Will Investors Shake Off Thursday’s Weakness?

Financial markets are looking a little flat ahead of the European open on Friday, following a similar session in Asia overnight and as traders try to shake of Thursday’s weakness.

The US dollar is recovering a little this morning, coming on the back of moderate losses on Thursday as the Senate proposed delaying the corporate tax cut until 2019, while making other changes to the tax bill in the process. While changes to the bill were expected, those proposed by the Senate will likely not sit well with Donald Trump and I expect further modifications will happen before anything is passed.

The delay in the corporate tax cut may not be one of those that’s changed though, with various people including Treasury Secretary Steve Mnuchin appearing not too concerned about it. While markets have responded negatively in the near-term, I don’t think this is too big a deal and it’s notable that losses in the dollar were not too heavy and while equity markets suffered rare modest losses, the dips were still bought.

This bodes well for a rally that hasn’t really been tested of late. Currently, futures suggest both Europe and the US will open flat on Friday which would suggest for now at least that there’s no hangover from Thursday’s selling. Of course this may change after markets open, although once again today there’s very little on the calendar today.

Brexit Negotiations and UK Data Eyed

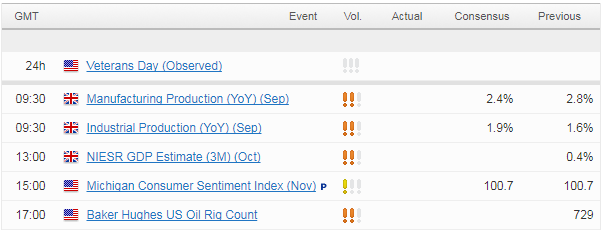

There will be a particular focus on the UK on Friday, with manufacturing and industrial production figures due out this morning and a GDP estimate for the past three months from NIESR this afternoon. Meanwhile, Brexit negotiations will continue as both sides seek to make sufficient progress on the exit bill, citizens’ rights and the Northern Ireland border.

That said, given how past negotiations have gone I’m not optimistic that the gap between the two sides will be closed yet. With Theresa May’s looking very vulnerable at home and with the EU not wanting a change of leadership at this stage, it’s possible that the Prime Ministers weakness may help the negotiations progress in order to give her a domestic boost. That said, the EU isn’t going to be overly charitable when it comes to May’s cause and so the UK will have to make more effort on the bill before any progress can be made.

Gold Rally Continues as Jobless Claims Jump

Quiet Session Expected as US Celebrates Veterans Day

It’s worth noting that while markets are all open today, it is the Veterans Day bank holiday in the US which is likely to have a significant impact on trading volume and could contribute to quiet trade at the end of the week.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.