Data to Put Improved Risk Appetite to the Test

Wednesday’s tech sell-off is doing little to weigh on risk appetite ahead of the open on Thursday, with futures on all three major indices around a third of a percentage point higher, tracking broad gains in Europe.

With US indices trading around record highs it seems investors are currently willing to shrug off Wednesday’s declines some of the biggest tech names, putting it down to profit taking rather than a sign of any underlying concerns given the already extended levels. With plenty of economic data to come today including income, spending and inflation – the Fed’s preferred measure – as well as appearances from Federal Reserve officials, this positive risk appetite may well be put to the test at times.

EUR/USD – Euro Dips as German Retail Slumps

Oil Edges Higher Ahead of Decision on Output Cut

Oil is trading a little higher today as OPEC and non-OPEC officials meet to discuss extending production cuts, which currently runs until March of next year. An extension of the 1.8 million barrel cut to the end of 2018 is expected to be announced and given the rally in recent months, I would assume this is almost entirely priced in.

With that in mind, anything short of this could trigger a decline in oil prices, as could an extension in line with expectations as we saw when the last one was announced in May. Only a more aggressive cut is likely to provide any substantial upside, although I’m not sure there’ll be much appetite for such action given the progress that’s already been made and the market share that is being conceded to US shale as a result.

Oil Traders Get Ready To Sing O(PEC) Vienna

Sterling Adds to Gains on Brexit Progress

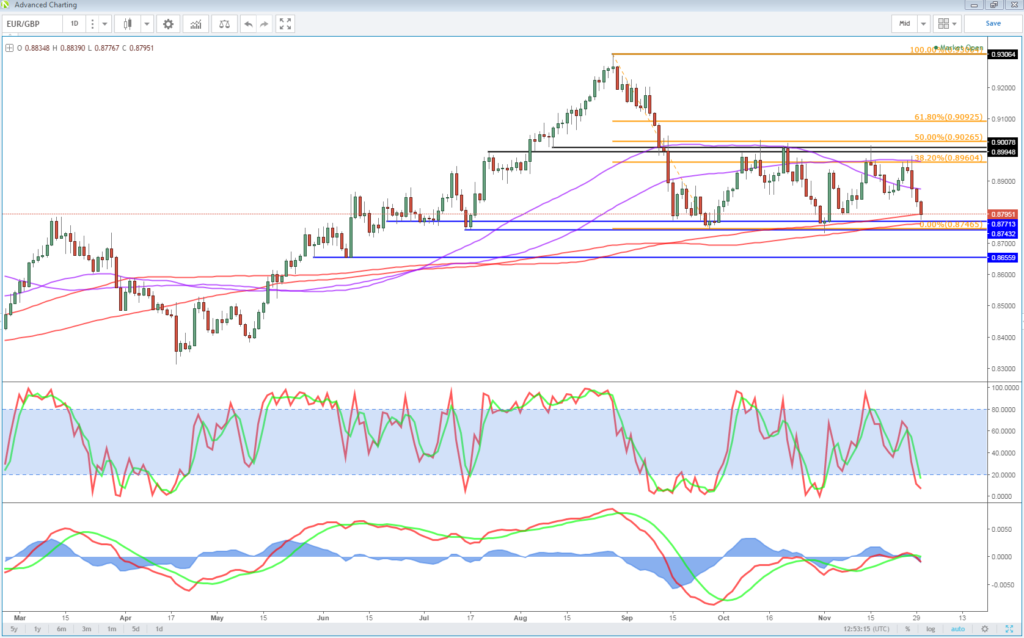

Sterling is trading higher again this morning as Brexit negotiators appear to be making steps towards agreeing on the terms of the divorce necessary to progress to future trade and a transition. The pound hit a two month high against the dollar on Wednesday and has now reached a similar high against the euro. The pair may find support around 0.8750 having done so on the last two occasions in September and earlier this month. A break below here could be quite a bearish signal for the pair, with next support coming around 0.8650.

Daily EURGBP Chart

OANDA fxTrade Advanced Charting Platform

While European equity markets are making decent gains across the board on improved risk appetite, the FTSE is slightly underperforming its peers which is likely being driven by the pounds gains. With the FTSE being a global facing index deriving the vast majority of profits from abroad, a stronger pound is actually negative for the UK index.

Bitcoin Back Below $10,000 After Wednesday’s Aggressive Rebound

Bitcoin is as volatile as ever on Thursday, with prices having risen as much as 8% earlier in the session only to trade slightly lower at the time of writing. This comes after reaching new highs above $11,000 on Wednesday before falling almost 20% on reports of exchange outages, a clear sign of how easily Bitcoin traders can be spooked and the risk this poses. I’m sure there’ll be plenty of more examples of this as speculation increases.

Daily Bitcoin Chart

Source – Thomson Reuters Eikon

Still, prices remain extremely elevated, despite dropping back below $10,000. While dips have been frequent and at times aggressive, it is notable that they have until now been viewed as buying opportunities prompting quick rebounds. This is helped by the fact that the foundations of Bitcoin as a tradeable asset are improving but the speculative component can’t be ignored and will likely continue to play a major role in the medium term.

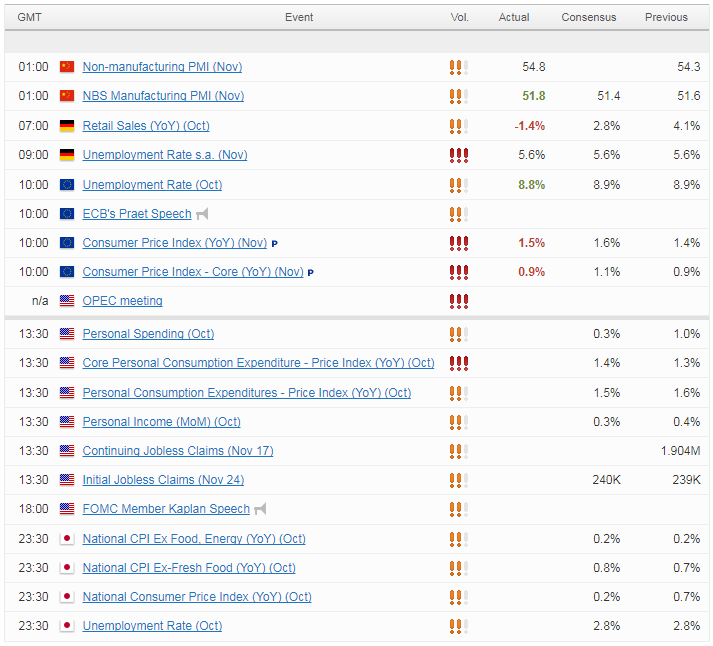

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.