Brent led WTI higher overnight but producer hedging and a very long speculative market highlight a lack of momentum.

Both Brent and WTI enjoyed a positive overnight session, but Brent was the clear winner, rising 2.0% with WTI a comparative laggard at +1.30%. Brent benefited from forceful Saudi comments that bit was determined to end the global supply glut as well as lingering worries about disruptions from US/Iran relations as well as Iraqi Kurdistan instability. WTI is less affected by such things, but it was boosted by a massive gasoline draw of 5.753 million barrels from the American Petroleum Institute’s (API) Crude Inventory data.

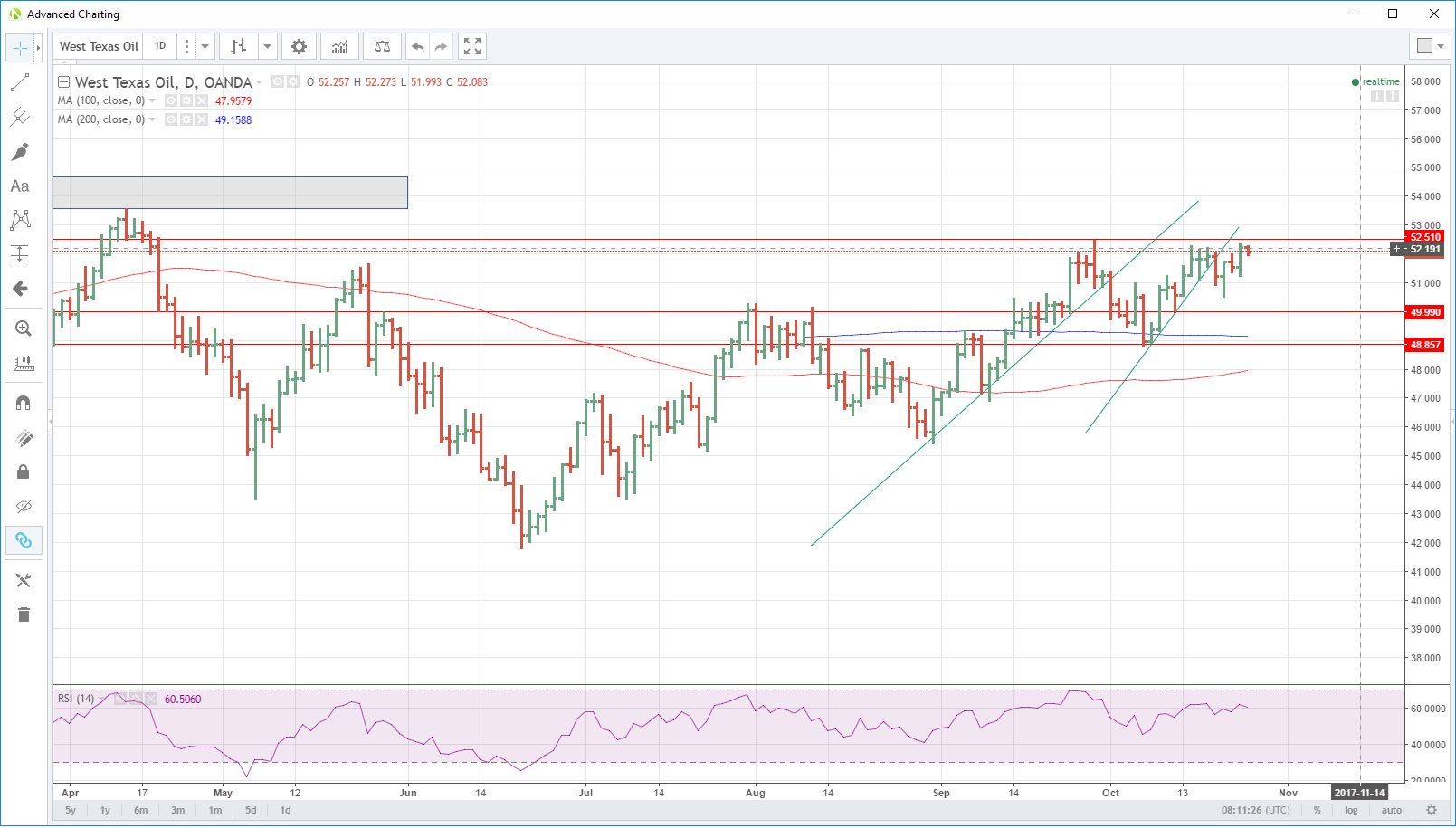

As the dust settles though, a realistic outlook is that both contracts have only moved back to the top end of their recent one-week trading ranges. Both Brent and WTI while looking technically constructive, have yet to test critical resistance levels that lie just above comprehensively. One suspects that shale oil producer hedging in both contracts may be capping potential gains and the street may need new reasons to give the rally in both new impetuses.

Brent

Brent spot is trading unchanged at 52.45 today with four multi-day highs lying just above each side of 52.50. Above there is the September high at 59.10 meaning at these levels Brent has some wood to chop before the street can start thinking of a test of 60.00. The rising support line of the last two weeks comes in at 57.15 this morning followed by 55.95 and then the long-term support line at 55.60.

WTI spot trades at its overnight highs of 52.25 this morning, but it has ground to a halt in this region six times over the last fortnight. Implying that the producer hedging is alive and well. The nest resistance is nearby at 52.50 before we arrive at the far more formidable 53.50/54.50 longer-term resistance zone. Initial support is at 51.20 with a break of the 50.00 area suggesting the rally will have run its course in the short term.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.