Europe is set for a slightly negative start on Monday, threatening to extend its losing streak to three sessions as political and geopolitical risk continue to weigh on risk appetite.

US, South Korean Military Exercises Threaten to Increase Elevate Tensions

Geopolitical risk could rear its ugly head again this week as the US and South Korea begin planned military exercises on Monday, just as tensions between the North and these two countries appear to have calmed. Should North Korea respond in kind, then we could see a repeat of the safe haven rush from a couple of weeks ago when the situation previously flared up between the countries.

The political situation in the US is another one to watch, with it taking over the reins last week as reports circulated that Donald Trump was about to lose one of his most important members of staff – Gary Cohn – but instead it was Steve Bannon that made way. While this is seen as far more palatable for investors, it still caps off yet another troubling week for the President.

Jackson Hole Symposium Eyed as Yellen and Draghi Make an Appearance

This week could get off to a slightly slower start – barring any escalation between the US and North Korea or in Washington – with the bulk of this weeks scheduled economic events coming later on. The Jackson Hole Symposium is the obvious event people will be most interested in, with both Federal Reserve Chair Janet Yellen and ECB President Mario Draghi making an appearance.

Both central banks are on the cusp of announcing measures aimed at reducing monetary stimulus in the coming months, the question is whether they will use this platform to prepare the markets for such a move. Reports last week suggested that Draghi is unlikely to take the opportunity given how the markets have misinterpreted previous remarks, an odd decision given the number of times the central bank has claimed its not interested in this. Still, we can expect investors to pay very close attention to what he says and respond accordingly.

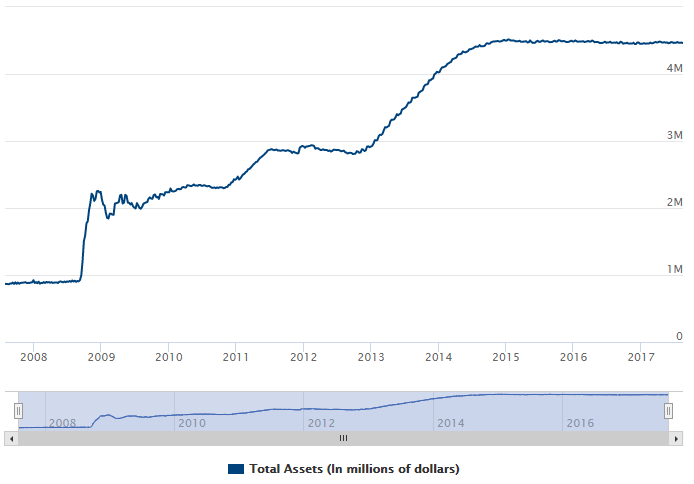

Yellen may not be so secretive on the other hand, given how open her colleagues have been when discussing plans to start reducing the Fed’s balance sheet, which currently stands at close to $4.5 trillion.

Source – Federal Reserve Website

Traders, though, may be more interested in hearing whether the latest inflation data has changed the view within the Fed on raising interest rates again this year, with markets currently unconvinced, to say the least.

Gold Hits Hits $1300 after Barcelona Attack

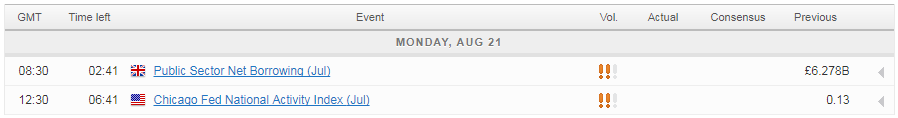

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.