Sterling came off its highs and yields on UK debt fell on Thursday in response to the Bank of England and Mark Carney’s unconvincing attempts to warn traders that markets are behind the curve on interest rate hikes over the next few years.

Despite the repeated warnings in the inflation report and from Carney himself, that expectations of two hikes over the next few years are “insufficient”, markets were far more responsive to the more dovish aspects report and press conference. The vote, for example, widened to six against a hike and only two for, which put traders at ease after the gap closed unexpectedly at the last meeting. While the conversation is still going on in the background and the numbers could easily change, it would appear a hike is further away in the near term.

Carney’s acknowledgement that the sole cause of above-target inflation is the drop in sterling was cited as another dovish comment, despite the fact that policy makers are voting for a hike in spite of this. Of course, it could perhaps be that traders are only concerned with the near-term expectations of the BoE given its history of bad forecasts and the sheer amount of uncertainty in the economic outlook due to Brexit.

All things considered, today’s decision, voting, inflation report and press conference has done little to clear things up and markets response to it would suggest just that. The BoE’s attempts to prepare markets for future hikes have fallen on deaf ears for now which could mean volatility in these instruments remains for the foreseeable future as we try to make sense of both the economic and monetary policy environment.

For a look at all of today’s economic events, check out our economic calendar.

UK 10-Year Gilt

UK100 (FTSE 100)

UK100 (FTSE 100)

GBPUSD

GBPUSD

EURGBP

EURGBP

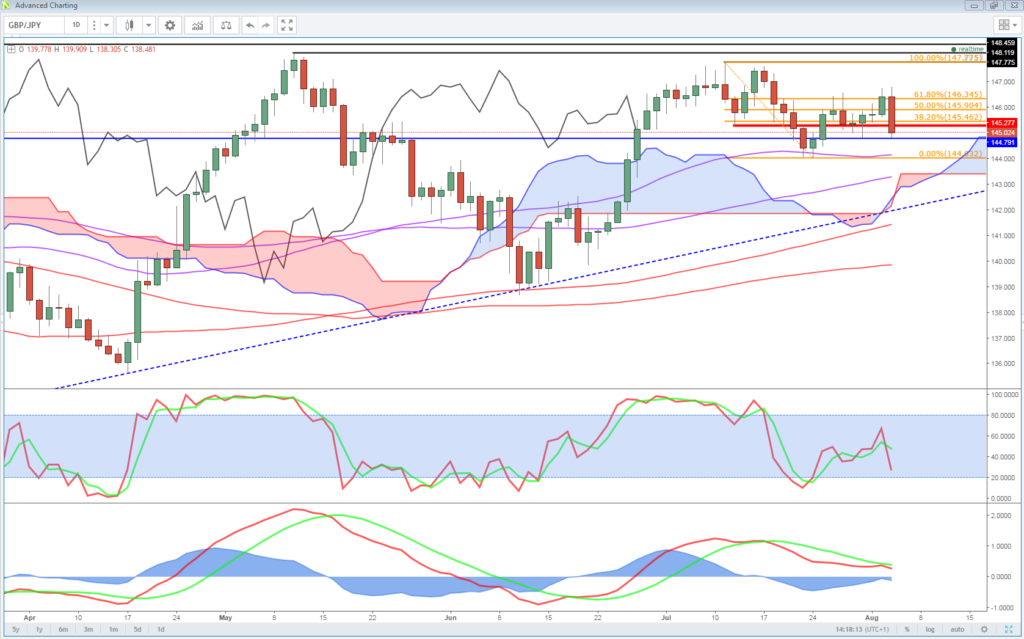

GBPJPY

GBPJPY

GBPCAD

GBPCAD

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.