As has been the case for much of the week, markets are heading into the weekend on a negative note as traders seek safety ahead of what could be a potential risky couple of days.

Safe Havens Preferred as Geopolitics Increase Weekend Risks

The war of words between Donald Trump and North Korean officials has stepped up in recent days and has put investors on edge, prompting a more risk averse approach in the markets. The weekend brings an undefined amount of risk for investors, with the potential for circumstances to escalate both dramatically and unexpectedly at a time when markets are closed.

It’s therefore unsurprising that safe havens are being preferred once again and I would be surprised if this doesn’t continue into the close, unless we see significant improvements over the course of the day. In the unlikely event that either side follows through on the threats of recent days and an attack occurs, we could see some dramatic moves at the open next week, something investors in perceived riskier assets would be very vulnerable to.

Euro Yawns as German CPI Matches Estimate

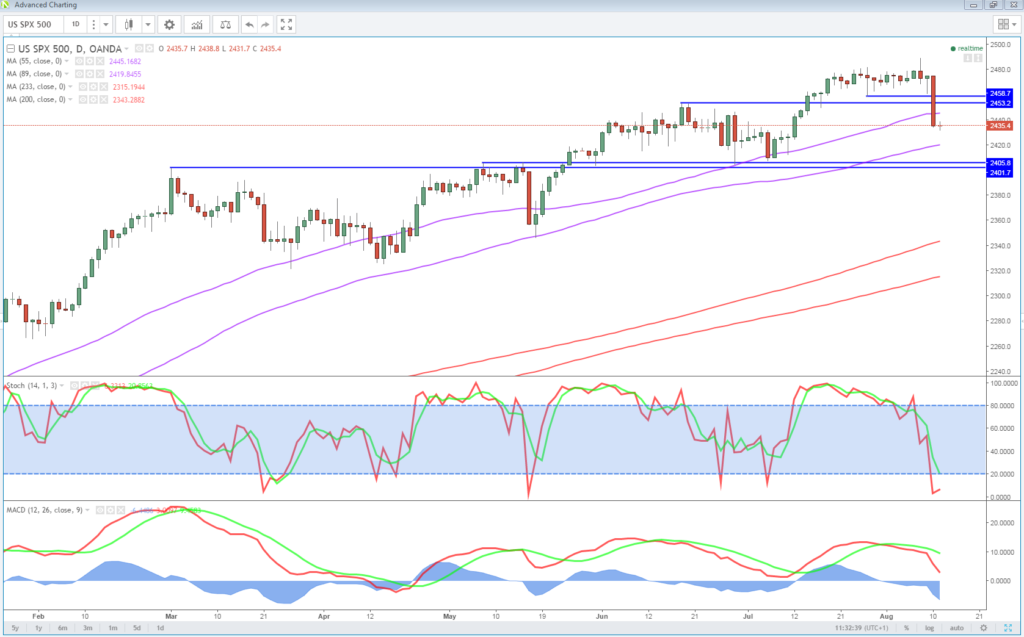

US Indices Seen Lower After Biggest Daily Losses in Three Months on Thursday

European equity markets are deep in the red early in the session – a typical response in risk-off trading – experiencing similar losses to those seen in the US on Thursday and Asia overnight. The S&P 500 and Dow broke through notable support over the last few weeks yesterday to make significant losses – the biggest percentage losses we’ve seen in almost three months – in a clear sign that investors are growing uneasy. Still, the moves we’re seeing don’t suggest to me that we’ve reached the stage in which investors are actually anticipating a military action from either side.

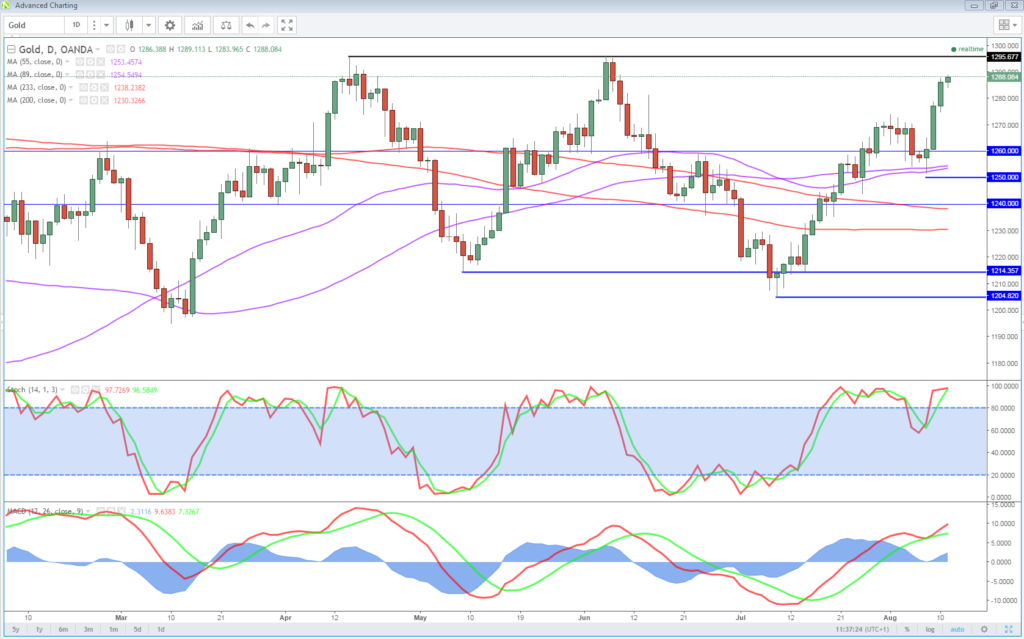

OANDA fxTrade Advanced Charting Platform

As we’ve seen over the last few days, the yen is making decent gains on Friday, benefiting from its status as a safe haven currency, although this could change in the event of a military strike from North Korea. The Swiss Franc is also making gains to a slightly lesser degree having made very strong gains on Wednesday which will undoubtedly raise questions about how active the Swiss National Bank is being in the FX markets. The central bank is obviously not averse to interventions. Gold has also continued its move towards $1,300 which has been a resistance zone over the last 10 months and a break above here would be a significant break and suggest investors are growing increasingly concerned.

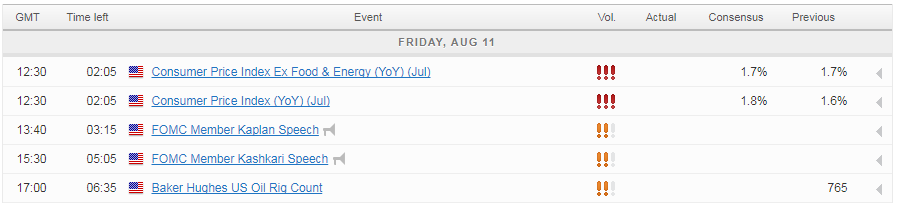

US Inflation Data and Fed Speakers Also in Focus Today

Geopolitics aside, there will be a focus on US economic data and monetary policy today, with CPI inflation data being released and two Federal Reserve policy makers making an appearance. Inflation – or lack of – has been an ongoing problem for the central bank and some policy makers have voiced concerns about this in recent months as they consider whether to raise interest rates again this year. Should we see another dip in inflation in July, it could make the job of building a consensus for another rate hike this year more difficult.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.