EUR/USD has edged higher but remains vulnerable, as the markets await the outcome of the upcoming Federal Reserve policy-setting meeting, set for Wednesday. There is growing speculation that the Fed will introduce additional monetary easing in an effort to boost US economic growth. While the politicians in Washington continue to squabble over the fiscal cliff, the Fed may decide to intervene with an additional monetary stimulus package. Operation Twist is nearing its end, and the Fed could decide to purchase $30-40 billion a month of Treasury notes. This would be in addition to the Fed’s current program of purchasing $40 billion a month of agency mortgage-backed securities.

There is little room for the Fed to adjust interest rates due to their low levels, and the markets are anticipating that the current low rates policy will continue well into 2015. Although recent unemployment data was positive, the unemployment rate is still quite high at 7.7%, and there are other weak spots in the US economy, particularly in the manufacturing and housing sectors. These soft spots could serve as the catalyst for further Fed intervention. If the Fed does indeed intervene, look for the dollar to soften against the euro.

The big story over the weekend was the surprise announcement by Italian Prime Minister Mario Monti that he intended to resign, after only 13 months on the job. Monti, a technocrat who is essentially acting in a caretaker capacity, has cut government spending and helped restore Italy’s financial credibility with its international partners. Unsurprisingly, his popularity has dropped as the government has introduced austerity measures. The markets are not happy to see Monti go, and news of his departure weighed on the euro in the early part of the week. However, Monti has sought to reassure the markets, stating that he intends to remain on the job until the 2013 budget is passed.

In Tuesday’s releases, strong economic sentiment data has given a slight boost to the EUR/USD. Both German ZEW Economic Sentiment and Euro-zone Economic Sentiment looked very sharp. The indices measure the level of optimism of institutional investors and analysts, and their views on the economy are highly respected by the markets. ZEW German Economic Sentiment, a key release, climbed to 6.9 points. This marks the first time that the index has bee above the zero level since May. Euro-zone Economic Sentiment was also strong, coming in at 7.6 points, well above the forecast of 0.1 points. This was the index’s best showing since April. Today’s highlight out of the US is Trade Balance, with the markets expecting a slightly higher deficit in the November reading.

EUR/USD for Dec 10, 2012 to Dec 11, 2012

EUR/USD Dec 11 at 12:20 GMT

1.2992 H: 1.2929 L: 1.2997

S3 S2 S1 R1 R2 R3

1.28 1.2880 1.2960 1.30 1.3030 1.3130

EUR/USD Technical

EUR/USD began the European session in uneventful fashion, but has since flexed some muscle, as it broke through resistance at 1.2960. 1.30 is an important psychological barrier, and the pair is currently testing that line. If EUR/USD does cross 1.30, it will have some room for more gains, with the next line of resistance at 1.3030. 1.2960 is the next line on the downside, and has strengthened as the pair trades at higher levels.

•Current range: 1.2960 to 1.30

Further levels in both directions:

•Below: 1.2960, 1.2880, 1.28, 1.2750, 1.2690, 1.2624, 1.2590, 1.25, 1.2440, 1.2390 and 1.2250.

•Above: 1.30, 1.3030, 1.3080, 1.3130, 1.3170, 1.3290 and 1.34.

•1.2960 is providing support. 1.2880 is stronger.

•1.30 is under strong pressure on the upside as the pair improves. 1.3030 is the next line of resistance.

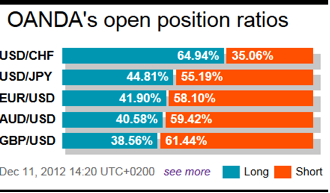

EUR/USD Long – Short Ratio

The euro has pushed higher on Tuesday, buoyed by today’s strong German Economic Sentiment release. Market sentiment continues to point to a downward bias. This would mean a retraction towards 1.2960, which is the next support level for the pair. EUR/USD is testing the 1.30 level, and if it breaks this important barrier, could move towards 1.3030, the next line of resistance.

Today’s Expectations

There was unexpectedly strong economic data out of Germany earlier on Tuesday. The euro responded in positive fashion, pushing higher as it tests the 1.30 level. We could see EUR/USD continue to post gains before consolidating.

EUR/USD Fundamentals

•6:30 French Final Non-Farm Payrolls. Estimate -0.3%. Actual -0.3%.

•7:00 German WPI. Estimate +0.4%. Actual -0.7%.

•All Day: Eurogroup Meetings.

•10:00 German ZEW Economic Sentiment. Estimate -11.4 points. Actual +6.9 points.

•10:00 Euro-zone Economic Sentiment. Estimate +0.1 points. Actual+ 7.6 points.

•13:30 US Trade Balance. Estimate -42.7B.

•15:00 US IBD/TIPP Economic Optimism. Estimate 51.6 points.

•15:00 US Wholesale Inventories. Estimate +0.5%.

(All release times are GMT)

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.