SGD was broadly stronger on Monday morning following a stronger Q3 GDP print which came in at 5.1%, much higher than expectations of 3.8%. Q/Q Singapore’s economy actually shrank by 1%, but even that is better than analysts’ forecasts of -3.6%. Both electronics and pharmaceutical industries shrank, but the declines were less than originally feared, as demand from neighboring economies Malaysia, Indonesia and continue to be robust despite the initial currency “crisis” a few months ago.

Besides the strong GDP numbers, SGD received further boost when the Monetary Authority of Singapore (MAS) released its half yearly monetary policy statement, opting to keep SGD at a “modest and gradual appreciation” path, while maintaining current NEER band width. This move is widely expected, as MAS needs to combat the rising inflation rates which continue to remain high despite recent Q/Q GDP decline. As such, even though a looser monetary policy should be favored to encourage exports (a la Japan style), MAS has opted to focus on fighting inflation for now given that overall Y/Y GDP remains higher than expected, giving additional buffer to MAS’s own forecast of 2.9% for FY 2013.

Hourly Chart

From a technical perspective, price is currently supported by the 1.245 level. Should we break the key round figure, we could see strong bearish acceleration as the downtrend from 10th October will be extended.

Stochastic readings agree, with stoch curve continuing to point lower and suggest that we’re currently within a bearish cycle. Even though readings are close to the Oversold region, it should be noted that the latest Stoch peak is on par with the previous peak seen on 11th Oct, but price is clearly lower. This divergence between Stoch and price action adds further bearish pressure especially since today’s Stoch peak happened just when a bearish rejection occurred at the 1.247 resistance.

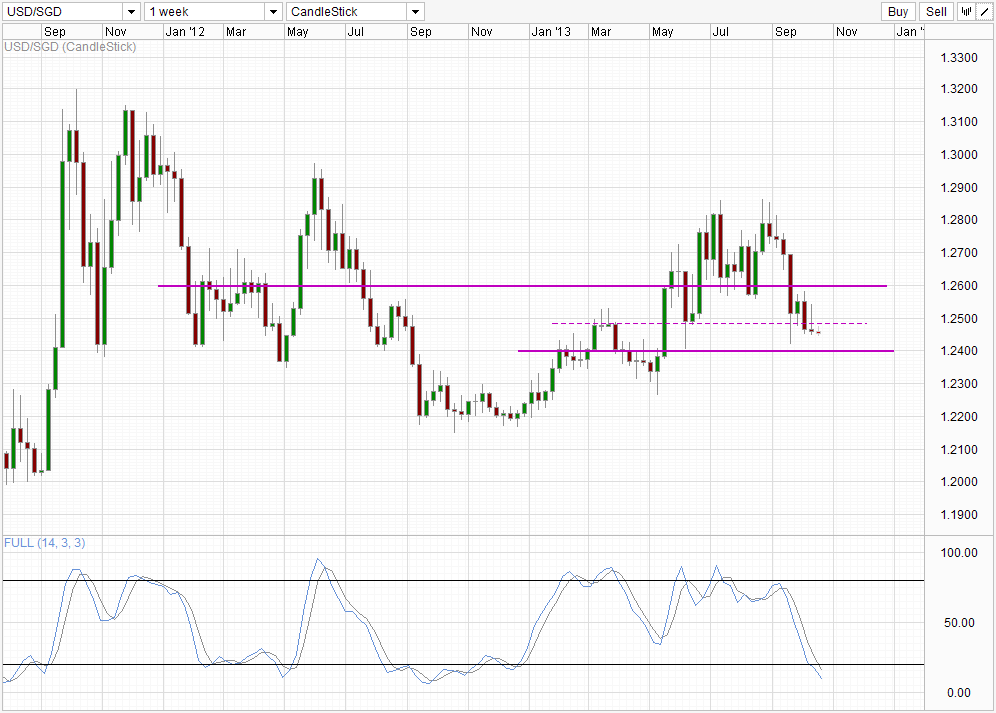

Weekly Chart

Weekly Chart is also bearish, with price aiming for the 1.24 support. However Stoch readings are already heavily Oversold, adding strength to the aforementioned support, increasing the chance of a rebound.

This is in line with fundamentals. A large part of USD/SGD decline since August high can be attributed to the US debt ceiling issue that is still ongoing. Currently there doesn’t seem to be a proper resolution and it is unlikely that we will see any improvement this 1-2 weeks. Hence USD weakness should continue for a while and drag USD/SGD closer to 1.24. However, USD strength will come back once this issue has been adequately resolved, helping price to rebound off 1.24 back towards 1.25 and perhaps even higher if the early 2013 bullish trend has been reverted.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.