Month-end flows in the USD contributed to a very choppy session on oil markets but helps gold up off the canvas.

Oil

Traders were left somewhat breathless overnight after the dust settled on a volatile session overnight which saw Brent and WTI trade in a 2.50% and 3.0 % range respectively. Despite the noise Brent managed to close unchanged at 57.35, continuing its gentle downward consolidation and taking the pressure of its overbought short-term technical indicators.

WTI was altogether more frisky as it broke 52.00 triggering stop-loss buying that took it to a 52.50 high. The party didn’t last though as its short-term overbought indicators and shale producer hedging saw traders lose their nerve and rush for the door just as quickly. WTI plunged to 50.90 before bouncing to close the session one percent lower at 51.25.

Despite the intraday volatility the technical picture still looks positive for both contracts with the consolidation and gentle pullbacks thus far suggesting that oil is pausing for breath at these levels. An increasingly positive view from the supply side, with potential Kurdish production disruption, and a plethora of energy agencies suggesting global demand is increasing suggesting there is life in the rally still.

Brent spot is unchanged at 57.45 in Asia with support at 56.50 and resistance at 58.40. A break below 56.50, its breakout level, suggesting the correction could extend to the 55.00 regions.

WTI spot trades at 51.25and is now running into shale producer hedging in reasonable size looking at the overnight price action. It has resistance at 52.50, but its defining level will be the long-term resistance zone at 53.50 to 54.50 which it must overcome to encourage fresh longs from these levels. Support sits at the overnight lows and trend line support at 50.90. A break would suggest a retest of the pivotal 50.00 zone.

Gold

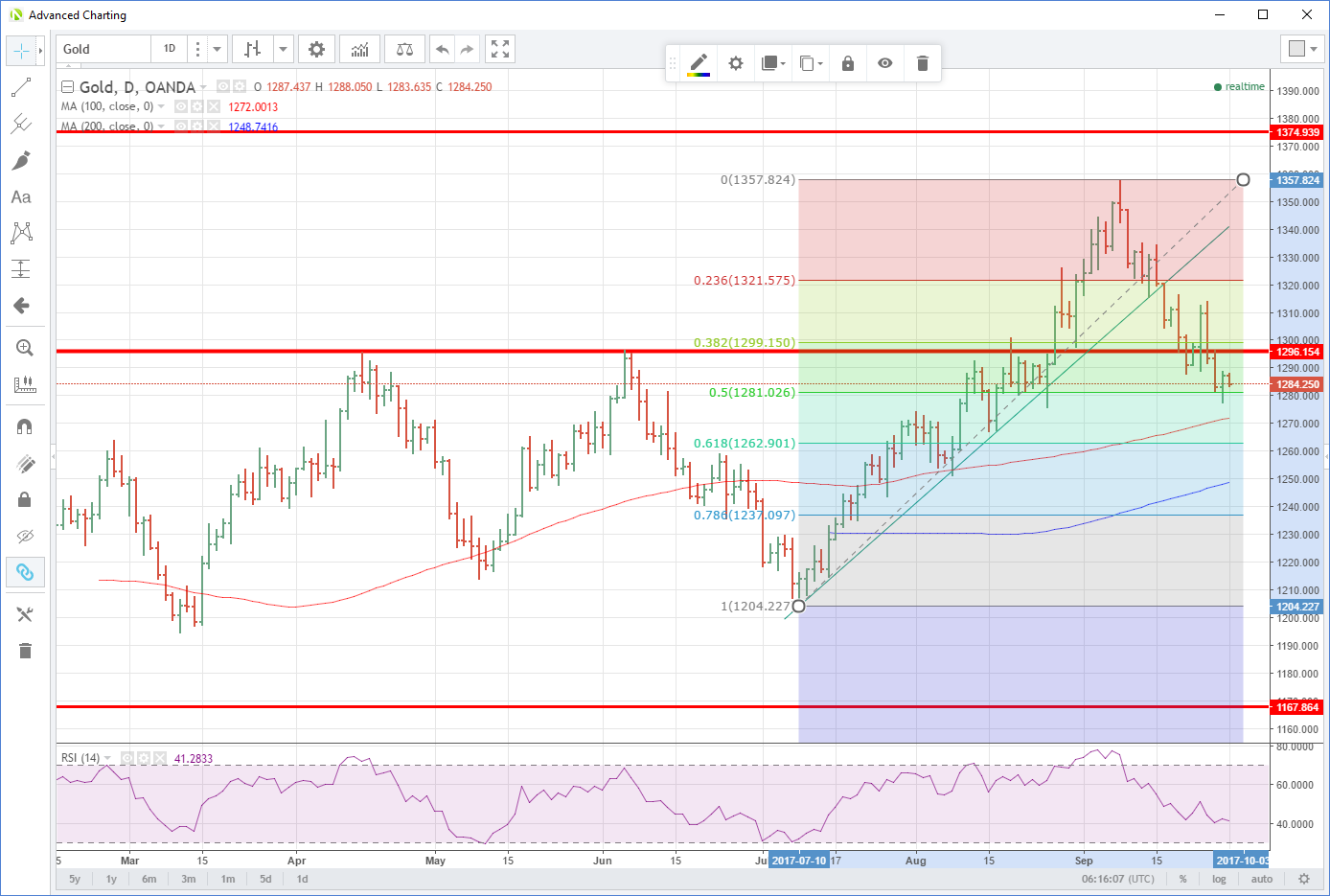

Gold benefited from a weaker U.S. dollar overnight as treasury yields faltered and then fell across the curve out to ten years. It took the heat out of the dollar and saw a modest rally in gold which rose to 1289.00 before closing at 1286.50. Despite falling through the 50.0 % retracement level at 1281.00 overnight, the bounce and close above leaves gold clinging on to its long-term retracement zone.

Asia should see buyers this morning as traders put on weekend risk event hedges. But as the day goes on, it will most likely find itself bouncing around to the nuances of the dollar, as the street processes its month-end portfolio flows on the FX side of the market.

That said, the 1281.00 level is still intact for now, with the 100-day moving average lending support behind at 1272.00. Gold is unchanged in Asia at 1286.50 with initial resistance at 1289.00, the overnight high, followed by 1296.00 and then the 1299.00/1300.00 area, the 38.20% retracement.

Overall we expect a choppy but directionless session for the day as we head into months end.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.