Thankfully it’s Monday and the beginning of a new week – let’s hope we get some market movement and prove that the summer doldrums are a myth. Despite everything it was a busy weekend in Moscow, Tokyo and Beijing. Japanese Prime Minister Abe got what he wanted over the weekend, the control of the “Upper House.” The LDP-New Komeito coalition now holds 135 seats after the election, regaining the majority and now surpasses the “stable majority” threshold of 129 seats that enables the coalition to control the house. The coalition already owns 325 seats and enjoys the so-called “super majority” in the Lower House. The country’s political stability has been regained by one part or coalition – the first time in six-years.

Many will view Abe’s political win as being net positive for USD/JPY, but with the outcome already fully priced, it is not a surprise to see the pair and the Nikkei a tad lower starting off this morning. PM Abe came to power seven-months ago, vowing to drag Japan out of 20-years of stagnation. To do this he launched an aggressive stimulus plan designed to push down the value of the Japanese yen and boost exports. However, to keep his country growing he must implement some further structural reforms, raise taxes and open Japan’s economy to more competition – all of which would be unpopular. Sunday’s win gives his coalition a clear political path to do so. However, the big question is whether Prime Minister Abe has the stomach to do so?

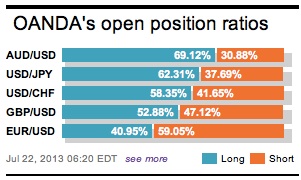

Investors see better buying opportunities on USD/JPY on pullbacks, mostly as JPY short positioning has been scaled back dramatically in the past few weeks, ahead of the “Upper House” elections. The market seems comfortable establishing Yen shorts closer to ¥99 and below for a renewed move towards ¥101.55. Through here, the pair should have the momentum to test the recent dollars highs of ¥103.75. Current levels (¥100.00) are somewhat neutral, which could mean that there is some latitude to short yen again. The biggest issue is whether the market will be given the opportunity to visit their desired Yen sell levels. Many political pundits believe that significant policy changes that impact yen will probably have to wait for a further two or three months, closer to the Diet session.

China was also busy in the Capital Markets this weekend. The PBoC announced and implemented their first steps towards interest rate liberalization with three changes that took effect last Saturday. Policy makers removed the lower bound of financial institutions’ lending rate, abolished the control on the interest rate of discount bills and lifted the upper bound of Rural Credit Cooperatives’ lending rate. To many, the most import change was the removal of the lower bound lending rate and this despite the actual impact on the economy to be limited. The PBoC previous policy allowed for a -30% downward adjustment, but only a minor portion of loans from commercial banks were lent at a discount. As per most policy’s implemented, it more to do with perception.

The G20 two-day soiree concluded on Saturday in Moscow, with Vladimir Putin winning the perception battle for a successful working meeting. The Global finance bosses from the 20-major economies have promised to pledge whatever it takes not to frighten capital markets and the investor. The Group of 20-nations have promised to pursue “carefully calibrated and clearly communicated” policy moves so that the US and Japan don’t cause cross-border damage when they start rolling back stimulus. They expect to move “more rapidly” toward market-determined exchange rate systems, following China’s internal banking change. In theory, it’s a very nice idea; the problem is that these policy makers tend to have a problem identifying a problem until it’s a tad too late.

Central Banks remain front and center for most of the major economies and India’s RBI has been very active of late. Its policy makers view the recent volatile moves in their currency futures and options are a result of speculative trading that was “offsetting some of the central bank’s steps to check volatility in the forex markets.” Conferring their concerns with the Securities and Exchanges Board (Sebi) before last weekend has resulted in the regulators taking measures by increasing the margin requirement and restricting open interest limits to keep speculators at bay. The market should expect market volumes to decrease dramatically. Any further restrictions has the potential to drive “natural” hedgers offshore to other financial centers where they can side step some of the rules. There is a fine line on how much pressure a regulator can put on investors before it begins to have a direct negative impact.

The key events this week are the flash PMI’s for the Eurozone where the market will be looking for signs of growth in manufacturing. Japan’s CPI release at the end of the week will be carefully dissected especially after Prime Minister Abe’s Upper House victory over the weekend. The Reserve Bank of New Zealand will announce its policy decision. Stateside contends with housing data, durable goods, confidence and treasury supply. ‘Helicopter’ Ben’s emphasis on the data-dependent nature of the FOMC’s commitment to reducing monetary stimulus suggests that the ‘mighty buck’ is expected to be very sensitive to the tone of US data releases over the coming weeks.

The 17-member single currency current bias remains on the upside for gains towards 1.3261. A number of factors are currently supporting the currency. An internal rift within Portugal’s ruling coalition appears to have been resolved. Falling peripheral euro-zone yields is likely to underpin the EUR. The spread between Portugal’s 10-years (6.37%) and bunds have tightened by 37 bps. While Italy (4.38%) and Spain (4.6%) have eased by 3 bps to bunds. Easing tensions has techs eyeing further support for the EUR.

Even with daily momentum remaining positive and adding to the overall upside potential, there remain a number of bearish reasons for the EUR. Given its below consensus forecast for the flash PMI’s and German Ifo this week, along with the resurgence of political uncertainty in the periphery countries, coupled with the difference in the monetary stance between the ECB and the Fed would suggest selling EUR on rallies. Despite Periphery spreads tightening, confidence is easier lost than gained. Do not be surprised to see some better selling into this morning’s EUR relief rally, especially if volumes remain thin on the ground.

Other Links:

For Now EUR A Bust, G20 A Must

Dean Popplewell, Director of Currency Analysis and Research @ OANDA MarketPulseFX

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.