Risk appetite is gradually returning to the markets again on Tuesday, although sentiment is likely to remain very fragile given the events of the past couple of weeks.

Geopolitical Tensions Could Reignite at any Moment

While geopolitical risk may have subsided for now, it still feels like we’re always on the cusp of an escalation between the US and North Korea. Especially in a week in which military exercises are being carried out in South Korea with the US. While the exercises were planned a long time ago, the antagonizing nature of them could provoke a response from North Korea which would could easily trigger another run to safety.

USD Rallies Ahead of Yellen Appearance at Jackson Hole

The US dollar is recovering once again from the political drama in the US last week. The greenback has understandably shown itself to be vulnerable to the political situation in the US and last week’s events did nothing to help the currency. A quieter start to the week is providing some support for the dollar today but it continues to languish not far from its recent lows, with the potential for the situation to deteriorate rapidly once again still high.

Source – Thomson Reuters Eikon

Today’s moves in the dollar may also be a reflection of expectations for this Friday’s Jackson Hole appearance by Federal Reserve Chair Janet Yellen. The event is seen as the ideal platform for the Fed Chair to prepare the markets for a balance sheet reduction announcement in September. It will also providing an update on the central bank’s position on interest rates. A number of policy makers have voiced concern about inflation in recent months, casting doubt on whether another rate hike this year will happen. Should the dollar continue to make gains in the coming days, it may suggest that traders are anticipating a more hawkish Yellen on Friday.

EUR Lower as Traders Anticipate Dovish Draghi Speech on Friday

ECB President Mario Draghi is expected to keep his cards very close to his chest when he speaks at the event. Draghi will be keen to avoid any further mishaps, having unintentionally misled traders last month which was later corrected by other ECB officials. With the euro already trading at high levels – as noted by the ECB in the recent minutes – Draghi may deliver as dovish a message as is possible while leaving the door open to tapering in the coming months. This expectation may be weighing on the euro today, along with the disappointing ZEW economic sentiment number from Germany, which worryingly fell for a third consecutive month to a 10-month low.

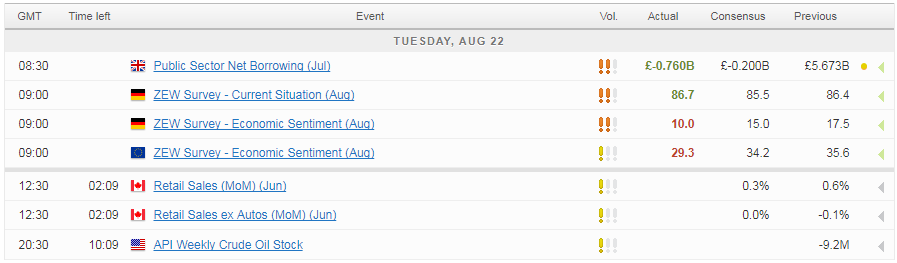

Another quiet day on the economic calendar lies ahead, with Canadian retail sales the only notable release.

Is it a Temporary Boost for the Dollar?

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.