Significant Policy Warnings May Be Too Much to Ask This Year

The Jackson Hole Symposium is this week’s highly anticipated event, in part due to a severe lack of other newsworthy market stories but also because two very important central bankers are scheduled to appear.

The Federal Reserve and the European Central Bank are not only two of the most important central banks in the world, they’re expected to be among the more active over the next year, with the former having already begun raising interest rates and the latter in the process of winding down its quantitative easing program.

With announcements expected from both in the coming months, investors will be looking to their speeches at Jackson Hole – a platform used to prepare markets for policy changes by previous Fed Chairs Alan Greenspan and Ben Bernanke – for similar policy signals.

EUR Climbs Ahead of Draghi Jackson Hole Speech

Janet Yellen – Federal Reserve Chair

Yellen’s remarks will be poured over by investors, primarily for clues on the future path of interest rates, with the prolonged period of low inflation now starting to unsettle some policy makers. The Fed had previously indicated that it plans to raise interest rates one more time this year but investors have been unconvinced for some time and recently, the scepticism has started to spill over into commentary from some policy makers.

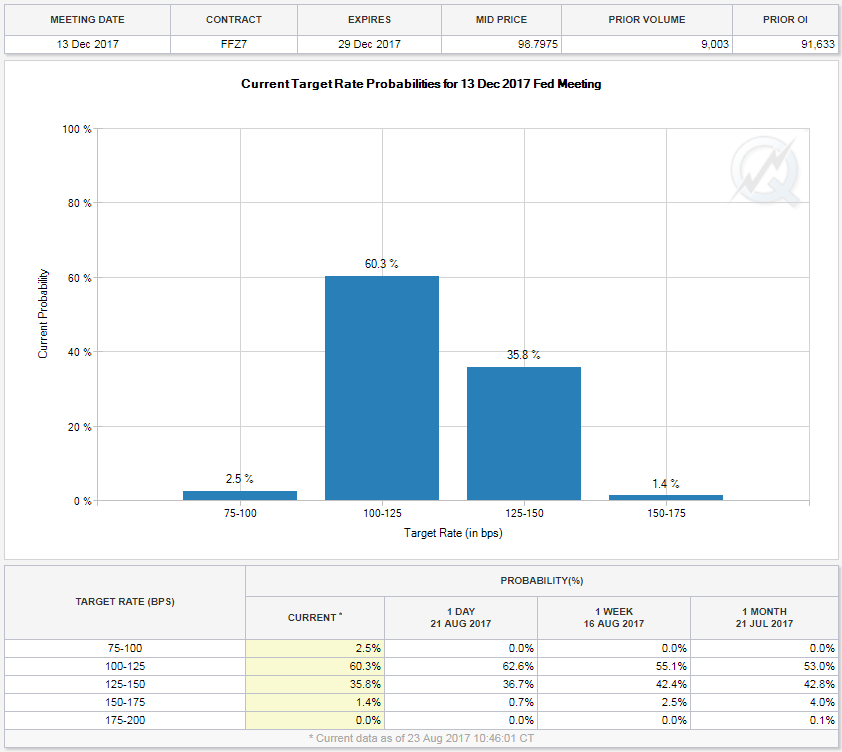

Swing voters within the FOMC, such as Jerome Powell and Robert Kaplan, appear to be among those that still need convincing, while others appear to lack the belief they once had. Should nothing change then I expect the Fed will likely hold off until next year to raise interest rates further but with the committee appearing so split, it’s very difficult to know. This is perfectly reflected in current market implied rate hike expectations.

Source – CME Group FedWatch Tool

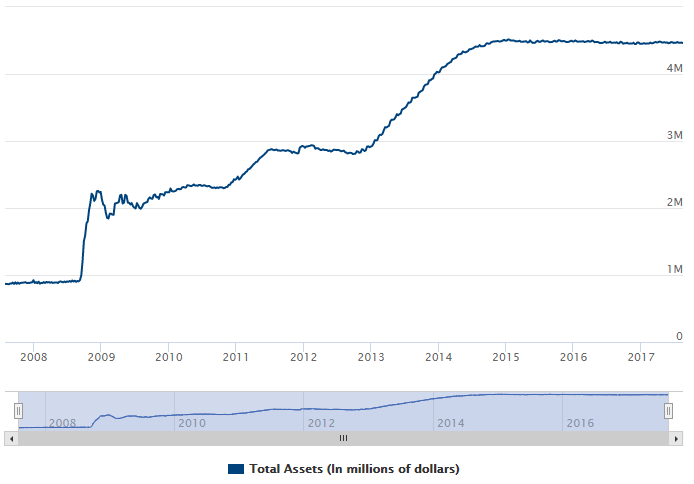

It’s also worth noting that the Fed will soon effectively be tightening on two fronts, with the central bank set to announce in September that it plans to start reducing the size of its balance sheet which was built up in the aftermath of the financial crisis through quantitative easing. The balance sheet currently stands close to $4.5 trillion, a level many believe is far too high.

Source – Federal Reserve

If the Fed starts the process of balance sheet reduction next month, it may buy them a little more time on interest rates and allow them to wait for inflation to pick up before hiking again.

Whatever they decide, traders will be keenly following Yellen’s comments on Friday for any suggestion that the pace of rate hikes will be slower than previously expected. Should this happen, we could see further weakness in the dollar and yields could fall.

Mario Draghi – ECB President

While getting policy clues out of Janet Yellen may be difficult, in the case of Draghi it’s like trying to draw blood from a stone, at least recently anyway.

The ECB has become obsessed, it seems, with the euro rate and bond yields and the unintentional tightening in financial conditions that these could trigger. At the end of June, Draghi suggested that recent progress could allow the central bank to pull back on unconventional measures – a clear reference to tapering of asset purchases – and markets were quick to respond.

Despite the market’s reaction being far from extraordinary, officials from the ECB were quick to clarify his remarks and effectively reverse the moves that followed it. Clearly they’re far more concerned about what are relatively minor moves than they would have us believe.

Dollar Flounders on Trump Comments

After this mishap, it seems likely that Draghi will very much keep to the script during his appearance at Jackson Hole and, unfortunately for us, I expect this script will be rather uneventful. Not only will the next ECB meeting in September come with new macroeconomic projections that will shape their decision on QE after December, but his speech also falls in the relatively illiquid month of August. The ECB will want to avoid any sharp appreciation in the currency and a similar rise in bond yields at all costs.

If anything, Draghi may deliver a rather dovish message that still leaves the door open to tapering at the end of the year while carefully managing the euro lower.

Of course, there is the potential that a warning of a policy shift comes from the event – and we should be prepared for significant volatility in case it happens – I just don’t expect it to come from Draghi this time around. And Yellen may remain tight lipped as well given the uncertain outlook on inflation.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.