Central Bankers in Focus on Monday

It’s been a relatively slow start to what is otherwise likely to be a busy week for the markets, with appearances from prominent central bankers being accompanied by numerous data releases.

As is so often the case, Monday is looking a little quiet compared to what is to come although we will hear from two notable central bankers – FOMC voter Neel Kashkari and Bank of England Chief Economist Andy Haldane. Kashkari is arguably the most dovish of the current crop of voters on the FOMC and has been open about his objection to further rate hikes which would suggest he’s preparing to dissent at the meeting in December, when the central bank is expected to raise interest rates. I would expect him to remain of this opinion when he speaks today.

Haldane on the other hand was one of those on the Monetary Policy Committee that backed a rate hike having not done so previously and it will be interesting to see whether he supports the current outlook of two of the next few years, or whether he feels further action is warranted in the more immediate future. I imagine Haldane will take a more conservative approach once again, with the recent hike having come at a very uncertain and difficult time for the UK economy.

US equity markets are poised to open a little higher again on Monday after having recovered in the latter part of last week to trade back at record highs. A strong showing for online retailers on Black Friday may have boosted sentiment, with Cyber Monday having the potential to be even better in a sign that the consumer is healthier than other numbers this year have indicated. New home sales from the US will also be in focus today.

Dollar Index Remains Under Pressure

Source – Thomson Reuters Eikon

The US dollar is starting the week on the back foot again after coming under significant pressure in the latter part of last week. While progress is being made on tax reforms, traders may well be doubting how quickly they will be enacted and how significant the final draft will be for the economy and therefore interest rates.

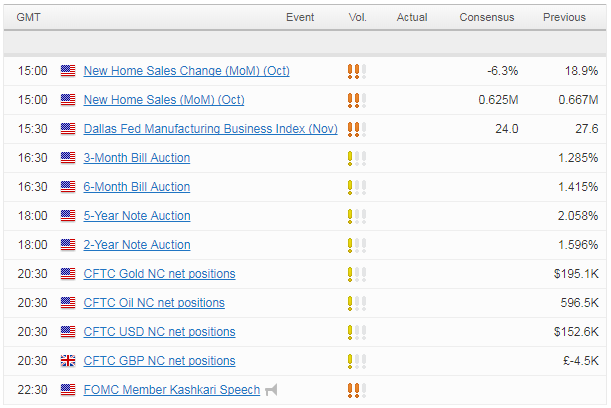

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.