Are We on Course For a Perfect Week For US Indices?

US futures are indicating a slightly higher open on Wall Street on Thursday, as indices target a fourth consecutive record close this week.

The S&P and Dow both ended Wednesday slightly higher to post a third record close for the week on the back of some stronger than expected surveys on the services sector – by far the most importance sector for the US economy – as well as slightly better employment data from ADP.

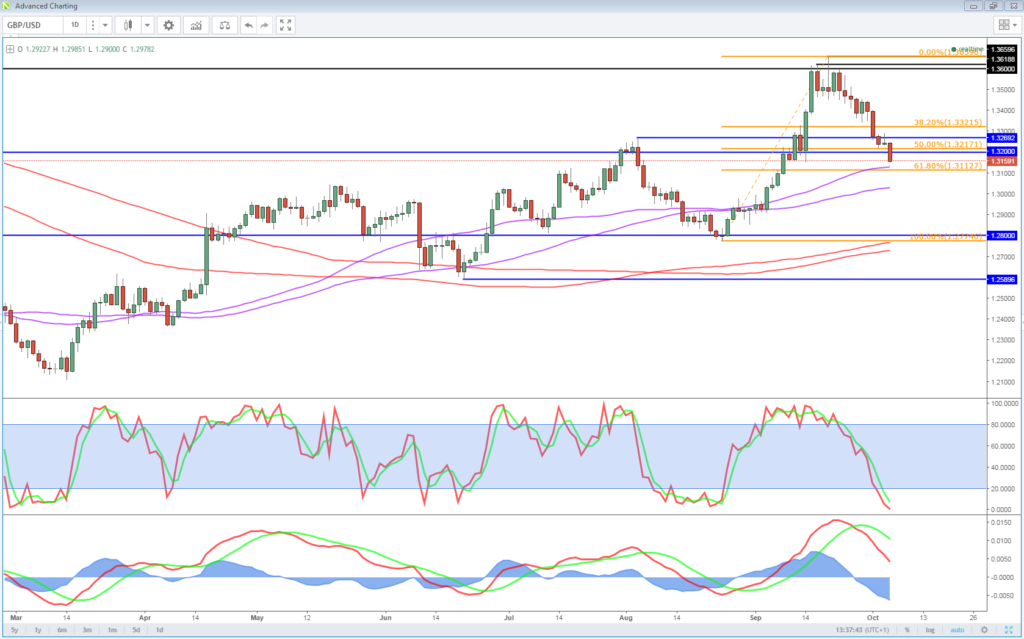

GBP Lower on Speculation Over Theresa May’s Position

Sterling is coming under pressure again this morning following speculation that Theresa May’s position is increasingly under threat following yesterday’s shambolic speech at the Conservative party conference. A change of leadership so soon after the election and just as Brexit talks appear to be making some progress may seem like a ludicrous idea but a leadership challenge has been brewing since the disastrous election campaign and yesterday was just the icing on the cake.

OANDA fxTrade Advanced Charting Platform

It seems more a matter of when rather than if a challenge will come. You get the feeling that those below her gunning for her job are simply biding their time, waiting for the opportune moment rather than fully throwing their support behind her. Naturally, all of this uncertainty is not good for the pound, especially as a change of leadership will likely alter the direction of the Brexit negotiations which have already progressed at a much slower pace than hoped.

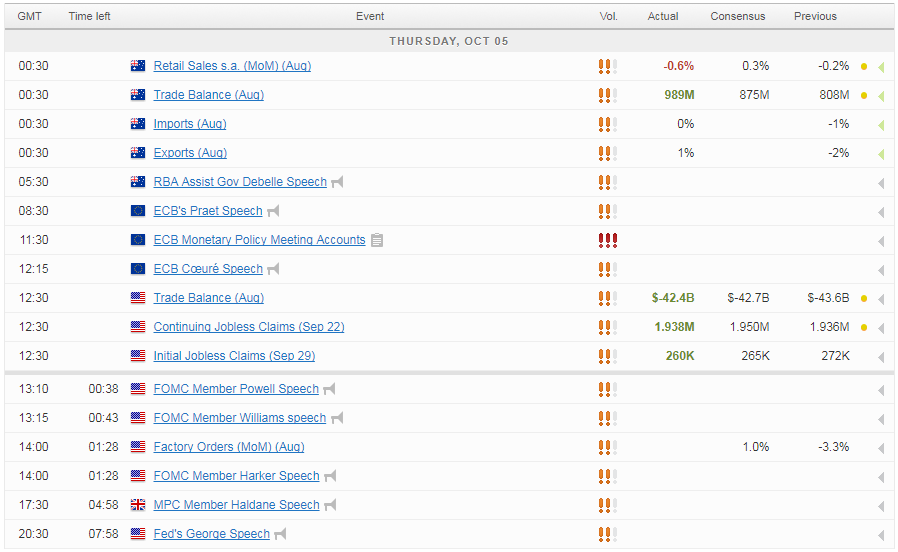

Expect U.S Jobs to be Affected By Summer Hurricanes

The pound will likely remain in focus today, with speeches from Bank of England policy makers Ian McCafferty and Andy Haldane still to come. While McCafferty is a known hawk and already in favour of raising interest rates, Haldane has previously sided with the majority but has shown a willingness to jump ship. Should he indicate today that he’s tempted to do so at the November or December meetings, we could see the pound rally once again.

Source – Thomson Reuters Eikon

Four Fed Policy Makers Scheduled to Speak

We’ll also hear from four Federal Reserve policy makers throughout the course of the day, including one of the leading candidates for the Fed Chair post, Jerome Powell. With the Fed having indicated at the last meeting that it still intends to raise interest rates again this year, it will be interesting to hear whether the data since then has changed this view or whether the same still applies. Jobless claims, trade data and factory orders make up today’s economic releases, although traders will be more focused on tomorrow’s jobs report.

ECB Minutes Get Muted Response

The ECB minutes from the last meeting received a somewhat muted response in the markets. The minutes effectively reiterated points already made in the statement and during Mario Draghi’s press conference, including how they will manage the QE programme beyond the end of the year – albeit without any indication of what the preferred method is – and a reference to the difficulty that the FX rate poses. The lack of a reaction is unsurprising as the minutes were quite clearly carefully worded to generate such a response and leave little to be interpreted, or more importantly, misinterpreted.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.