US equity markets are poised to open higher on Thursday, paring Wednesday’s losses which came on the back of Donald Trump’s NAFTA and government shutdown warnings.

The short-term nature of the declines is probably a good reflection of how seriously people are taking Trump’s latest threats. We often see a knee jerk reaction to such negative remarks but the fact that we’re already pushing higher a day later suggests people don’t expect either to happen. Of course, should it become apparent that he will follow through on them then it will likely be a different story altogether.

Will Draghi or Yellen Deliver a Summer Bombshell?

Jackson Hole Gets Underway But Key Speeches Don’t Come Until Friday

Barring any political or geopolitical distractions, focus will likely now shift to the week’s main event, Jackson Hole. In what has otherwise been a very slow week for markets – as it typically the case at this time of year – this gathering of central bankers, policy experts and academics was always the standout event that could trigger some market volatility.

Unfortunately, we’ll have to wait until tomorrow for the highlight of the event, appearances from Federal Reserve Chair Janet Yellen and ECB President Mario Draghi. With both central banks on the cusp of making new policy announcements, their views will be poured over for the slightest hints. Markets don’t seem overly concerned about the Fed’s balance sheet plans so interest rate clues is what people will be looking for, whereas with ECB, it’s all about tapering. When will it happen, how much will it be and how long will it last.

Euro and Dollar Seek Guidance from Jackson Hole

UK Growth Softens as Consumer and Business Spending Slows

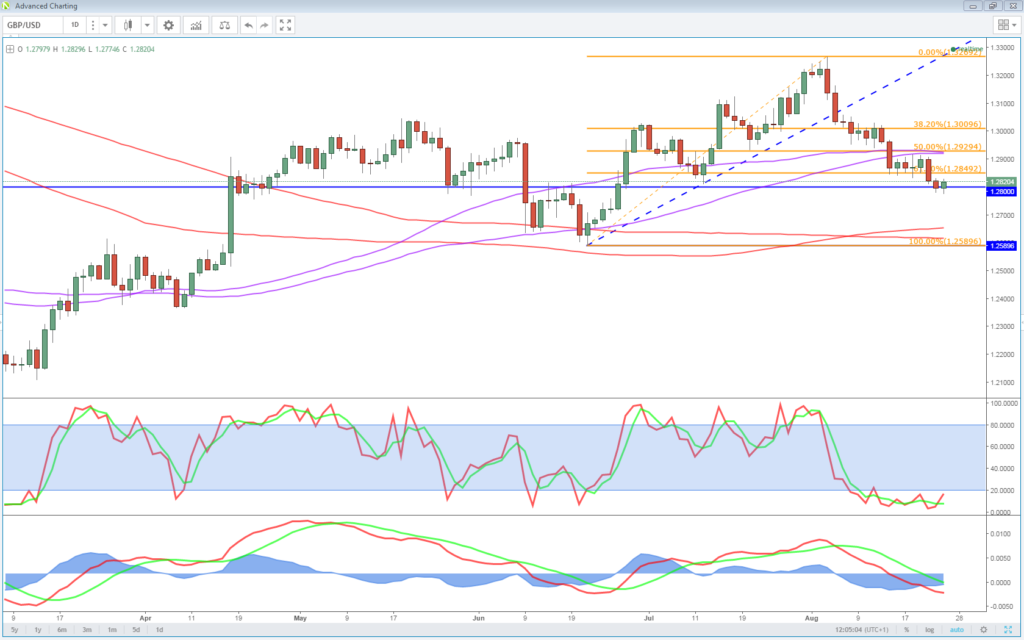

On the data side, it’s once again looking a little quiet. We had second quarter GDP data from the UK this morning which painted a rather grim picture of the economy. Consumer spending – a key component of the UK economy – slowed once again as households continue to feel the squeeze of negative real wage growth while business investment stagnated. It’s clear that while the economy has not nose-dived, it is suffering in the aftermath of the Brexit vote. The pound fell initially after the data but quickly recovered to trade off it’s lows just below 1.28 against the dollar. The pair remains under pressure though and should this support break, 1.26 could be on the cards.

OANDA fxTrade Advanced Charting Platform

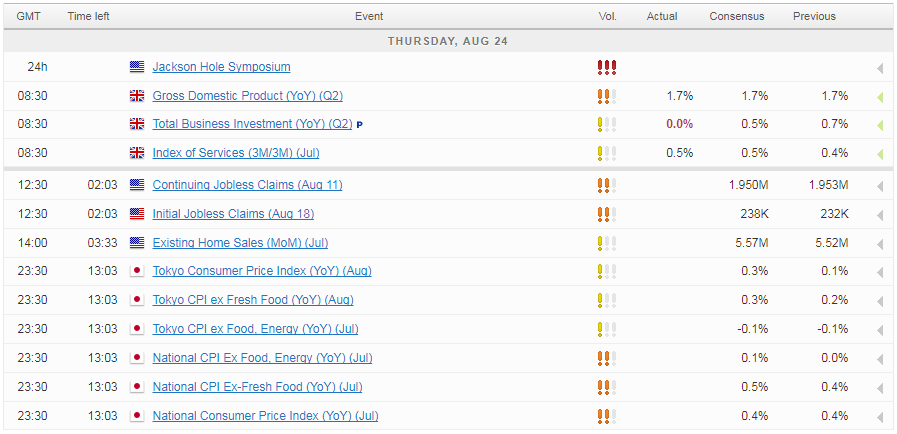

There’s a couple more pieces of data still to come from the US today including existing home sales for July, weekly jobless claims and mortgage delinquencies.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.