USD/INR has been trading consistently higher since Monday, with the decline from US midday on Monday the only significant pullback that has occurred during current run. It is interesting to see USD/INR rising higher given the current fundamental outlook where US is potentially facing a real default possibility – pushing USD weaker against most other major currencies. In theory, this should actually result in a lower USD/INR especially since we’ve seen many investors selling short-term treasurys.

The million dollar question is where would all these new investor cash go?

Rupee may not be the best option currently given the uncertainty, but it would make sense if traders decided to brave the winds and long Rupee with this additional cash, since interest yields for INR is so much higher than USD and definitely way higher than short-term treasurys right now. Even if investors do not think that this return is worth it, we should not be seeing further outflow of funds from India as your traditional safe assets are not doing well.

Perhaps the only reasonable explanation would be Rupee speculators who have been shorting USD/INR ever since RBI Governor Rajan took over are starting to lose confidence and starting to unwind their long positions. But this is not a good explanation considering that prices managed to clear the 61.3 resistance – a strong bullish signal which implies there is a strong bullish driver behind this move.

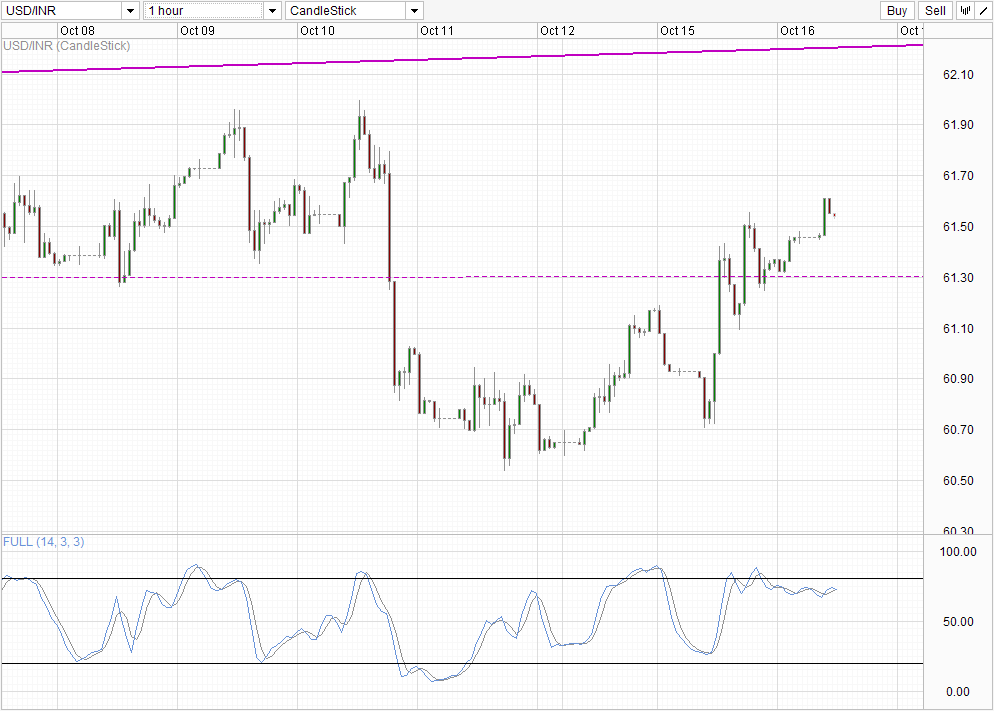

Hourly Chart

From a pure technical perspective though, 61.9 is the obvious bullish target. Stoch curve is currently flat, but the clear divergence between higher highs in prices but lower highs of Stoch peaks suggest that stochastic bearish signal that was formed yesterday is heavily impaired and may not be reliable. Nonetheless, if we are unable to break the 61.7 soft resistance, the likelihood of a push towards 61.30 increases. But if 61.30 holds, this week uptrend will remain intact.

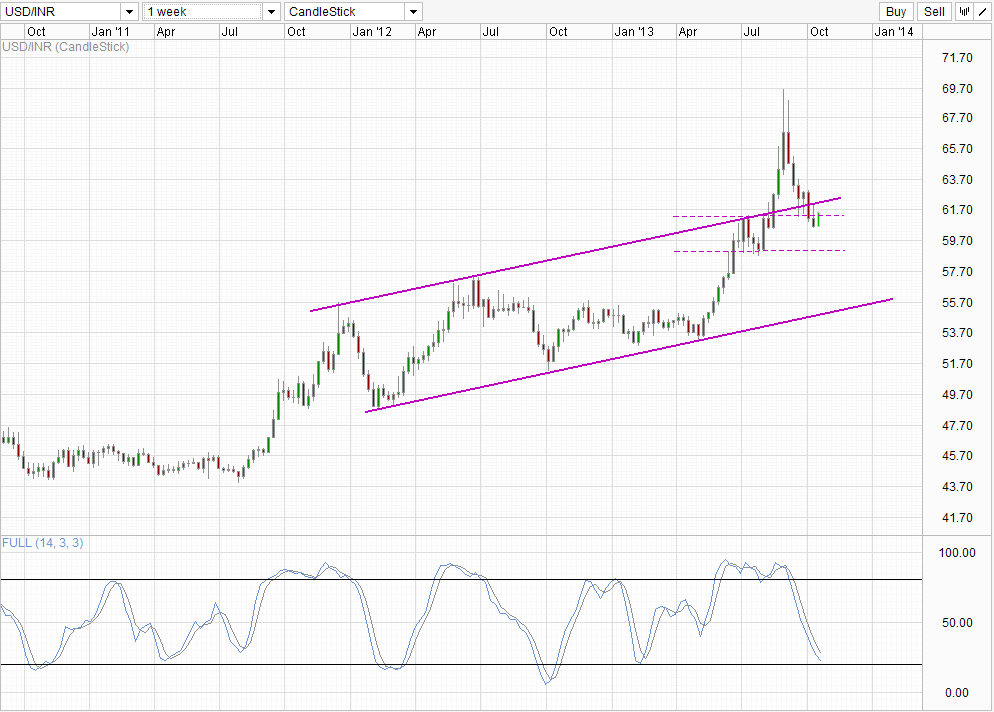

Weekly Chart

Weekly Chart supports a short-term bullish outlook as well. Prices are breaking off from the 59.0 – 61.3 consolidation zone which opens up the possibility of a Channel Top retest. If Stoch curve stays below 50.0 following the retest with prices staying consistently below the Channel Top, the long-term bearish technical outlook for USD/INR remains, and a push towards Channel Bottom is possible with 59.0 expected to provide support.

However, this does not really line up with the fundamental outlook where USD strength remains favored in the long run as long as the Obama administration prevents the country from defaulting on loan obligations. India’s economy remains weak, and that will continue to provide long term bullish pressure for USD/INR unless RBI manage to turn to corner. Hence, expecting USD/INR to hit Channel Bottom from this bearish move alone is hopeful at best, and reckless at worst.

More Links:

GBP/USD – Returns to and Tests Resistance at 1.60

AUD/USD – Moves to Four Month High near 0.9550

EUR/USD – Relies Heavily on Support at 1.35

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.