Oil prices tanked overnight as an overbought commodity market finally ran out of steam.

The long-awaited short-term correction in oil prices finally occurred overnight with Brent and WTI, both plunging some 3% as commodities prices, in general, were cratered on fears of slowing growth in China. To be fair, given the bullish run and extended long positioning across commodities in general in recent times, it was only going to one straw to break the camel’s back and see a mass rush for the fire exits by long positioning.

Oil, in fact, received a series of camel straws across its back which all came together to produce the overnight sell-off. The American Petroleum Institute’s (API) Crude Inventories came in at +6.5 million barrels against an expected drawdown of -1.6 million barrels. China data yesterday was slightly on the soft side. Finally, the International Energy Agency (IEA) Report put the boot well and truly into crude. The IEA forecast that demand would drop with prices at these levels, that American shale would continue to ramp up production and said temporary chances in production rather than structural ones were responsible for much of the recent rally.

Brent crude’s double tops at 64.80 and 64.45 are now well in place as strong medium-term resistance with interim resistance at 62.70. Below its present level at 61.60, critical support for the rally currently sits at 60.00, a daily triple bottom and also trend-line support this morning. A daily close under this level opens the doors to a test of the long-term trend line at 57.30.

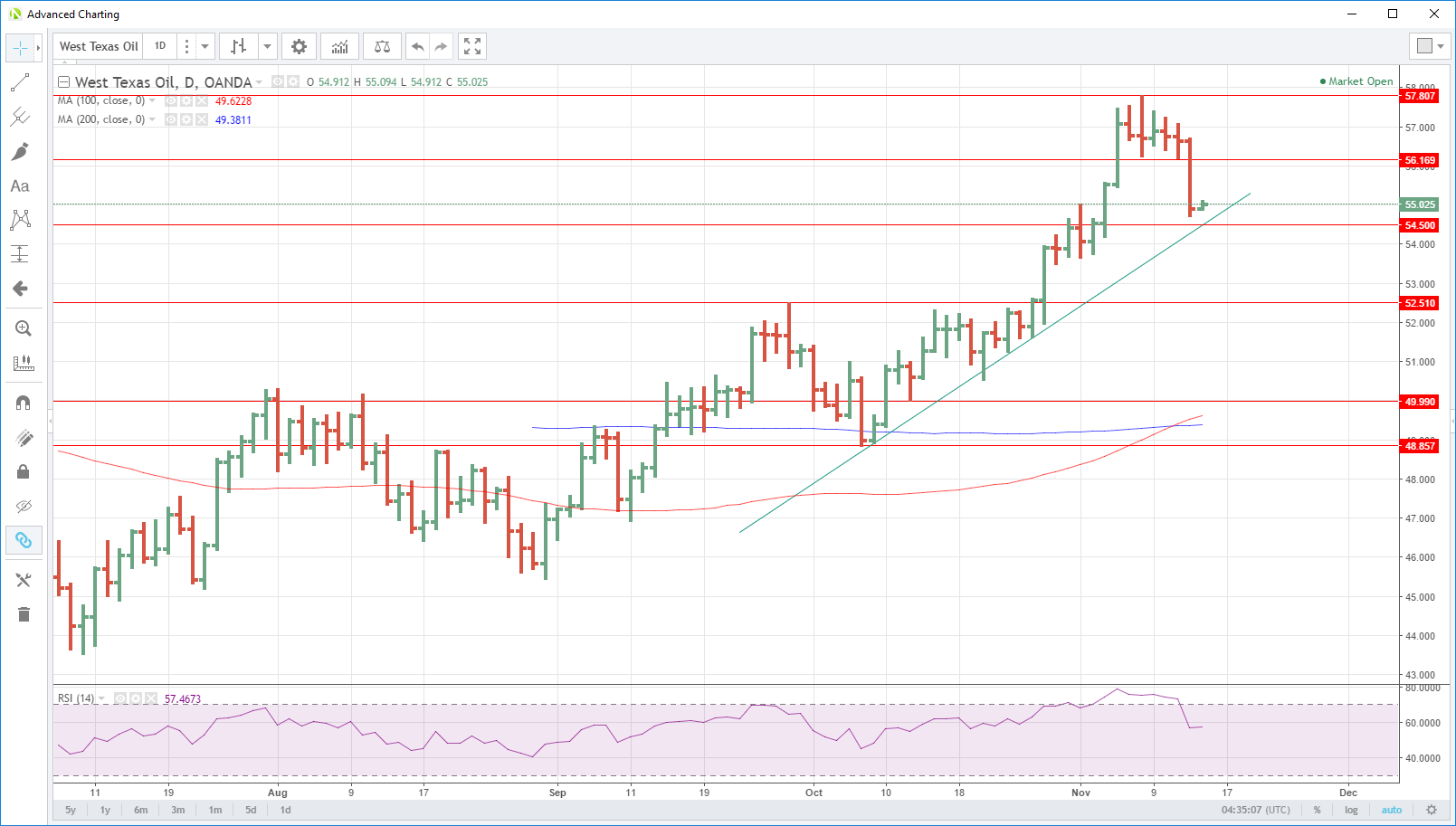

WTI sits at 55.00 barely above its overnight close. 56.15, the approximate low of the week is now formidable resistance. This is followed by last week’s high at 57.80. WTI’s downside looks less secure with trend line support nearby at 54.50 with a break opening up 53.50 and then 52.50.

On a positive note, the technical indicators have unwound their extremely overbought levels and then some. Whether this is enough to support crude prices, as we negotiate tonight’s official U.S. Crude Inventories, remains to be seen.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.