Keystone pipeline travails and a more substantial than expected drop in crude inventories saw crude gush higher in Asian trading.

WTI races higher in Asian trading as TransCanada announced it would reduce shipments by 85% on its Keystone crude pipeline until the end of November. It is due to its attempts to fix a leak in the pipeline and today’s announcement raised temperatures amongst traders as the pipeline carries 600,000 barrels of oil a day to U.S. refineries. The decision caught the street by surprise and implies both oppositions will increase again to the new Keystone XL pipeline, and that the initial leak may be a somewhat more serious problem than at first thought.

Overnight, crude had pushed higher, buoyed by the American Petroleum Institute (API) Crude Inventories, which showed a surprising 6.356 million drawdown against survey expectations of a 2.1 million barrel drop. Brent finished 0.80% higher at 62.75 and WTI climbed a respectable 1.30% to close at 56.80.

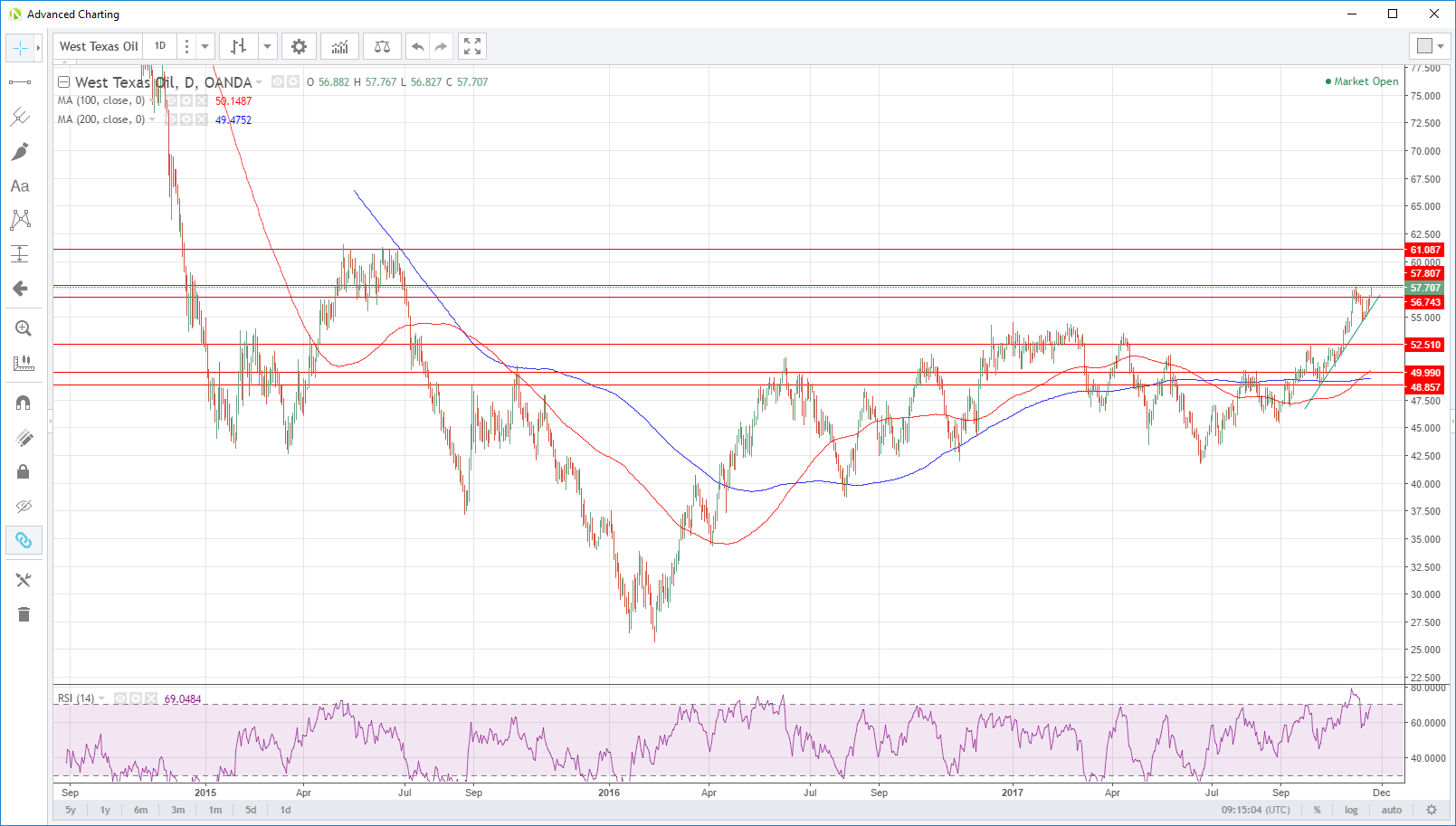

The favourable climate has continued in early Asia with Brent marching 0.80% higher to trade at 63.30. WTI was even more impressive, climbing another 1.35% to 57.65, leaving it within a hair’s breadth of its 2 ½ years highs at 57.80 set earlier this month. The street will be looking towards tonight’s official U.S. Crude Inventories for further confirmation that inventory drawdowns are back on track after last week’s glitch.

Brent Crude has resistance at 63.30 with a break reopening a test of its major resistance zone, the daily double tops at 64.40 and 64.85. Support remains at 62.25 followed by the far more significant 61.25, a series of four recent daily lows.

WTI spot looks the more interesting of the two contracts today. It appears poised to test the 57.80 high set last week, and a break will almost certainly trigger some stop-loss buying. The technical picture shows no resistance until 61.00, and thus a daily close above 57.80 sets the scene for a possibly significant new leg to the rally. Support appears at 56.75, the day’s low followed by its medium-term trend line support at 55.75 that has held all pullbacks of the last two months in almost textbook fashion.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.