IBEX Lagging European Stocks as Catalonians Strike

In what is otherwise a very busy week for financial markets, it’s been a relatively slow start to trading on Tuesday with few economic releases and an abundance due later in the week leaving markets in wait and see mode.

The after effects of the Catalonia referendum over the weekend are still being felt in certain areas of the market, with the IBEX trading in the red and once again underperforming against its European peers while Spanish yields are also a little higher, although this is in line with gains in other European bonds. The euro is recovering a little this morning having tumbled to its lowest since the middle of August against the dollar earlier in the session.

The bulk of the losses came on Monday in the immediate aftermath of the referendum, although this was partially driven by broad dollar strength. With Catalonians on strike on Tuesday, protesting the Spanish authorities heavy handed response to the referendum over the weekend, and the next steps hard to predict, we may continue to see risk aversion when it comes to Spanish assets until we get further clarity.

EUR/USD – Euro Quiet as German Banks Closed for Holiday

GBP Down as PMI Disappoints and Conservative Party Conference Continues

The pound is coming under pressure once again on Tuesday following another disappointing PMI survey, this time showing an unexpected contraction in the construction industry, the first since shortly after the Brexit vote. With both PMIs having disappointing so far this week, we’re now looking towards the most important of the three, the services PMI, tomorrow to complete the hatrick.

OANDA fxTrade Advanced Charting Platform

The pound may remain volatile over the next couple of days as the Conservative party conference continues in Manchester. With a number of ministers due to speak today including Brexit secretary David Davis and Boris Johnson – a constant thorn in the side of Prime Minister Theresa May – it could be an interesting couple of days for the pound. Johnson’s speech in particular will be of interest given his persistent undermining of May when it comes to Brexit and his clear desire to replace her before the next election.

Sterling Stymied by Construction Numbers

Powell Appearance Eyed as Potential Fed Chair-Elect Speaks on Regulatory Reform

With the bulk of this week’s US data being released over the next three days, it’s going to be one of the week’s quieter sessions on Wednesday. We will hear from potential Fed Chair-to-be Jerome Powell, one of four people to have interviewed to lead the central bank when Janet Yellen’s term expires in February. Powell is due to speak on regulatory reform before a Reuters conversation on US Financial Regulation but as always, officials can stray off topic onto monetary policy, especially when prompted during Q&A sessions.

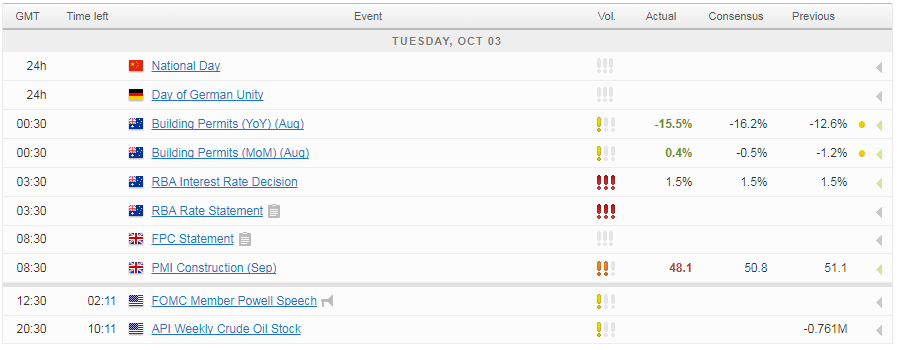

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.