EUR Remains Under Pressure After German Election

It’s been a steady start to trading on Tuesday, with political uncertainty and geopolitical risk once again weighing on risk appetite.

Coalition talks in Germany and New Zealand following elections over the weekend will likely lead to some uncertainty in the near-term which is weighing on the kiwi but having less of a negative impact on German-related assets. Bund yields fell slightly in the immediate aftermath of the election while the euro has fallen back towards 1.18 against the dollar but it’s important to note that both had made significant gains prior to this and the latter in particular was looking a little overstretched.

Rather than being a source of negativity for the euro, I think traders are seeing the election as an opportunity to lock in some profits which is triggering a small but arguably necessary correction. With 1.18 now coming under pressure, I think further downside could be on the cards in the near-term, with 1.1660 being the next test to the downside potentially more to come. A correction would provide the EBC the opportunity to announce tapering next month with the currency trading at more comfortable levels.

Safe Havens Pare Gains as US Labels Declaration of War “Absurd”

We saw some safe haven flows on Monday after it was claimed that US President Donald Trump had declared war on North Korea with his comments over the weekend. Foreign Minister Ri Yong-ho made this statement in New York which immediately triggered moves towards traditional safe havens such as Gold, although these moves have already been partially reversed today. The US immediately rejected these claims and branded them absurd which has possibly helped alleviate any concerns although it’s clear that the rhetoric between the two countries is intensifying.

This underlying risk will remain in the markets, leaving them vulnerable to these bouts of sudden safe haven flows, until we start to see signs of a diplomatic solution being found. Something that doesn’t look like it’s coming any time soon with the leaders of both countries clearly more intent on appearing dominant than finding a solution.

EUR/USD – Euro Slips to 4-Week Low, US Consumer Confidence, Housing Reports Next

Fed Officials Provide Distraction From Political and Geopolitical Headlines

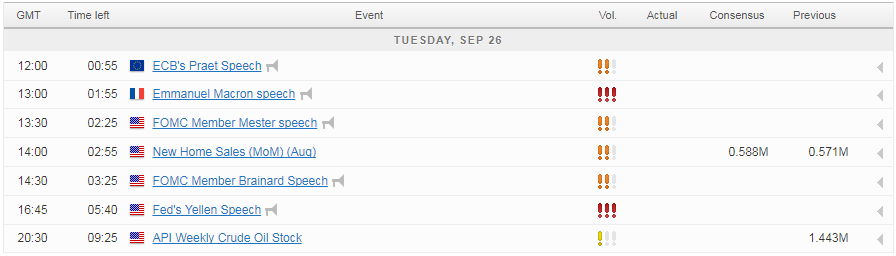

Politics and geopolitics aside, we will get some economic data from the US today and also hear from a number of Federal Reserve officials. Chair Janet Yellen is clearly the most notable of the Fed speakers today but we’ll also hear from Charles Evans, Loretta Mester, Lael Brainard and Raphael Bostic which should make it an interesting day for the dollar and US yields, particularly as the central bank stood by expectations of one more rate hike at its meeting this month. CB consumer confidence and new home sales data will also accompany these appearances.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.