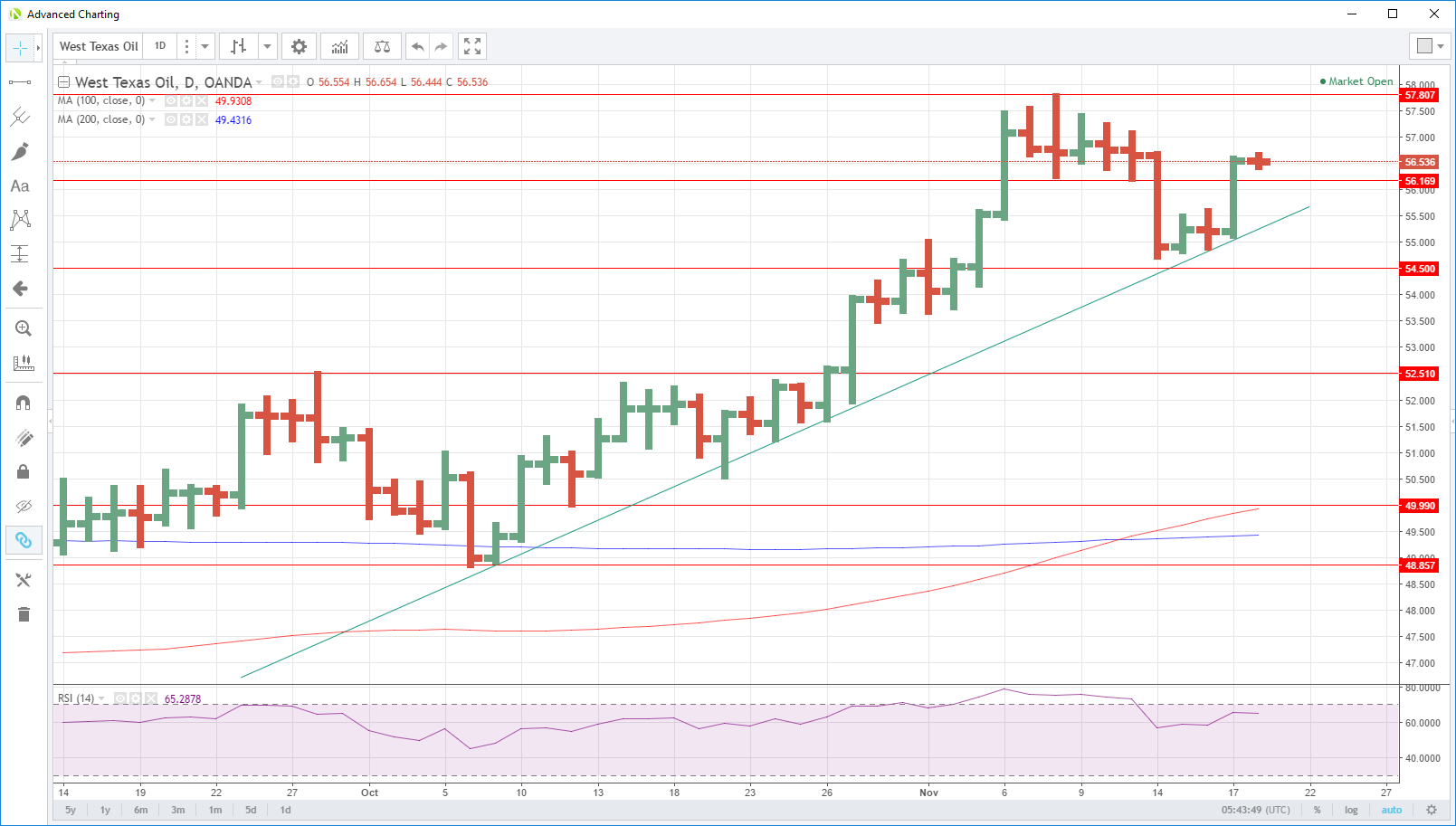

Oil’s impressive rally on Friday has changed the technical picture completely suggesting we could see attempts at new highs this week.

After the fireworks of Friday, crudes price action in Asia has been tepid, to say the least. Both Brent and WTI remain almost unchanged from their respective New York closes.

The same couldn’t be said for Friday’s session with Brent climbing a respectable 2.20% and WTI soaring 2.40% with both contracts tracing out some very bullish technical price action. There was no one driver for the rallies; rather we feel oil benefited from a general rotation out of U.S. dollars. The worst of the corrective sell-off would appear to be over now as well with the weak long positioning flushed out. Traders seem to be turning their attention now to the OPEC/Non-OPEC meeting on the 30th of November and an extension of the production cut deal to cover all of 2018.

Brent crude is unchanged at 62.25 and has traced out a bullish outside reversal day on Friday, having made a marginal new low and then forged higher to close substantially above the previous days high. The triple bottom at 61.25 is now a quadruple bottom after Friday and will provide formidable support to any pullbacks now. Resistance is currently at 63.30 ahead of the challenging double tops at 64.40 and 64.85.

WTI spot trades at 56.55 as we await the start of the European session. It held its 6-week trend line support impressively on Friday with the low of 55.15 being the line itself before rallying to 56.55. Today this line comes in at 55.275 and is followed by support at 54.50. The charts are now clear for another challenge of the November highs at 57.80.

We expect trading to be muted this week due to the Thanksgiving Holiday in America with both contracts being susceptible to geopolitical event risk. That said, the technical picture on both is no longer overbought and the price action very constructive.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.