A relatively subdued session in Asia overnight is providing little direction ahead of the European open on Tuesday, with indices currently seen opening a little higher.

Divisions Within The BoJ

The summer period can often be a very quiet one for the markets but with the major central banks across the globe waking up from years of extreme accommodation, this has certainly not been the case so far. One of the few that has until now shown no signs of shifting has been the Bank of Japan but the minutes overnight may suggest that some divisions are appearing among policy makers.

The minutes from last week’s meeting showed some disagreement within the committee regarding the disclosure of an exit strategy from its bond buying program. While the yen was relatively unresponsive to these divisions, the fact that some are already considering its exit strategy publicly at a time when there are concerns regarding liquidity of Japanese bonds should be monitored in the months ahead.

OANDA fxTrade Advanced Charting Platform

The BoJ wouldn’t be the first central bank recently to consider tightening well ahead of market expectations and these divisions could represent early signs of such a shift.

Still, traders don’t currently view these divisions as a sign that bond buying could be scaled back. The BoJ only last week pushed back the date for when the 2% inflation target would be hit to 2019 which makes any tapering in the near-term unlikely.

Fed Meeting Gets Underway

The Federal Reserve will begin its two day meeting later on today, with the announcement and statement following it tomorrow evening. While no change in policy is expected and no press conference is taking place, with the central bank believed to be preparing measures to reduce the balance sheet from September, there may be hints at such a move in the statement.

Will BoE’s Haldane Maintain Hawkish View?

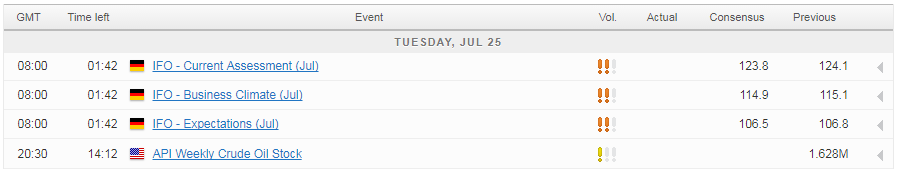

As for today, we have a couple of economic releases lined up with German Ifo business climate due this morning and CB consumer confidence this afternoon. We’ll also hear from Bank of England policy maker Andy Haldane this evening, which should be interesting given his recent comments on interest rates and the dip in the inflation data. Earnings season also continues and could well be the key focus for many investors.

USD/CAD Canadian Dollar Higher As Oil Surges After OPEC Comments

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.