Safe Havens Under Pressure as Geopolitical Risk Eases a Little

Risk appetite looks to have returned on Monday, with traders relieved at the inactivity in North Korea over the weekend after reports suggested the country could engage in more provocative testing.

The rogue state celebrated its 69th founding anniversary on Saturday and there had been speculation over the week leading up to it that further tests could be planned. Last year, the occasion was used to carry out its fifth nuclear test and given the ramp up in testing in recent months, it was feared the same would happen again.

Irma Gusts Topple Oil as Gold Flakes

Given the market response in recent weeks to such actions, traders were understandably cautious throughout the week but with the day having passed without drama, we’re seeing a move away from the safe havens. Strong gains in Asia overnight are looking to be replicated when the European week gets underway, with indices currently seen around 0.5% higher.

Gold Off its Highs but Remains Elevated

The traditional safe havens are coming under some pressure this morning, a partial unwinding of the sizeable flows seen in recent weeks. Gold has come off its highest levels in more than a year this morning, gapping lower on the open in a sign of relief for traders, but still remains a very elevated levels which is representative of the risk environment we still find ourselves in.

OANDA fxTrade Advanced Charting Platform

The yen is another safe haven that is seeing some of the recent flows unwound this morning. The dollar is trading back above 108 against the yen this morning, having fallen to its lowest in almost 10 months on Friday, not helped by the greenbacks own difficulties. A combination of political risk, a less hawkish Fed and more hawkish central banks elsewhere has driven the dollar to its lowest since the start of 2015 and the slide doesn’t appear to be easing up yet.

Difficult FX Trading Conditions

UK Data and Central Bank in Focus This Week

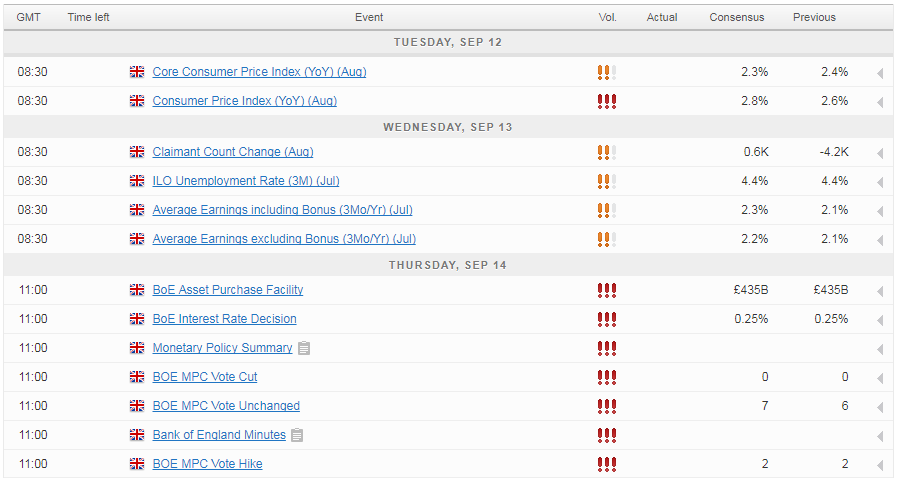

This week the UK will be primarily in focus, with the Bank of England monetary policy decision due on Thursday and coming after jobs and inflation data earlier in the week. Monday is looking a little quieter though, which barring any surprise events could offer some reprieve for markets.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.