Can Earnings Spur New Highs in US Equity Markets?

US equity markets are on course to open a little higher on the final trading day of the month, with the S&P 500 and Dow eyeing new record highs as more companies line up to report on the third quarter.

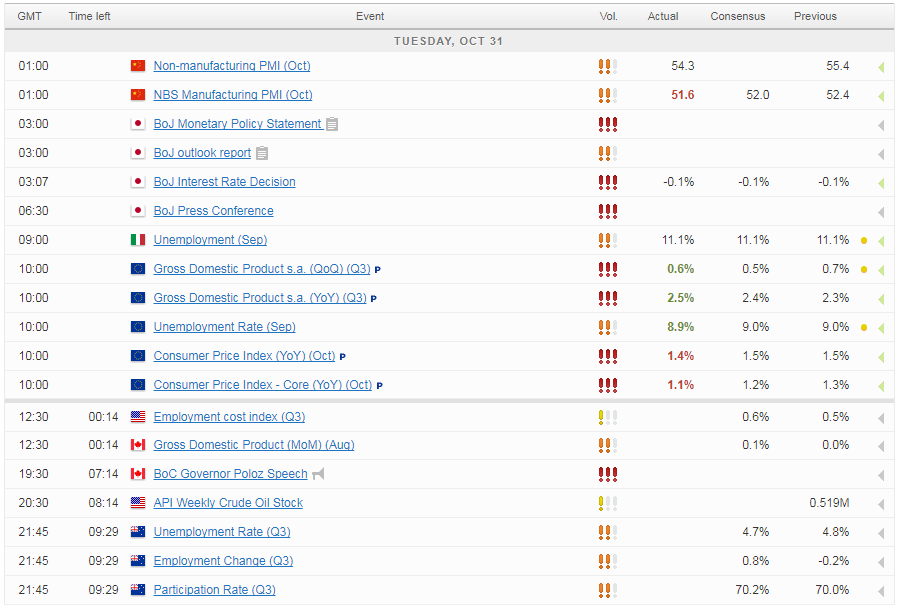

While it’s been a busy session in Europe with notable economic releases from the eurozone and overnight with the Bank of Japan making its latest monetary policy decision, the US is looking a little quieter, with the bulk of the week’s economic events coming over the course of the next few days. The only notable US releases due today is the employment cost index which has been gradually improving but remains quite volatile. Higher costs typically mean higher prices and goes some way to explaining why the inflation data has underperformed expectations.

EUR Edges Lower on Mixed Inflation and Growth Data

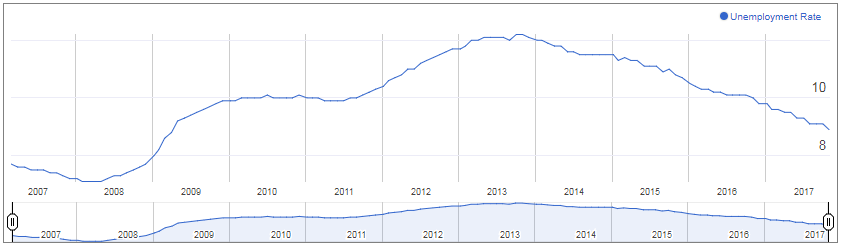

The euro is edging lower on Tuesday following a mixed batch of economic data that will likely complicate matters should it continue into next year. The eurozone economy grew by 2.5% last quarter compared to a year ago, while unemployment fell below 9% for the first time since January 2009, in a clear sign that the region remains on a positive trajectory and is continuing to gather momentum.

While that will be reassuring to ECB policy makers as they wind down their stimulus program on the expectation that it will lead to higher inflation, the CPI numbers themselves will be less encouraging. Prices rose by 1.4% in October compared to a year ago, while core prices rose by only 1.1%, both of which are well below the ECBs sole mandate of below but close to 2% inflation. While the other economic data may give the impression that this will improve over the medium term, the experience of other central banks should act as a warning against such assumptions and discourage against being too keen to tighten.

DAX Steady on Mixed Eurozone Data

BoJ Revises Inflation Forecasts Lower and Retains Accommodative Stance

One of those that can vouch for this is the BoJ, which is dealing with unemployment at 2.8%, annualised growth of 2.5% and yet inflation remains at only 0.7% which is the highest in two and a half years, at which point it was only higher as a result of the sales tax increase. The central bank overnight left its monetary policy unchanged and reduced its inflation forecasts to the year to March 2018 to 0.8% from 1.1% in a further sign that the job of driving inflation to 2% is far from straightforward in the current economic environment.

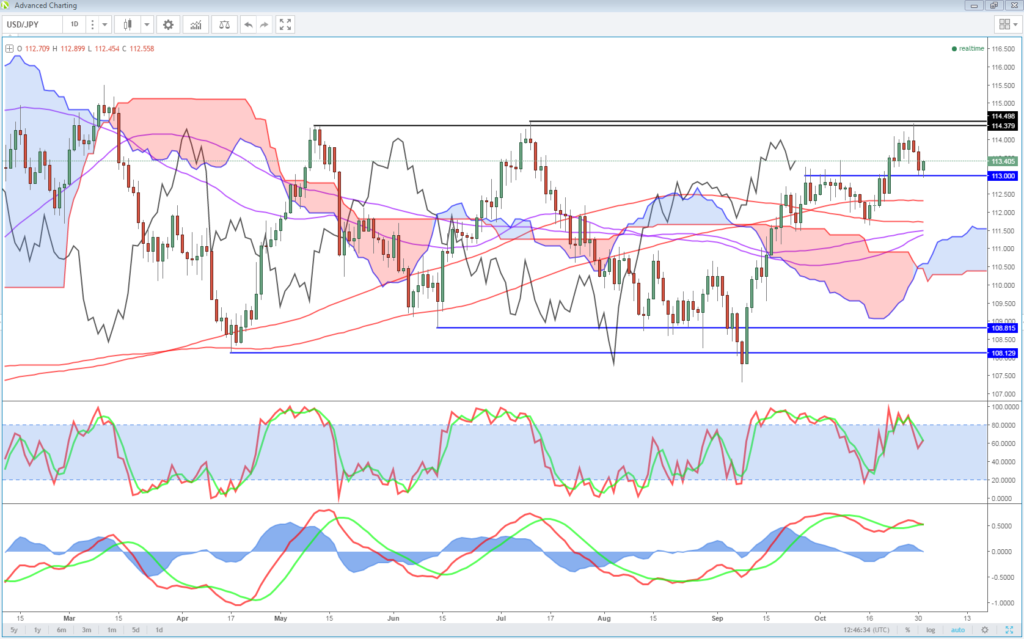

Still, the central bank is convinced it will happen gradually and remains committed to achieving its target, albeit not yet through more stimulus as one dissenter on the board preferred. The yen softened a little overnight in response to the downward revision to inflation expectations and continues to trade around its lowest levels in six months against the dollar. Should the dollar have a strong end to the year as looks possible, we could see the pair trading back at levels not seen since the end of last year.

OANDA fxTrade Advanced Charting Platform

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.