Financial markets are set to open on a more downbeat note on Friday, with earnings from Amazon on Thursday being blamed for the initial underperformance along with the US Senate’s inability to pass the “skinny repeal” of Obamacare.

Amazon Earnings Weigh “Skinny” Obamacare Repeal The Real Problem

While Amazon’s results may only be responsible for some short term negativity, with the tech sector as a whole still enjoying a remarkable year, the failure in the Senate could pose further problems for President Donald Trump and his growth agenda. It’s generally believed that the repeal of Obamacare will unlock the ability to cut taxes, a key policy of Trump’s during the campaign and one that was partly responsible for such a strong post-election rally in equities, the dollar and rates.

CAC Slips as French CPI and Consumer Spending Decline

Equity markets have been rather resilient to the delayed approval of tax cuts and spending measures that were intended to boost growth in the world’s largest economy, from the currently below par levels. This has been aided by healthier earnings, as we’ve once again seen for the second quarter, despite the occasional blip, as we had with Amazon. Today is looking a little quieter but we will get numbers from Exxon Mobil, Merck and American Airlines, among others.

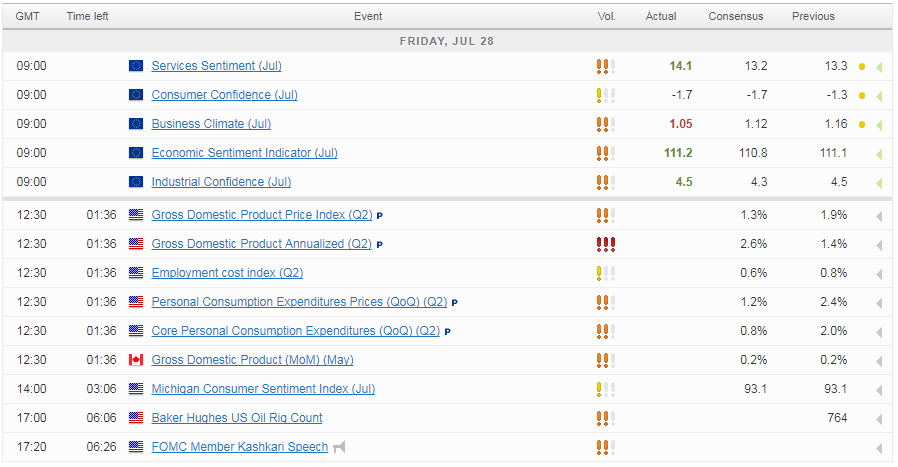

US and Canadian GDP Releases Eyed

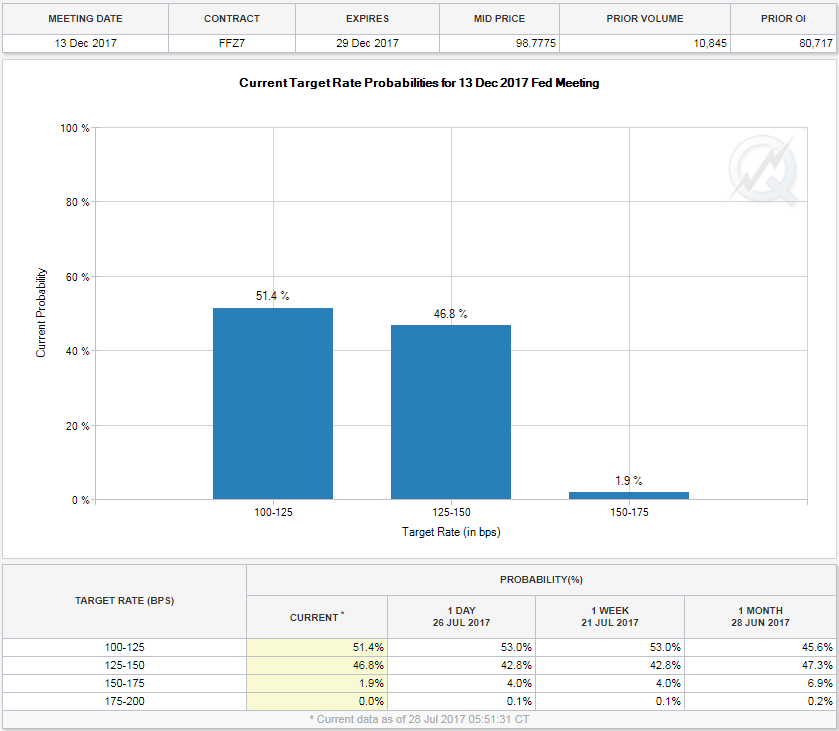

Friday is also looking a little quieter on the economic data side as well, with US and Canadian second quarter GDP the only notable releases. The US will be of particular interest, with expectations currently for quite a sizeable upward revision to 2.5% which would make the first half of the year not the shambles it first appeared. With inflation and jobs data still to come next week, it could also act as another incentive for the Fed to pursue another rate hike this year – although that’s unlikely to come until December – with policy makers comfortable with the path the economy is on.

Source – CME Group FedWatch Tool

We’ll also hear from Neel Kashkari later on today, a voter on the FOMC and arguably its most dovish member. While his comments will be of interest, being one of the few doves among a committee who’s consensus is still to tighten does mean his comments possibly carry less weigh, as far as traders are concerned.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.