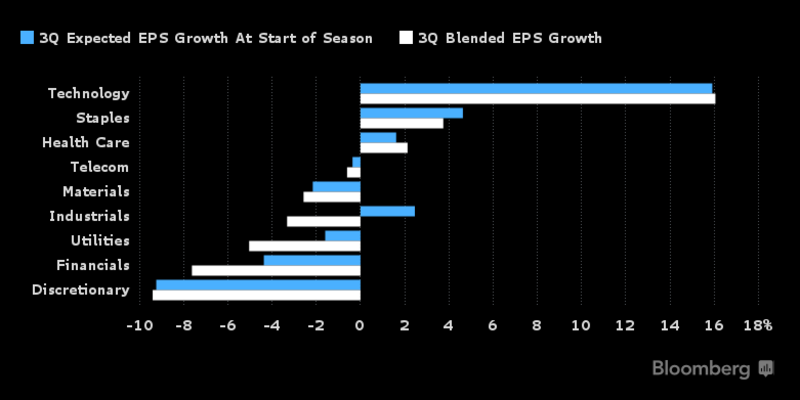

Things can only get better. At least that’s what the stock bulls must be hoping as third-quarter earnings season falls short of expectations. Yes, it’s still early, but the members of the S&P 500 Index were on pace to record earnings growth of just 2.4 percent through last week, below the already lame 3.7 percent that was forecast, according to Bloomberg Intelligence.This week brings a heavy slate of reports, as 185 of the benchmark’s constituents post results. At 21.85 times earnings, the S&P 500 is on the pricier side of historical averages. The prospects for rising profits and U.S. tax cuts have been the main justifications for the benchmark’s almost 15 percent gain this year in the face of turmoil in Washington and rising geopolitical threats. “Earnings will naturally be a key factor when it comes to the sustainability of the stock market rally,” Craig Erlam, a senior market analyst at Oanda, wrote in a research note.

That said, Erlam says not to give up on stocks just yet. Global risk appetite remains strong, and investors are becoming increasingly optimistic about the economic outlook. Add tailwinds such as U.S. tax reform to the mix and despite lingering geopolitical and political risks, the rally may have some way to go yet, he notes. Although earnings growth has fallen short of projections, revenue gains of 4.2 percent are about in line with early season expectations, according to Bloomberg Intelligence. Seven of 11 sectors, led by technology, are tracking above the revenue consensus from the start of the season.

Source: The Daily Prophet: Is It Too Soon to Worry About Earnings? – Bloomberg

USD/CAD Canadian Dollar Drops After Wholesale Sales Miss and Dollar Resurgence

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.