Safe Haven Unwinding Seen as Traders Eye Data Releases

With geopolitical risk once again appearing to subside, attention will turn back to the fundamentals on Wednesday as we enter the business end of the week with regards to economic releases.

The start of the week was shaping up to be much quieter with the bulk of the data coming between Wednesday and Friday but a missile launch by North Korea and the devastating impact of Hurricane Harvey ensured that was not the case. Risk aversion at the start of the week is not starting to be unwound, with Gold have come off its highs, the yen paring gains and equity indices and US futures in the green.

EUR/USD – Euro Edges Lower Ahead of German Preliminary CPI

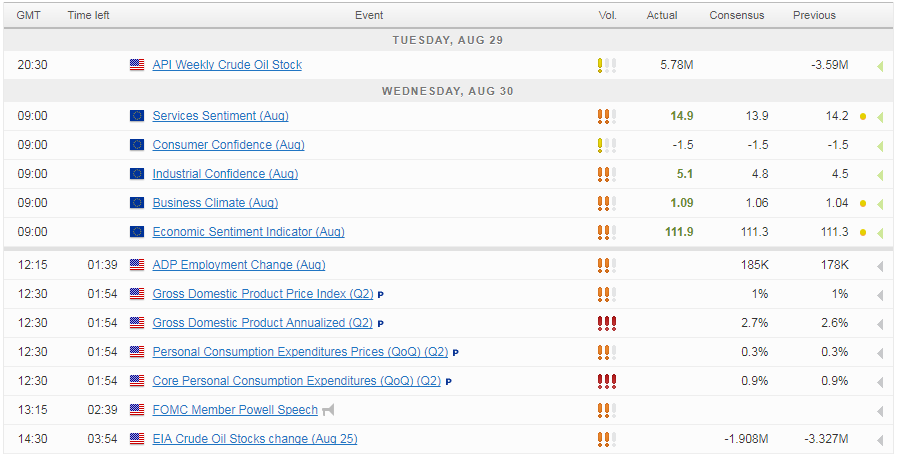

I think we’re still some way from investors feeling comfortable with the situation but this is certainly a case of no news being good news. As long as we see no further escalation from either North Korea or the US, focus will likely shift to the economic data, with US GDP, ADP non-farm employment and crude inventories all being released. Growth for the second quarter is expected to be revised a little higher to 2.7% from 2.6% on an annualised basis, while ADP is expected to report 185,000 jobs were created in August.

The ADP is seen as an early estimate of Friday’s NFP number but it hasn’t historically been very accurate. It has however been useful in highlighting when expectations are perhaps far too high or too low. Should we see a big beat or a big miss, we may see people adjusting their expectations ahead of Friday’s jobs report.

Would Dovish Powell Signal an End to Rate Hikes This Year?

We’ll also hear from Jerome Powell – a permanent voter on the FOMC – who we haven’t heard from recently. Powell is typically lies between the doves and the hawks on the committee and was previously in favour of continuing gradual rate hikes this year and anticipated three in total. Any suggestion that he has since become less in favour of another increase may indicate that the tide has turned towards the doves within the committee, lessening the chances of another hike this year.

Dollar Recovers, Pushing Euro and Pound Lower

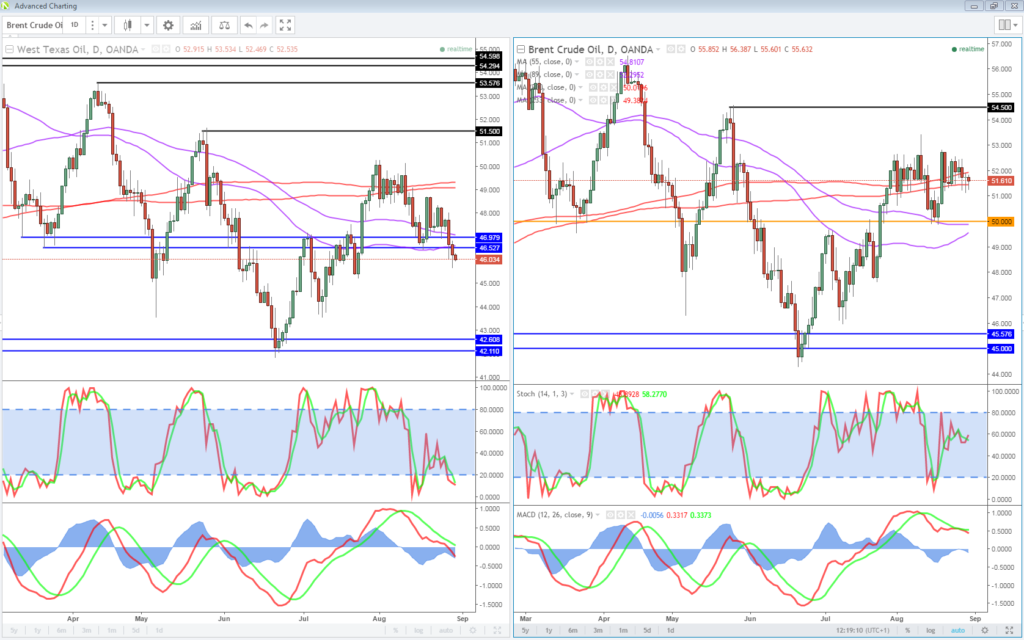

Oil Slips Ahead of Inventory Data

Oil is trading slightly lower again as we await the inventory numbers from EIA. The impact of Hurricane Harvey could lead to a near-term rise in crude inventories, which is weighing on WTI crude in particular. We’re still expecting a drop this week, with API reporting a drawdown of 5.78 million barrels but it will be interesting to see what happens in the coming weeks. The widening gap between WTI and Brent will also be interesting to watch in the weeks ahead.

OANDA fxTrade Advanced Charting Platform

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.