It has been a long time coming, but the structural backwardation and some serious Saudi rhetoric finally see Brent Crude march through OPEC/Non-Opec’s price Nirvana of $60.

Oil ran rampant on Friday as the Saudi Crown Prince’s comments that Saudi Arabia supports a production cut extension and falling U.S. inventories saw Brent break the magical $60.00 level. Brent rose 1.80% on the day, but WTI was not to be outdone, rising an impressive 2.50% on the day. Both contracts closed the week at their highs at 60.55 and 53.80 respectively.

Saudi Crown Prince Salman reiterated his comments over the weekend, but the reaction has been non-existent in Asia this morning with both contracts unchanged in early trading. It is somewhat surprising; however, we note that both contracts relative strength indices (RSI) are both approaching overbought levels. This may imply that crude has risen enough in the short-term and some consolidation is required, or some new data to give renewed impetus. We note that the RSI’s moving into extremely overbought territories has been an excellent advance indicator of crude oil downward corrections this year.

BRENT

Brent crude trades at 60.50 with support at 60.00, 59.50 and then 59.10. Resistance is hard to find from a charting perspective with nothing now but clear air until the 69.00 regions!

WTI

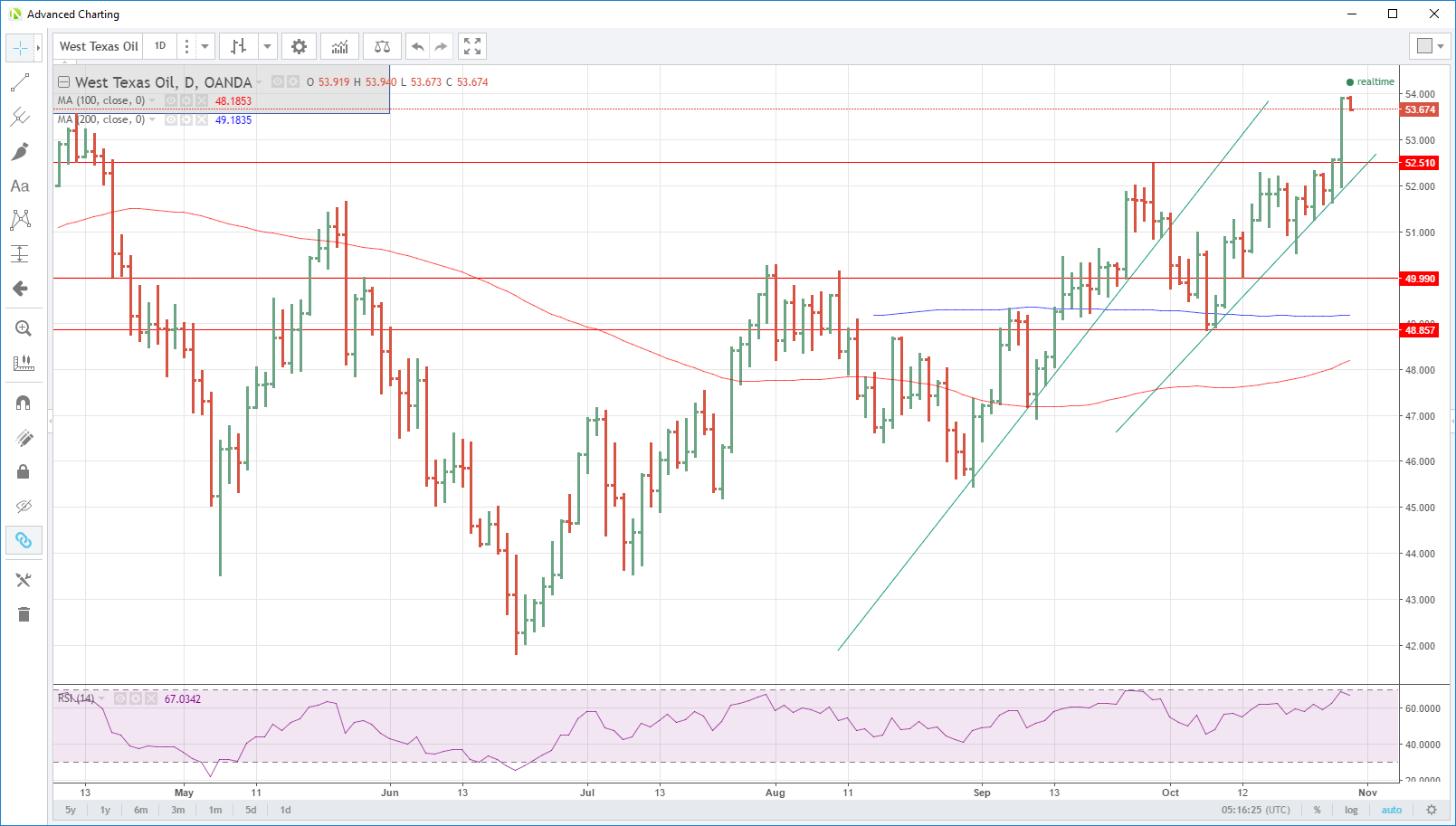

WTI trades slightly lower by 10 cents at 53.80. An absence of profit taking this morning after Friday’s rally perhaps indicating it still has further legs to the upside. It has resistance at 54.00 and then 54.00, the top of its long-term resistance zone. Support is at 53.50 and then 52.50.

In summary, the charts look very constructive for both crude contracts, most especially Brent which also has the added benefit of backwardation of its prompt futures contracts to support it. However, traders should keep a close eye on the daily and weekly RSI’s for indications of a potential short-term, and possibly very aggressive, downward corrections that could occur.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.