What is correlation? Wikipedia Definition:

In probability theory and statistics, correlation, (often measured as a correlation coefficient), indicates the strength and direction of a linear relationship between two random variables. In general statistical usage, correlation or co-relation refers to the departure of two variables from independence.

Some currency pairs tend to move together in the same direction. Other currency pairs tend to move in opposite directions. Understanding how currency pairs tend to move relative to one another can be used in a number of different ways. It can be used to analyze how diversified your Forex portfolio is and, indirectly, your risk profile. It can also be used to understand how to enter into hedging trades.

Currency correlations measure how closely currency pair prices have (statistically) moved together in the past.

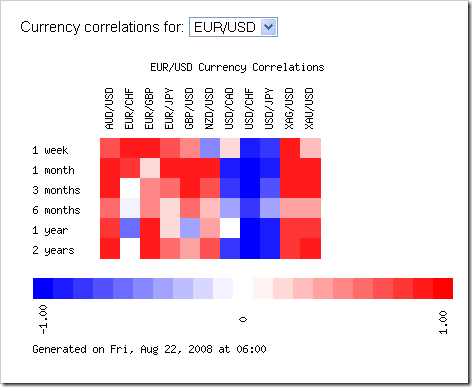

Example of how some currencies are correlated with each other. Positively or Negatively

The darker the color the higher the correlation. In the case of the heatmap above you can plainly see the high correlation between EUR/USD which is the pair we are comparing to XAG/USD. Silver is a commodity that losses value when the USD gains vs the EUR. Given that high correlation it would be highly likely that as the USD apreciates vs. the EUR, it would also appreciate vs Silver. The opposite would also be true.

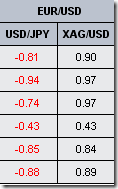

There is a table view in order to compare the numerical correlation values of the various pairs. A perfect example of direct and inverse correlation is in the following two columns.

A correlation coefficient, a number between -1 and +1, is used to express how closely correlated two pairs are.

EUR/USD is inversely correlated with USD/JPY. In the past week the pairs were inversly correlated at -0.8. A gain by the EUR vs. the USD was correlated to a loss of the USD vs. the JPY. In the next column is the example of the opposite type of correlation. In the past week when EUR gained on the USD there was a correlation of 0.90 between Silver advancing on the USD.

Finally, if two pairs have a correlation coefficient close to 0 then the two pairs tend to move independently of one another.

It is important to note that currency correlations can change over time because of changes in monetary policies or shifts in the eco-political landscape. For example, a new extensive free trade agreement between two countries may mean that their currencies will correlate more strongly in the future. Traders will want to analyze changes in correlations since such changes affect their risk profiles.

The live version of the OANDA FXCorrelation tool is hosted at FXInfoCenter

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.