The Middle East takes centre-stage, with Trump’s decertifying of Iran and the Iraqi Army’s advance of Kurd held Kirkuk spooking oil and gold markets.

Despite the soothing comments from various Oil Ministers over the weekend, the market hasn’t waited around and has taken Brent and WTI 1.0 % higher in early Asia. President Trump’s decertifying of Iran’s compliance with its nuclear deal has spooked the markets with traders worried about potential disruption to supplies. The situation is further complicated as the decision has pitted the U.S. Administration publicly against the other signatories to the original 2015 deal.

Further fuel was thrown on the fire this morning as it the story broke that the Iraqi Army is advancing on a military airfield nearby to and the oil-rich city of Kirkuk. This city, the airport and the oil fields are held by the Kurds and are considered by them their territory. Reports of clashes have emerged, and with Kurdish production totalling 550,000 barrels a day, the crude market is on edge.

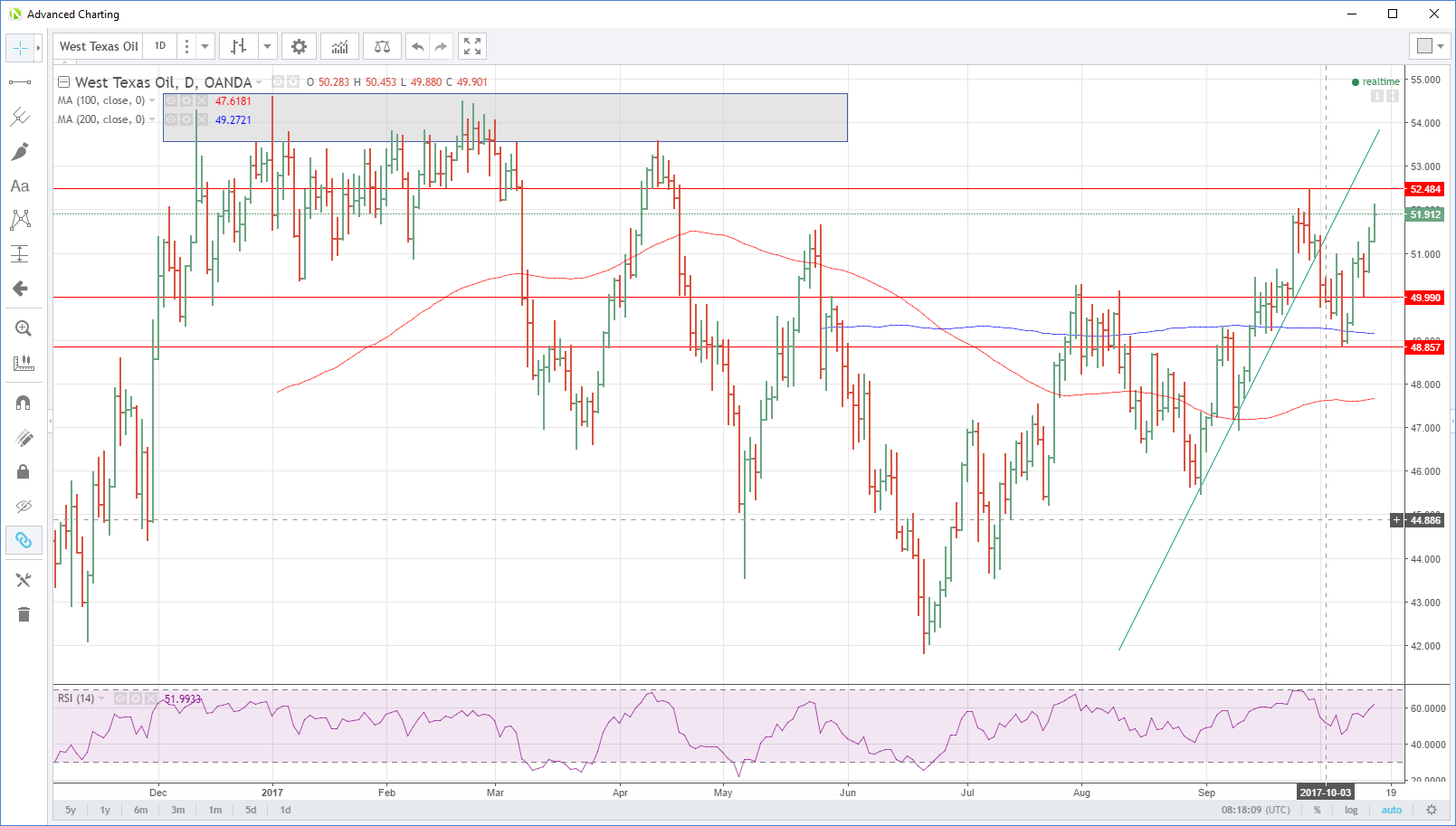

Following on from Fridays 1.30 % rally on both contracts, Brent has traded 70 cents higher to 58.00 this morning with WTI jumping 50 cents to 51.85. We would expect both contracts to remain supported by Middle East geopolitics throughout the European session today.

Brent has resistance at 58.50 followed by the crucial 59.00 a barrel regions. A break of this sets up a long-awaited test of the 60.00 level. Support rests at 57.25 and then 56.40.

WTI has nearby resistance at 52.00 with a break opening a test of the September highs at 52.50. beyond this level lies the formidable long-term resistance zone between 53.50 and 54.50. Support is initially at 51.25 followed by 50.50 and then the 50.00 region.

Gold

Gold’s week-long recovery picked up speed on Friday, finishing 11 dollars higher at 1304.00 to cap an excellent week as the 1260.00 lows become a distant memory. A lower U.S. CPI saw the dollar weaken into the end of the weekend into this morning in Asia gave support to gold and precious metals generally. Geopolitics gave it further boost as President Trump decertified Iran’s nuclear deal compliance sending tremors through the oil market, and North Korea appeared to be preparing for more missile tests.

The latter is particularly important as Japan goes to the polls on the 22nd of October. Geopolitical risk does not abate this week with the Japanese elections, the ongoing tensions with Iran and North Korea and finally the China National Congress starting on Wednesday. The advance by the Iraqi Army on Kirkuk, turning up the temperature in an already hot weekend for the Middle East, should all combine to ensure that gold maintains a safe haven tone this week.

Gold opened at 1302.50 in Asia with the week starting quietly and has slowly made its way higher to 1305.00 into early Europe. Resistance is nearby at 1306.00 with a break opening a challenge of the 1315.00 area. Supported is clearly denoted at 1290.00 followed by 1281.00.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.