Futures Flat But Optimism Remains

US futures are relatively flat ahead of the open on Monday, but sentiment remains very positive as we head into a key week for corporate earnings.

With 185 S&P 500 companies due to report on the third quarter this week, earnings will naturally be a key factor when it comes to the sustainability of the stock market rally. Global risk appetite remains strong though and investors are becoming increasingly optimistic about the economic outlook. Add tailwinds such as US tax reform into the mix and despite lingering geopolitical and political risks, the rally may have some way to go yet.

While the week is looking busy from an earnings perspective for the US, it’s looking a little light when it comes to economic data. Durable goods orders and third quarter GDP represents the most notable of the data releases this week while the Federal Reserve blackout period came into effect this weekend ahead of next week’s meeting, meaning all will go quiet on that front.

EUR Lower Ahead of Thursday’s ECB QE Announcement

The ECB will be the headline act this week, with the central bank apparently preparing to announce details of its bond buying extension on Thursday. While the extension itself will come as no surprise, the size and duration of the extension will be of keen interest. With the extension largely priced in at this stage, it will be interesting to see whether we see much more upside in the euro which has already reached levels the ECB clearly deems to be uncomfortable in recent months.

The euro has pared gains against the dollar recently but this has been driven primarily by a recovery in the greenback on more hawkish interest rate expectations. With that in mind, I do question whether the prospect of the ECB under-delivering on Thursday is greater than the alternative. This could be through a more prolonged extension period for example or a more staggered approach to tapering. Even if the ECB delivers in line with expectations, it could trigger some profit taking on positions built up in recent months.

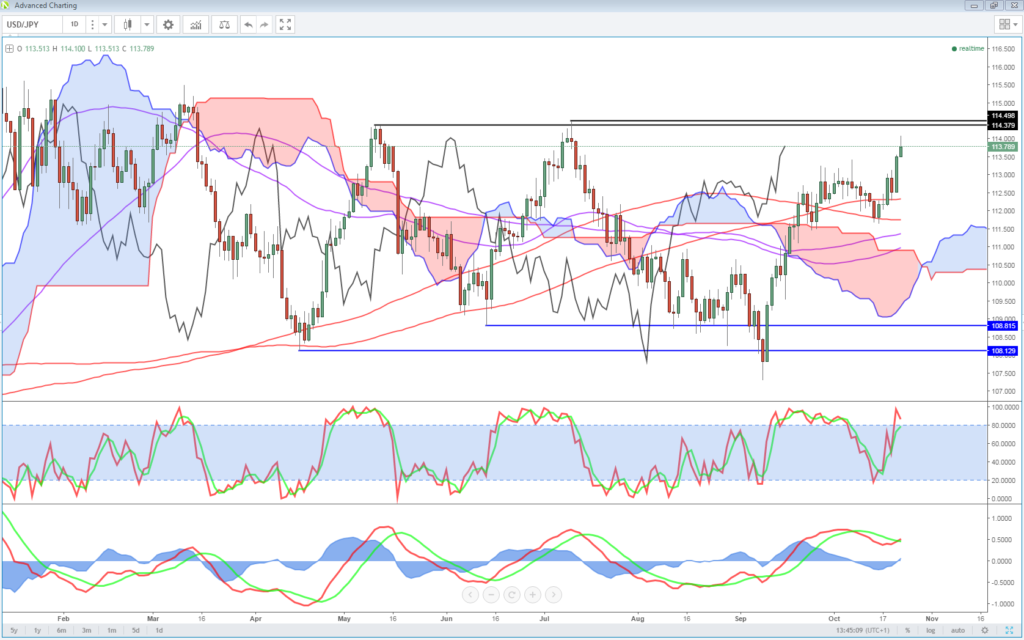

OANDA fxTrade Advanced Charting Platform

IBEX Stumbles Again as Madrid Prepares to Impose Direct Rule on Catalonia

The IBEX is underperforming its European peers once again on Monday as Madrid moves closer to imposing direct rule on Catalonia and leaders in the region discuss their next steps, having rejected the motion. The prolonged stand-off creates more uncertainty for businesses in the region, many of which have proposed moving headquarters out of Catalonia. Given the steps being taken by Madrid, it’s difficult to see a situation that doesn’t involve more unrest and altercations, at the very least.

Yen Slips as Abe Secures Super Majority

The Japanese election over the weekend which saw Shinzo Abe’s Liberal Democratic Party retain its two thirds super majority in the lower houses of parliament, has weighed on the yen and lifted the Nikkei 225 to its highest since 1996. The result has effectively given Abe a fresh mandate to continue with Abenomics which means more fiscal stimulus and a prolonged period of ultra-loose monetary policy. This could continue to weigh on the yen, particularly as other central banks across the globe pursue tighter monetary policy.

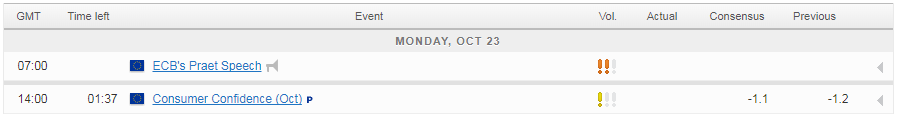

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.