Capital markets are back focusing on yields, especially US yields and 10-years at that, now that the benchmark issue is backing up towards +2.97%. With President Obama asking Congress to delay a vote authorizing the use of military force, while his administration pursues a proposal that would have Syria surrender its chemical arms, is a market green light to apply ‘new’ risk again. So, watching yields is the next most appropriate deed, ahead of a market where the US Treasury will auction +$21b 10-year notes in the first reopening of the +2.5% August 2023 issue later today. Currently, investors and dealers are expecting a moderate post-meeting sell-off, with the corporate sector leading the way ahead of the FOMC meet announcement next week.

There are still many obstacles ahead that potentially could derail Obama’s plan; even logistics remain highly problematic and could scuttle any success. There appears however to have been a “clear ratcheting down of tension in the Middle East, especially in Syria” despite the Obama’s administration expressing skepticism that a deal could be reached. Current price action is indicating that many traders are willing to sit the remainder of this week out ahead of the highly anticipated FOMC meeting next week.

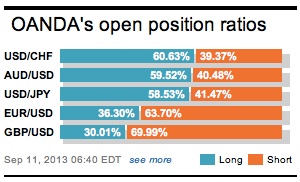

Especially after last weeks NFP “punts” having gone awry and with the safety trades being unwound on the suggestion of a diplomatic outcome to Syria, has convinced many investors to sit this ruckus out. Range trading is being touted for most FX pairs with any risk on strategies being considered reason enough to short the JPY and CHF again. Analysts note that if there is a risk of position adjustment, it is most likely opposite to the strategies that became popular after last weeks payroll data.

Most market positions currently taken have a “close to market average and lower volatility.” Hence, the reason why option traders continue to tout that the dollars left hand side being the most vulnerable with noted reachable stop-losses. Presently, with many option traders positioned for CHF and JPY position falls, would suggest that any pre-FOMC “down moves are probably limited.

With such little economic data being released, any announcements seem excuse enough for the most idle to get involved. This mornings fall in the UK jobless rate to +7.7% from +7.8% m/m initially brought some significant market attention. Gilts performed accordingly on better date – yields managed to back up, but those losses seemed to have been quickly recouped despite UK product still underperforming bunds on the day. The fall in the unemployment rate, which Governor Carney said needs to fall to +7% before the BoE would consider raising rates, has not altered current market expectations of the timing of the next rate hike. The UK futures market continues to price in a +80% November 2014 UK rate hike.

Even with encouraging data on the growth front – recent Chinese reports revealing a more stabilized economy – Emerging Markets trades remain somewhat under pressure; at least until US Treasury yields can better steady themselves. Investors remain anxious about a further rise in global yields and the effects of continued capital outflow from the region to have any significant pro-emerging market trades on and ahead of next weeks FOMC rate decision.

Pro-EUR traders will continue to pick away at the single currency’s topside, more so now that Obama has taken a step back from his initial aggressive stance. Keeping Monday’s low (1.3222) intact puts the EUR bulls in control and with little market opposition, mostly because of the lack of fundamental data, opens up key resistance around 1.3300-10. Muddying the dollars water is the fact that many are now considering that next weeks FOMC meet will turn into a “taper lite” event. For so long the FX market has been driven by the growing conviction that the FOMC would start cutting its asset purchases from +$85b a month this month. The evidence is showing that despite an exodus from emerging market currencies, the dollars own gains have been modest (+2.6% TWB on the year). Is the market preparing for a “liter” event?

Other Links:

EUR Run Squeezes Shorts – Will FOMC Inflate Dollar?

Dean Popplewell, Director of Currency Analysis and Research @ OANDA MarketPulseFX

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.