European futures are pointing to a slightly higher open on Friday, adding to gains from earlier in the week which have broadly been triggered by the possibility of slower tightening from the Federal Reserve.

Has the Fed Become More Dovish in Light of Persistent Subdued Inflation?

Yellen’s comments on Wednesday regarding the neutral rate and subdued inflation sent a more dovish message to the markets than we’ve become accustomed to, particularly of late with a number of central banks suddenly appearing in a rush to tighten monetary policy. The recent commentary has weighed a little on equity markets and it would appear the prospect of a less hawkish Fed has offered a little reprieve.

USD/CAD Canadian Dollar Higher After Yellen Testimony

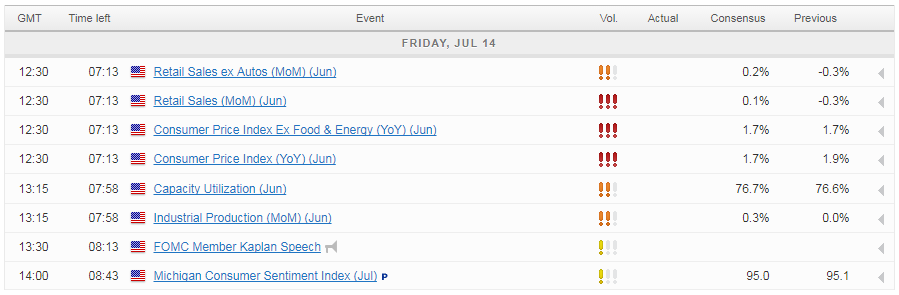

While we may not be hearing from many central bankers during today’s session – Fed’s Robert Kaplan the only policy maker due to make an appearance – it is likely that focus will remain on the Fed as we get some important US economic data. Retail sales and CPI inflation are two of the most important pieces of US data we get each month and both are due to be released shortly before the open on Wall Street.

Weak Retail Sales and Inflation Data Could Dent Rate Hike Hopes Further

With the first half of the European session looking very quiet, the US will be the primary focus today. The Fed is currently expected to raise interest rates once more this year, most likely in December, and announce plans to start reducing its roughly $4.5 trillion balance sheet following years of US Treasury and Mortgage Backed Securities purchases.

Source – Federal Reserve Website

Market have struggled to get on board with one more rate hike though and Yellen’s comments on Wednesday suggest Fed officials are not entirely convinced either.

Dollar Flat Ahead of US Retail Sales and Inflation Data

Weakness in the data today will only fuel these concerns, particularly with regards to inflation which has remained stubbornly low throughout the tightening process so far. While CPI may not be the Fed’s preferred measure of inflation, it is released earlier and identifies whether prices are ticking higher or remain subdued. Should we see the latter today, as expected, and it be accompanied by uninspiring spending data, it will only harden people’s belief’s that the Fed should hold off on the next hike until next year and could therefore weigh further on the dollar and Treasury yields.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.