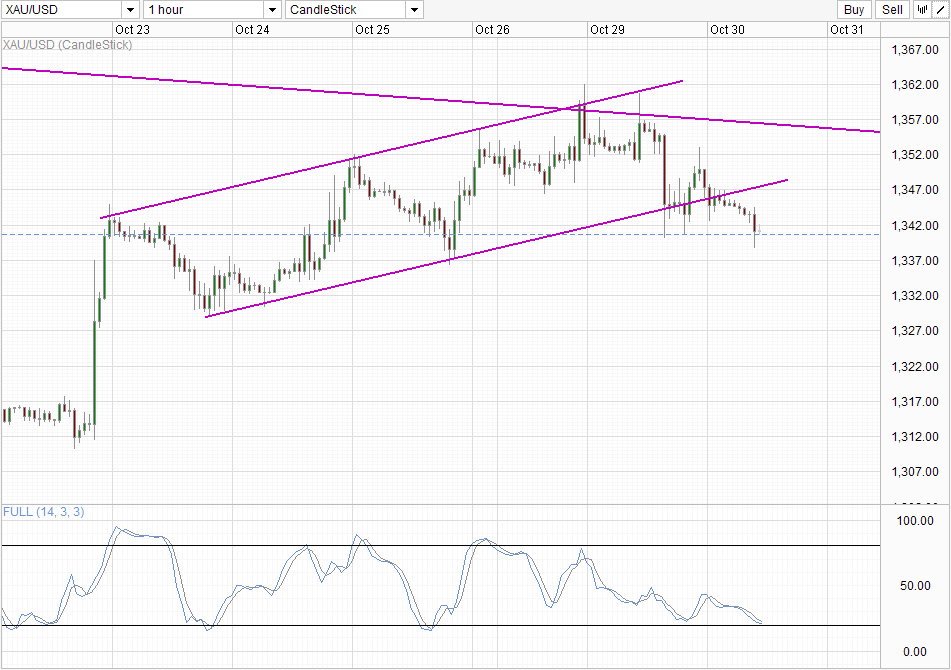

Hourly Chart

From a pure technical perspective, the Channel Bottom breach has heavily impaired the recovery rally that has started since 22nd October. However, without breaking 1,310 it is difficult to pronounce that the overall bullish corrective pressure has been effectively invalidated, especially since further support can be reasonably expected around 1,335 and 1,330 even if 1,340 round figure is broken. Furthermore, Stochastic readings suggest that a bullish cycle will be forthcoming in the future. Even though Stoch readings are still above Oversold region, previous 3 troughs have not really entered deep within the Oversold territories, and hence it is entirely possible that the same may happen again – increasing the likelihood of 1,330 – 1,335 support zone holding even if 1,340 fails.

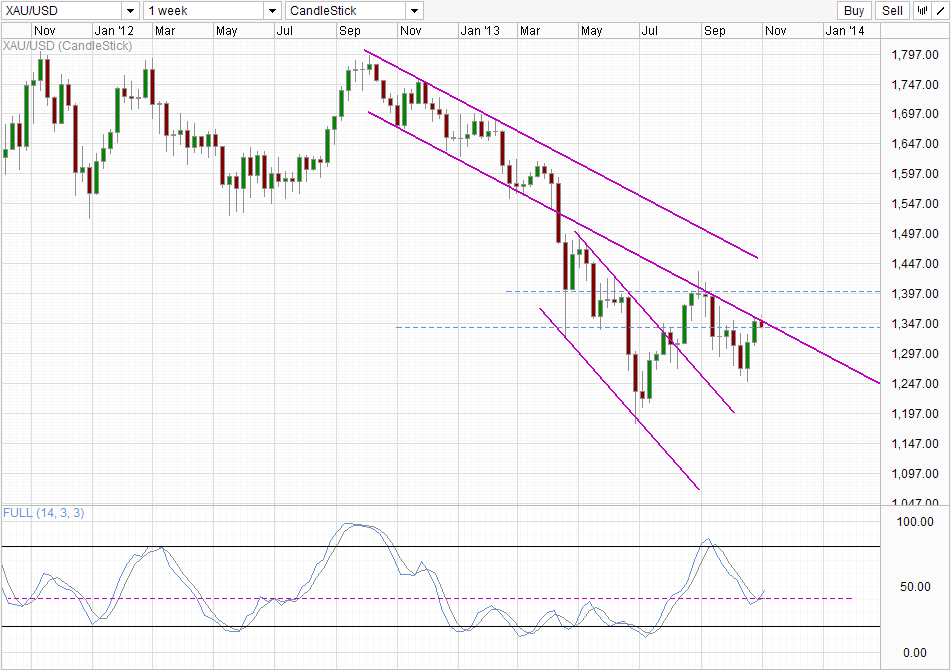

Weekly Chart

Long-term momentum is undoubtedly bearish though, with the overhead Channel Bottom rejecting any further advances. However, Stochastic curve is continuing pointing higher, forming an interim trough just around the 40.0 level. Hence, it may be too early to pronounce that the bearish rejection is already in play, as further bearish confirmation (e.g. prices pushing below 1,340 coupled with Stoch curve pushing below 40.0) may be needed.

Fundamentals are peculiar as well – Gold prices have rallied strongly in the past 2 weeks on the back of weak economic numbers coming out from US, fueling speculation that the Fed will continue stimulus undisturbed until April 2014. Latest Commitment of Traders numbers agrees, showing higher Net-Long in Non-Commercial Positions. However, Open Interest has been falling continuously without any bullish response since the beginning of September, which implies that current rally is a result of lesser sellers rather than more buyers. Hence, the possibility of a bearish reversal moving forward eventually is high as the rally is not supported by volume.

On the physical side – it is possible that recent demand from India ahead of their Deepavali celebrations where Indians traditionally buy huge amount of Gold as gifts have driven up prices in the short-run. Given that the celebration ends this weekend, gold bulls will be losing yet another reason for continued rally, hence increasing the likelihood for an eventual decline.

Furthermore, market has already mostly priced in a dovish FOMC outcome today (Wed 2:00pm EDT), any mention of QE tapering event before April 2014 will result in a huge bearish correction while it is likely that bullish reaction from a dovish announcement may be muted. Nonetheless, even if FOMC announcement came out more dovish than expected, traders can still see if prices managed to push above Channel Bottom mentioned in the weekly chart. Failure to do so will affirm the bearish bias and strong bearish movement will be more likely moving forward.

More Links:

GBP/USD – Moves to Two Week Low at 1.6050

AUD/USD – Breaking Through Key Level at 0.95

EUR/USD – Drops Sharply Below 1.38

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.