US futures are pointing to a higher open on Tuesday as traders await another batch of earnings reports and some important economic releases from the world’s largest economy.

Strong Earnings Continue to Fill Trump Void

It’s been a very good earnings season so far which is helping to sustain US stocks at record highs and offset any disappointment with Donald Trump’s inability to make progress on his growth policies. After a slow start to the week, the number of companies reporting will pick up again from today, with Apple unsurprisingly the one that stands out, reporting after the closing bell.

Dollar Under a Political Cloud

Inflation,Income and Spending Data Could Weigh on Rate Hike Expectations

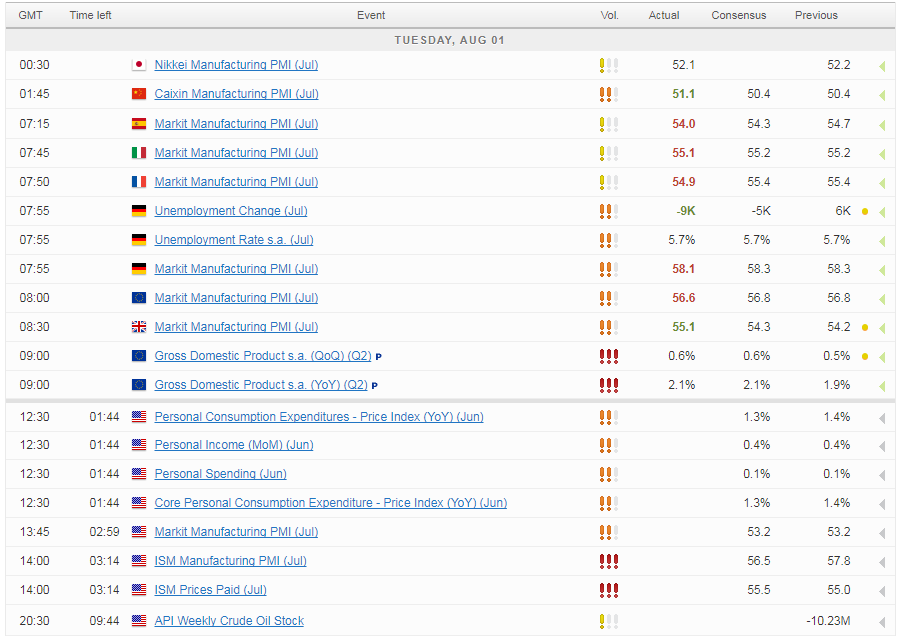

While earnings season will continue to be a key driver of sentiment in the markets, there’s a lot of economic data being released today, much of which will be of keen interest to the Federal Reserve and therefore traders. The most notable of these will be the core PCE price index – the Fed’s preferred measure of inflation – which is expected to weaken for a fourth consecutive month and cast further doubt on whether the Fed should still be considering another rate hike this year.

Alongside this we’ll get personal income and spending figures, which are important metrics from both an economic health perspective and inflation. While earnings appear to have been growing gradually, spending has been slowing this year which isn’t entirely conducive with higher price pressures. This has long been a concern of the Fed’s and should it not improve in the coming months, it could help pursued them to slow the pace of tightening. We’ll also get two manufacturing PMIs after the open on Tuesday to complete what is likely to be a very busy session.

Precious Metals Get Their Thrill, From Capitol Hill

Another Large Inventory Draw Could Drive Oil Prices Higher Once Again

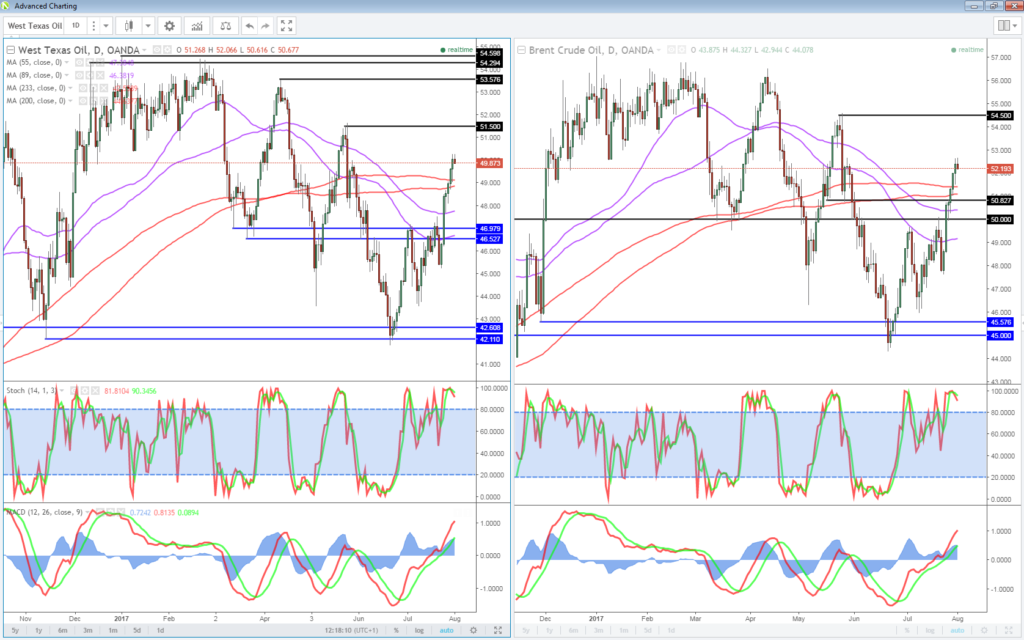

Oil is currently trading flat on the day having rallied over the last week, breaking through $50 in the process, as we await more inventory data from API. Last week’s numbers pointed to a sharp reduction in inventories, which came as Saudi Arabia cut exports to the US in an apparent attempt to draw on the very numbers that are having such a significant impact on prices. Another large drawdown today could boost prices further, with $54.50 offering the next test in Brent and $51.50 in WTI.

OANDA fxTrade Advanced Charting Platform

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.