BoE Has Prepared Markets For a Rate Hike, Will it Deliver?

On Thursday, the Bank of England is widely expected to do something that a large group of people will never have experienced, raise interest rates.

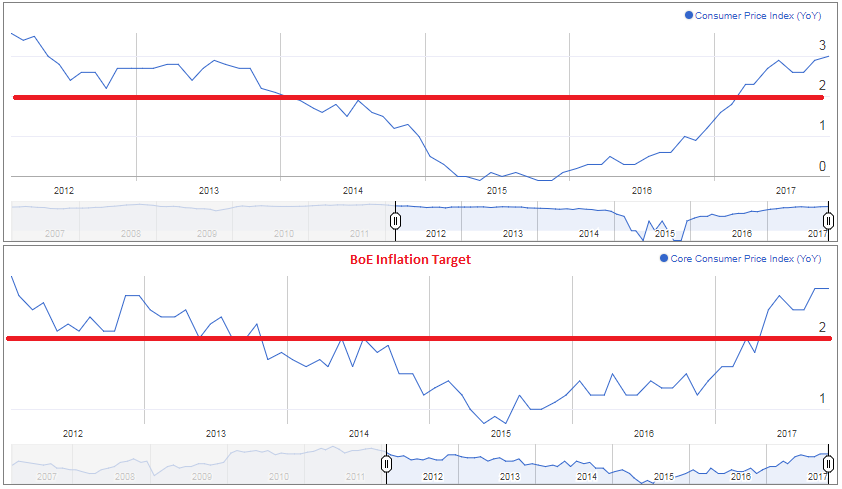

For the first time in a decade and the first since the global financial crisis, policy makers will discuss the merits of a rate hike in a bid to prevent inflation moving too far above target. Or at least, that’s what we’re being told despite the acknowledgement that higher inflation is almost entirely down to the one-off currency depreciation that occurred since the Brexit referendum last year.

Inflation reached 3% in September, far above the central bank’s 2% target and at the top of the range that the government deems acceptable before Governor Carney must write a letter to the Chancellor explaining why the central bank is failing to achieve its mandated target.

Interestingly, this is also around the level that the central bank expects inflation to peak at which begs the question why they’ve waited so long to raise interest rates. Also, why do they now deem it to be the right time to do so before we have a chance to find out how far it will fall again once the initial impact of the currency move falls out of the calculation?

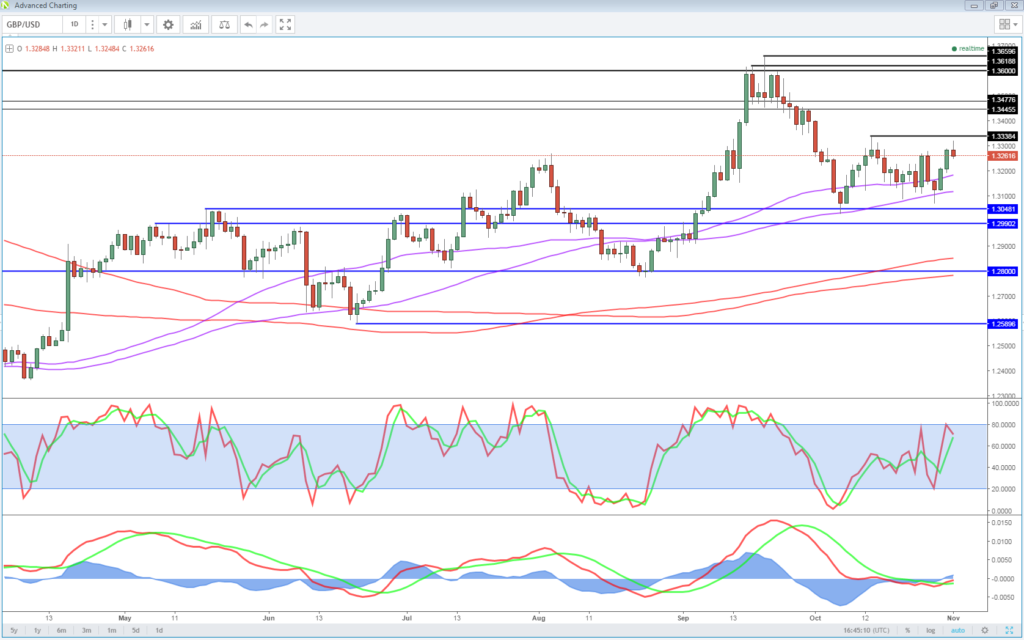

GBP/USD – Pound Subdued Ahead of Expected BoE Rate Hike

If Inflation is Above Target, Why is a Rate Hike So Controversial?

As is to be expected in post-Brexit Britain, the decision on whether or not to raise interest rates is far from straightforward. This is clearly evident when listening to one of Carney’s press conferences or appearances before the Treasury Select Committee, as well as in the rhetoric from his colleagues on the Monetary Policy Committee.

Not only does the inflation data and outlook not necessarily warrant a rate increase but the uncertain economic outlook muddies the water even further, which explains the divide on the committee.

It’s quite clear that the economy has slowed since the vote last year, with the country falling from the top of the G7 growth table to the bottom in the first half of the year. Employment may have remained strong for now but with real wage growth having turned negative and spending slowed, it’s clear that the economy is stalling which begs the question, is it really the correct time to raise interest rates?

The argument for the hawks on the MPC is that the economy hasn’t slowed as much as was feared in the months after the referendum – partly due to the actions it took – and so a reversal of the rate cut in August 2016 makes sense.

While this hasn’t been acknowledged by policy makers, there may also be a case that the BoE took a risk when cutting interest rates last year, taking base rate below the level that for the seven years previous was deemed to be the lower bound. Perhaps this is no longer seen as being a risk worth taking.

If this is the case then the BoE may refrain from committing to, or even hinting at, further rate hikes in the foreseeable future, which you would expect if this was in fact the beginning of a tightening cycle. Instead it may opt for the ECB approach of data dependent decision making. In other words, the less we know the better.

Markets Rally Ahead of Fed Decision

How Will Markets React to a Rate Hike?

Despite the divisions that we’ve seen within the MPC and the fact that the decision appears far from straightforward, investors are almost entirely convinced that the BoE will raise interest rates tomorrow. In fact, according to Reuters, a rate hike is almost 90% priced in. That would suggest to me that a rate hike alone won’t be enough to lift the pound or UK yields too much. A change of heart on the other hand could deal a big blow to both, not to mention the central banks credibility.

How the pound trades – and the FTSE for that matter, don’t forget the inverse correlation that the two share – in the aftermath of the decision will likely depend on the minutes, economic projections and press conference that accompanies the decision.

GBP Currency Index vs FTSE 100

Source – Thomson Reuters Eikon

Any indication that more rate hikes are planned for next year could trigger a sharp rally in the pound as I’m not convinced this is currently priced in, while anything else may weigh on the currency once the initial volatility – of which I expect a lot – has passed.

Super Thursday may for once live up to its name and I’m sure markets will be very sensitive to what policy makers have to say about the path of interest rates going forward, whatever the decision. Given the range of outcomes that we could see tomorrow, UK markets could get extremely volatile and the upside and downside potential should not be underestimated.

A hawkish rate hike from the BoE could see GBPUSD blow through 1.33 and see 1.36 being tested once again while no rate hike could see 1.30 severely tested, the success of which may depend on whether the increase is slightly delayed or postponed. In the case of the latter, I wouldn’t be surprised to see 1.28 tested in the not-too distant future.

OANDA fxTrade Advanced Charting Platform

For more views on GBP, check out the recording of our live market analysis webinar on Monday where Senior Market Analyst Craig Erlam discusses GBPUSD, EURGBP, GBPCAD and GBPJPY. You can sign up for our next webinar here.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.