Is it really the best of a bad lot? Even disappointing PPI and manufacturing data yesterday suggests that the US recovery is somewhat uneven. So far this has not been able to stall the ‘mighty’ dollar’s rally. The dollar bull continues to rely on the last few weeks’ upbeat jobs prints to aid the buck in its quest for higher prices. It was lower energy prices that led US wholesale prices to its biggest decline in the producer price index in more than three-years last month (+0.7%). This would suggest that US inflation is currently a relative non-issue, implying that the Fed has time on its side to continue with its monthly QE program without having to worry about any spike in prices.

In today’s reality, a giant wave of disinflation seems to be enveloping the globe. These falling prices are been driven mostly by recessionary forces rather any improvement in domestic economic output. The world is experiencing “a lack of demand problem” and “not a positive supply shock.” Under these variables, the market has been blaming the complacent policymaker. The US will get to hear from a host of their own policy makers today – six in fact. Already in Milan this morning, Philly Fed President Plosser (non-voting member) has already repeated his speech delivered earlier in the week calling for the central bank to begin winding down its monthly $85-billion bond-buying stimulus. He believes that the current US labor market conditions warrant a pullback as soon as the next meeting.

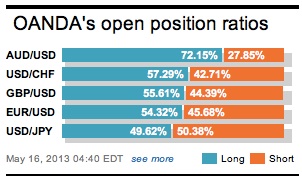

“Helicopter” Ben himself gets to speak this Saturday on the “Economic prospects for the long run.” This may be a subject matter that could interest investors on the markets open next week ‘down-under.’ The impact of what the Feds to do with QE comes at an important time in the markets. To some, current risk taking is been seen as a little too exuberant – just look at some global equity indexes recent highs. Of late, the “mighty” dollar has been the only game in town, with the ‘dollar’ index in danger of eclipsing last year highs. Through 84.10 with any conviction and this market may witness the ‘bucks’ strength been extended. A plethora of investors have been favouring the recent dollar move and expressing their views through short EUR and JPY outright positioning.

One week on and the worlds most crowded and talked about trade continues to go deep. Being supported on pullbacks has yen now eyeing ¥103 as its next intended target. With the market looking towards the eventual end of QE by the Fed has given yen the green light to be slammed in the wake of the Bank of Japan’s efforts to stimulate its own domestic economy through its bond-buying program. Overnight data confirms that Japan’s economy has been expanding more than expected. Domestic GDP rose at an annualized pace of +3.5% (consensus +2.7%) in Q1, compared to a revised +1% gain in Q4, 2012. In quarter-over-quarter terms, GDP rose +0.9% from a revised +0.3% increase. Domestic demand showed steady growth supported by a resilient consumption. The surprise was in net exports, which contributed +1.5bp to GDP.

Other weekly portfolio data revealed that the Japanese investor remains a net buyer of foreign assets for a third-consecutive week – it seems that the six-weeks of ¥ repatriation from early March to mid-April has finally stalled. Domestic Japanese residents purchased +¥186-billion of foreign bonds, +¥19-billion of foreign stocks, resulting in a net outflow of Yen equal to -¥206- billion. It’s no wonder that USD/JPY has quickly become a more crowded trade, especially now trading north of ¥100. However, the pace of the Japanese investors buying of foreign bonds is already beginning to slow and currently remains below the pace seen this time last year. Even the speed of foreign purchasing of Japanese equities has also rebounded. Investors would be better off following EUR/JPY where “corrective pressures” are most likely to appear first hand.

EUR supporting data this morning shows that the 17-member zone has posted its largest trade surplus (€22.9-billion) on record, driven by sharp rise in exports and a decline in imports. The export figures would suggest that the Euro-zone might soon return to growth. Other data revealed that Euro regional consumer prices fell for a fourth straight month and certainly a reflection on a weakness in demand.

Again, AUD outright selling has led the EUR to current lows (1.2850) where, first time around at least, corporate and option hedging buyers have been active buyers of the single currency. The market concern is that the softer-than-expected tone of yesterday’s US data is unlikely to prove persistent support for the USD strength. Even a weaker than expected CPI print later this morning would be further market proof.

In the best of a bad lot theory, the USD should remain better supported in short run against the JPY and Aussie, and weaken against EUR. As long as there is no real widening in yields spreads in favor of the “mighty dollar” and the Euro-zone credit spreads do not widen significantly, then there is an argument to not turn aggressively negative on the single currency. Investors should expect some consolidated buying at these lower levels.

Other Links:

Being A Persistent Dollar Bull Is Hard Work

Dean Popplewell, Director of Currency Analysis and Research @ OANDA MarketPulseFX

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.