Powell Testimony Eyed For Fed Direction Clues

US equity markets are expected to open slightly higher on Tuesday following a flat and rather slow start to the week.

Federal Reserve Chair-designate Jerome Powell will testify on his nomination before the Senate Banking Committee on Tuesday and his comments will be monitored closely for clues on the direction he plans to take the central bank under his leadership. Based on the comments released overnight, it would appear Powell intends to send a message of continuity which means rate hikes will proceed, or intend to, as has been laid out already.

The regulatory component of his testimony may be of more interest though, with some seeing his appointment as a push towards looser regulation, something that has been a key feature of Trump’s first year in office and likely a big part of Powell’s nomination. In his prepared remarks Powell referenced a desire to consider ways of easing regulatory burdens although, likely in a bid to appease those concerned, he also stressed the need to preserve core reforms. I imagine he will be questioned heavily on these views. William Dudley and Patrick Harker will also appear today.

USD/CAD – Canadian Dollar Ticks Higher Ahead of Inflation Reports

UK Banks Pass Stress Tests But OECD Revises 2017 Growth Lower

A rare piece of good news for the UK this morning as the Bank of England announced that all banks passed its stress tests for the first time since the financial crisis. While the tests didn’t test for Brexit scenarios specifically, they did suggest that banks are equipped to deal with a disorderly exit due to severity of the scenarios that were tested, which encompassed a range associated with it.

The OECD did add a small dose of negativity to the mix though, revising its growth forecast for the UK to 1.5% this year, down from 1.6%, although that was accompanied by a revision higher for 2018, to 1.2% from 1%. While the net revision may be positive, it’s hard to ignore the fact that this still means we’re headed for a period of slowing growth at a time when other countries prospects are looking much brighter, which was also reflected in the OECD’s latest forecasts.

CAC Rebounds as German Political Crisis Eases

Bitcoin Closes in on New Milestone as Frenzy Continues

The Bitcoin frenzy continues on Tuesday, with the cryptocurrency set to reach yet another milestone as it closes in on $10,000. While you can’t ignore the fundamental factors supporting the rise of Bitcoin – the latest being CME Group’s decision to launch Bitcoin futures – a 900% increase since the start of the year and the frenzy that’s formed around it does suggest there’s a large speculative force at play here.

Source – Thomson Reuters Eikon

While there’s no reason that can’t continue, nor anything to suggest it is overvalued in the long term, I do worry that it is vulnerable to further sharp and painful corrections, possibly more severe than anything we’ve seen since the start of the year. It will be very interesting to see how Bitcoin traders respond the closer we get to $10,000. Any severe corrections that may come in the future will also be a major test of speculators continued desire for such risk.

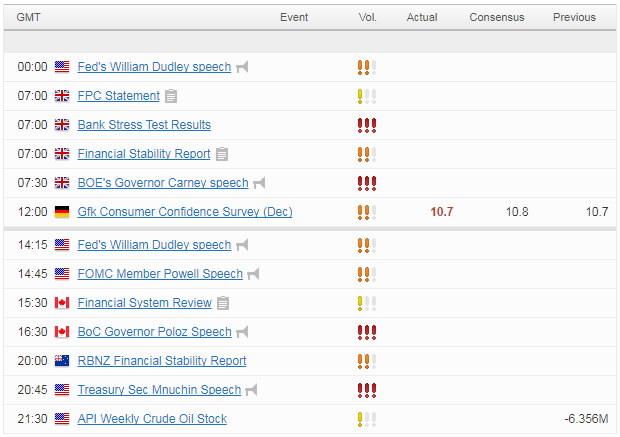

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.