Central Banks Feature Heavily as Trump Readies Fed Chair Announcement

It’s been a relatively calm start to trading on Monday but that isn’t likely to last long with the rest of the week packed full of major economic and political events that should ensure markets remain quite volatile.

With the Federal Reserve, Bank of Japan and Bank of England all holding monetary policy meetings this week, there’ll undoubtedly be a strong focus on central banks. When it comes to the Fed though, it may not be the interest rate decision itself that attracts the most attention, rather President Donald Trump’s announcement on who will succeed Janet Yellen as Chair from February, with the incumbent still in the race.

Mueller, Fed and NFP to Guide U.S Dollar This Week

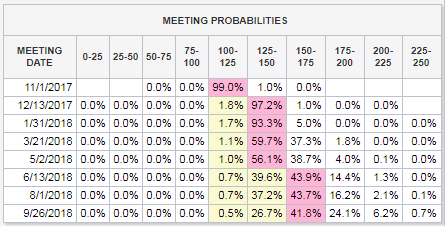

With Stanley Fischer, the vice Chair, having left the Fed recently, there’s actually two posts that need filling so it’s possible that two of the three frontrunners – Jerome Powell, John Taylor and Yellen – take up prominent roles at the central bank. The Fed is not expected to make any changes to monetary policy at this week’s meeting with a rate hike currently priced in for December – 98% according to Fed Funds futures versus 1% this week.

Source – CME Group FedWatch Tool

Will BoE Follow Through on Interest Rate Warnings?

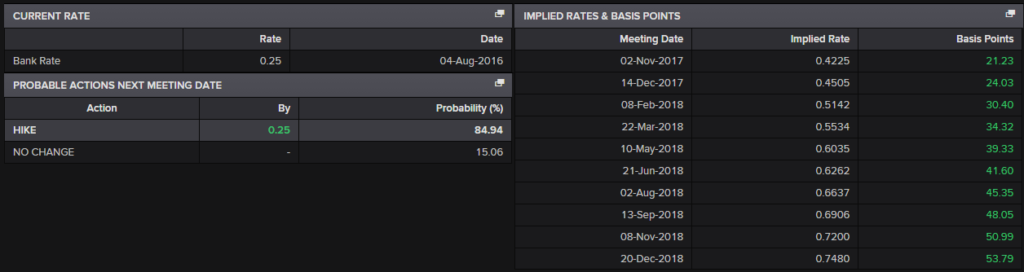

The BoE on the other hand is expected to raise interest rates this week, the first such move in a decade, with policy makers claiming to be concerned about above-target inflation in an environment that has so-far weathered the Brexit storm better than expected. Interestingly, despite markets strongly pricing in a rate hike – 85% as of this morning – policy makers have given the impression that they are not so convinced in recent public appearances. Should they vote in favour of a hike on Thursday, I will be very surprised if the decision is unanimous.

Source – Thomson Reuters Eikon

Major US Economic Indicators Due This Week

It’s not just about central banks this week though with a whole host of economic data being released, including arguably the most important of the lot, the US jobs report. Markets may be pricing in a rate hike from the Fed in December but weak data between now and then will raise doubts about whether they will follow through. Wages are a key concern for policy makers when it comes to the shortfall in inflation, whereas job growth has been strong for some time, making the conundrum of why wage growth hasn’t followed an increasing frustration.

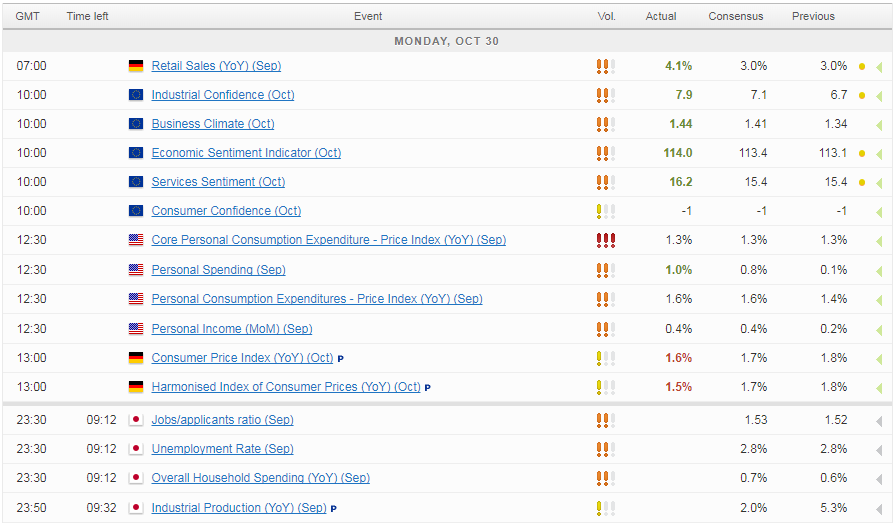

We’ll get inflation data for the US today in the form of the core personal consumption expenditure price index – the Fed’s preferred measure – which is expected to show price growth remaining relatively subdued at 1.3% year over year. This will be accompanied by income and spending figures, the latter of which is expected to be particularly strong for September, with the former bouncing back to 0.4%.

OPEC Cracks Open The Champagne As Brent Breaks $60

Finally this week there’s a number of companies that will report third quarter earnings, including 139 S&P 500 companies.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.